By Ashley Preen

May 14, 2019

Do you know how much your business is worth? Now, we’re certain that you’ve either been asked this very question. Or, it’s a question that has been running through your mind. So, we decided that we should shed some light on this somewhat complex process.

You may have come across this article because you are looking to sell up. Or, it could be because you’re genuinely curious about how it works. For instance, this question may have sprung to mind after an episode of Dragon’s Den. Sure, the budding entrepreneurs seem to know the in’s and out’s of their valuation. However, when quizzed by the Dragon’s, many of these entrepreneurs seem to trip up over their own calculations.

We don’t know about you, (now we’re assuming you watch Dragon’s Den), but we often find ourselves scratching our heads when we hear the participant’s valuation pitch. For instance, some of these entrepreneurs seem to pluck a figure out of thin air, just to impress their potential investors. Now, we understand that pitching is daunting – but the worst thing you can do when valuing your business is – guess!

Guessing, or presuming will never end well – unless you’re a fantastic salesperson. Even then, regardless of your pitching skills, guessing will only shoot you in the foot. So, if you would like to learn how to evaluate your SME accurately, keep reading. This article may leave you feeling pleasantly surprised, once you know how to do this complex skill.

“Sorry, I’m out” – Courtesy of Jenny Campbell (Dragon’s Den)

Those dreaded three words… Now, we’ve used Jenny as an example, as she has no fear when it comes to using the somewhat infamous phrase. Actually, if you’ve never seen an episode of Dragon’s Den, we’d better provide some context.

Jenny Campbell is one of the Dragon’s, (investors), and what she is most well known for is not investing. Now, her lack of investment isn’t always down to the valuation or pitch – she just seems to enjoy sitting on her cash.

The image above is from a YouTube clip from the show last year. Where she finally said “yes,” to a deal – as you can see from her fellow Dragon, Debra Meaden. This acceptance of a deal comes as a shock.

Anyway, we digress. The point is, you don’t want to lose an investment or sale (if you want to sell up), because of a murky, inaccurate valuation. Unfortunately, many businesspeople, are yet to understand this process. Although it is complex, when you know how, and have a simple guide (like this one). It becomes far easier! Moreover, knowing how to value your business, will be invaluable throughout your entrepreneurial career.

Well, we have already briefly mentioned one of the reasons you should value your business at some point. The first is if you are seeking investment. Oh, if you are at this stage, we have a helpful article on how to pitch to investors here. When you can present an accurate, solid valuation, you will, in turn, gain the confidence of your investors.

We’ve already covered, what happens when you rely on guesswork or fudging your figures – remember Jenny? So, we don’t want you to leave a potential investment meeting feeling embarrassed because you presented inaccurate figures.

The second reason is if you’re looking to sell. Now, this option is a complex area on its own, and it can often be a difficult decision. Many businesspeople, sell up for various reasons. However, if you want your potential sale to see fruition, you need to have an accurate figure. Although there may be some “bartering” involved, the sale price will generally be near the valuation figure.

Thirdly, if you want to gain a clearer picture of your management. Now, depending on the size of your venture, this point may not be relevant. However, if you have a manager(s), then you can gain a better understanding of how well they are performing. Moreover, a valuation can shed light on your employee’s work ethics, to identify the over and underperformers. Thus, you can use the valuation to motivate and encourage, by rewarding those who truly have the best interest in your company.

Yes – several. So, we’re going to look at the top three factors that have an effect on your valuation. Although, in theory, value is generally associated with what people are willing to pay? And, yes at times it can be a buyers’ market. However, there are external factors that frequently come in to play, when valuing a company.

This factor is the reasons behind the valuation. For instance, are you having to sell because you’re in a deficit? There’s a huge difference in the value when it comes to a voluntary sale compared to a forced sale. As they say, it’s often a “dog eat dog world.” Unfortunately, there are some businesspeople who will take advantage of a forced sale, to get a cheaper price tag.

Bookkeeping comes in handy with this factor. If you have a clear overview of your company’s assets, sales, and outgoings, it will provide you with a more accurate valuation. This factor is where the tangibility of your business is assessed, can you continue to stay in profit? Do you have valuable assets/resources? Is your product/service still relevant?

These are the questions that will be asked by buyers and investors, as they begin dissecting your valuation. So, it’s vital you can first understand the tangibility of your venture – this assessment can sometimes be challenging because you will be somewhat biased. It’s only natural. This business could be your first, your baby, so it’s hard to see its faults.

So, that’s why many entrepreneurs seek external advice, for instance, accountants. Moreover, according to Growth Business: “Until a valuation is carried out by a team of qualified accountants, no business owner can be sure what their company is worth.”

Why? Well, an accountant will have an unbiased view and will look at the figures, rather than the emotional attachment. Now, your accountant, (well if you used Pearl), will have your best interest in mind. As we say here at Pearl Accountant’s, “We help our clients build great businesses.”

This factor is linked to point one, especially if it’s a forced sale. Not surprisingly, if you’re the company is still under five years old, and has a negative net value, it will have an adverse effect on the valuation. On the other hand, if you’re a well-established venture, who are looking for investment or selling to move on to greater things, you are likely to have a positive valuation.

There are also, more intangible factors, which can be slightly trickier to assess. Such as:

This quote, by Linda McMahon, sums intangible factors when valuing a small business, quite nicely:

“Small business people are people with goals and values that can’t be calculated on a profit and loss statement.”

Although, the above factors and the quote are true. Moreover, they can be challenging and can impact the accuracy of the valuation. There are still some techniques, as well as external advice, to give you a transparent, accurate and importantly, viable valuation – which, leads us quite nicely to the second part of this article.

Well, we’d like to start the second half of this little guide, with another quote.

“Try not to become a man of success. Rather become a man of value.” – Albert Einstein

Now, this quote ties in quite nicely with our six simple-ish steps. There is a common misconception, which is that something is only worth, what someone is willing to pay. Although, this belief may hold some truth, when it comes to your own business, it is in a sense invaluable.

It is important to note that most industries will have a specific method or “formula” to work out the valuation cost. We have selected the five most well-known and used, across different industries. You may find that option one, is not too helpful for instance, if you primarily have intangible assets.

So, as an example, small retail owners, tend to value their business using the “multiple of turnover” method. Whereas, an e-commerce or “mail-order” store, are commonly valued by turnover. Although there are a right and wrong, it’s generally finding the method that works for you. Then, if you’re still unsure, you always have the option of using your accountant to double check your maths.

If you would like to gain an accurate picture of your small businesses value, the different methods below should help you. However, if you would like a second opinion, then Pearl is always here for you. Right, let’s get to it…

This step is possibly the easiest, as you should ideally have this information to hand. Again, this is where tangibility comes in – what are your tangible assets. Now, your assets can be digital or physical. Nowadays, digital assets do fall into the whole picture when valuing your small business. For instance, you might have a killer website or online service that is your driving source of revenue.

Some forms of tangible physical assets include:

Common examples of digital assets include:

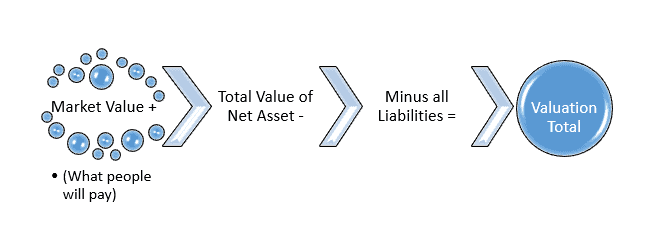

When it comes to calculating the total cost of these assets, including any losses or liabilities, your books come into play. Hopefully, you’ve kept your books organised, up to date and accurate. Your books will help to show the net value of these assets. So, the easiest way to work this out is:

Now, this is where the complexity begins to kick in. As this method does not account for external factors, such as inflation, recessions, and appreciation/depreciation.

You may be surprised at the net worth figure, and don’t worry you’re not alone. This result can come as a shock because this valuation tool will typically produce the lowest value. Why does this happen? Well, it’s because it’s based on figures in “black and white,” rather than the intangible assets, which are a little trickier to value.

So, this is where the common assumption of something is only worth, what another person is willing to pay, comes into play. Your brand recognition, customer loyalty and industry goodwill aren’t factored into this valuation. In accountancy, we refer to this gap as being:

Your company’s ‘market value’ (aka what people will pay) + the value of ‘net assets’ (excluding liabilities) = Valuation

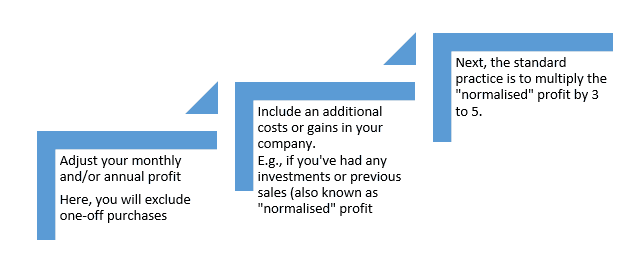

This method can be applied to nearly all businesses if they hold a solid track record of profit and consistent sales. This method involves:

Once you have completed the three steps, the result or final figure will be your price vs earnings ratio.

This method is ideal for new startups, who are planning to hire employees. The entry valuation method is based on an estimation of the costs of starting your new business. Now, this is where many businesspeople get tripped up.

For instance, one may value their idea/service/product to be worth £10 million, when in reality it’s only £1 million. Although, this is relatively simple compared to the above two methods. You have to be extremely realistic when calculating your estimations.

You will need to estimate some of the following:

We’d also like to note, that if you’re at the very initial stages of your new startup, there are some other costing considerations. Let’s say that the main reason for valuation is to seek investments, you will need to calculate the costs of registering a company, any banking or payroll software, website design, basically, everything you need for your company to hit the ground running.

Arguably, this valuation method is popular for an established business, which has been previously sold. In fact, it works perfectly for established businesses that have accurate comparisons (competitors).

The best way to describe this valuation technique is to compare it (pardon the pun), to a house valuation. For instance, most homes tend to be valued on average price based on recent sales of comparable properties.

This technique works well for businesses too. So, if you have one or two competitors that have been “sold-on,” you can compare their assets and services to give you an average valuation. Besides, being a relatively simple valuation method, it’s ideal when you’re looking to sell, rather than investing.

Why? Well, when it comes to investments, you generally want to showcase as much profitability, tangibility and how beneficial it is for investors. So, it is recommended that you use one of the more informative valuation methods so that you can paint a clear picture of the advantages of a long term investment.

The last, but certainly not least is method five. This valuation method is ideal if you’re looking for potential investors. Actually, this method is reported to be Warren Buffet’s preferred way of establishing the value. As he famously said:

“Price is what you pay. Value is what you get.”

Essentially, he is explaining that a price tag and the perceived value is something completely different. Again, this method may not apply to new start-ups, as it’s generally used to work out the long term value of a mature, well-established venture.

Discounted cash flow, works by predicting a valuation of profit, based on several years of stable, net cash flow. This method also accounts for the future value of your business, i.e., the continued profitability. The value is the calculations of the predicted dividends over the next 10-15 years, as well as a residual value at the end of the “term” (the 10-15 years forecast).

Now, without risking sounding contradicting, this method is by far the most complex. It involves the need to having basic accountancy, stock and industry knowledge. However, it is possible to do this on your own, or with help from your handy accountant.

Hopefully, we’ve provided you with some helpful guidelines that you can use to work out the value of your small business. We believe that it always serves businesspeople well if they have an understanding of their valuation. Although, it can be challenging and complex at first, even with the simplest of methods.

So, if you’ve got a big investment meeting book, or you’re looking to sell up, you don’t have to go through the valuation process on your own. Here at Pearl Accountants, we have a team of business specialists who would be happy to help you gain an accurate, error-free valuation of your business.