By Ashley Preen

May 7, 2019

The road to starting a small business is stressful and rewarding. If you’ve already started the process of your new startup, then you’ll know that there are tons to do.

First, you need to pick your company name. Then, you have to register your company. The next step is to open a business banking account. This article, well let’s call it a guide, is designed to help you decide which business account is best for your business.

As they say “money talks,” but what happens when you start making sales? Yes, you can use your personal account. However, you should separate your personal and business finances. Why? Well for starters, legal reasons. Secondly, business accounts have different features.

We recommend, opening a business account at the early stages for any new startups. If you’re thinking, I’ve only just thought of a name, slow down! Well, we say, stay motivated and keep ticking things off your to-do list.

Moreover, there are many reasons that you should open a business account during the initial stages. The first is that it will help you to maintain and monitor your cash flow. Not only that, it looks professional, especially when you start receiving payments from clients. Oh, and seeing your company name on a shiny plastic card is always a plus.

Let’s assume you’ve registered your startup. You have a great company name, your products/service are good to go. Now, all that’s left is to start making sales.

As mentioned, it is recommended to open a business account, regardless of how you operate, i.e. a sole trader or limited company. However, you don’t want to limit or delay growth at the start of your venture.

The beauty of business is that there isn’t really a limit (in terms of success). We only hinder and limit ourselves, when we apply limitations or barriers. In this case, not having a business account to hand when you start expanding

So, let’s look at the “ifs” when it comes to using your personal account. Typically, the requirement of a needing a business account depends if you are running a limited company or you’re a sole trader.

As a sole trader, in essence, you are the business. So, essentially, your business and personal bank can be viewed as one, for tax purposes. Thus, in theory, you can use your personal account. But, here comes the “if” – if your bank allows it.

Yes, it may be easier to continue using your personal account. However, even if your bank allows you to do so, what happens when you grow? In business, you always need to plan. What we mean by the plan, is planning for now as well as the short and long term (back to our beauty of business anecdote).

The reality is that most UK bank accounts are that most banks prefer that you keep personal and business transaction separate. Even if you are a sole trader, your bank will begin to notice if you start making/receiving larger transactions. When you’re bank notices a change in banking activity, you can expect a nice monthly fee. Let’s call it a blessing and a curse.

So, yes, you can use your personal account theoretically. However, we expect your bank will be giving you a call to discuss your “options.”

Unlike the ‘flexibility’ when it comes to banking, limited companies are legally separate entities. The main difference is that there a no personal finances with a limited company. Even if you’re the sole employee or director, you can have your salary/dividends paid into your personal account. However, this payment will have to come from a business account. Moreover, it is a legal requirement that any UK registered a limited company has its own bank account.

Now, to revert to the question: Can I use my personal account?

The answer is yes and no, depending on how you operate. However, our answer and recommendation are that you should have a business account. Depending on what stage your venture is at if you haven’t thought about opening a business account, you should! Why? Well, for the following reasons:

Also, if you’re not one for paperwork, there are easier options. For instance, your accountant can help you open your bank. Here at Pearl Accountants, we have a dedicated new startups team, who are on hand to help you with any stage. However, we’ll look at how we can help shortly.

In this section, we will be looking at how to select the best bank account for your business. We will also list the top 5 business bank accounts, according to the latest statistics.

You may or may not know about the abundance of options when it comes to business banking in the UK. As much as opening a business account for new startups is a priority it shouldn’t be rushed. Instead, you need to consider certain factors and shop around for the best deals.

Let’s say, you’ve been using your personal account, and you’ve received a call from a personal banker. This personal banker then offers a business account deal that shouldn’t be missed. We recommend that you don’t say yes right away!

Although the easier option may seem to be sticking with whom you bank with personally, you actually may end up paying higher monthly fees, transaction charges and interest. So, keep in mind that you can have two banks, one for personal and one for your business.

If you’re already proactive and you’ve been looking into the best business accounts, then you’ll know that there are tons of options. If you haven’t done worry, basically there are tons of banking options with high street lenders. So, before we select the best business banking account for your small business, let’s looking at what you should consider first.

First, you need to think about how you’re going to use your account and what you want from a business account.

Like all things, there are pros and cons to every business banking account. For instance;

So, just looking at the two examples above, you really need to think about how you will use your business account. Our advice is that you select a business account that aligns with your banking activity.

We recommend that you take some time to really consider your needs. However, if you’ve not made any sales, and you can’t predict your banking activity, seek advice. You can find tons of tips online, and your accountant will be able to advice you based on your ventures industry. Essentially, your first step before you even begin comparing is to consider your short and long term needs for your business.

Hopefully, you understand how you will be banking. Now, it’s time to look at bank account fees.

Generally, most business accounts are accompanied by monthly fees. Sometimes, business accounts also have additional charges for transactions. These fees vary with every bank and every account. Typically, you will be charged for:

Again, you have to refer to your bank needs, to understand which transactions/services you mainly need. For instance, if you’re business deals mainly in cash transaction then look for a business account, which has lower paying-in charges.

Additionally, some banks do offer free-fee periods when you first join. However, be sure to look at the fees after the trial. Hidden costs often hide in the small print.

Surprisingly, even in the digital world we live in, some business account doesn’t offer online banking. Perhaps, you prefer to bank in person. It’s still recommended to have an online option too. As we are evolving technologically, so is the world of business. Although nothing beats the personal touch of visiting a branch to cash your hard earned money, an online option is always convenient.

Nowadays, the vast majority of the business bank account has online banking options. Plus, these free online business accounts are also free to use. So, you can go completely digital and have a sole online bank, without a branch. However, you need to consider what happens when you need help or advise. Again, opting for an online bank depends on how you operate a business. It may be financially beneficial for your business, rather than paying a monthly fee with a high street lender.

Perhaps you’re ahead of the game, and you already have a business account. You’re probably wondering how do I find the best one for my small business. Don’t worry; we’re nearly there! So, if you’re looking for a better business account for your venture, you may have noticed the switching offers.

Switching your business account is always a great option if your current provider doesn’t meet your needs. Not to mention, many providers offer switching offers, such as “no-fees” for the first 3-6 months. Some even entice budding businesspeople with money for new startups or switching your account.

Like all things, there’s often a catch. Like we said above, be sure to read what happens at the end of the offer. If it’s a cash switch offer, check the fees and monthly rates, you may end up losing money.

Although it’s great to take advantage of offers, always be diligent – and when unsure, ask! As there are plenty of professionals and fellow businesspeople who will help. Luckily, if you make the wrong choice, it’s relatively easy to switch your bank account.

However, we don’t recommend “deal” hopping when it comes to your business account. Nine times out of ten you will lose more in the long run, which comes from being a long-term, loyal business banker. Now, without sounding repetitive, the best banking option is what works for you and your business needs.

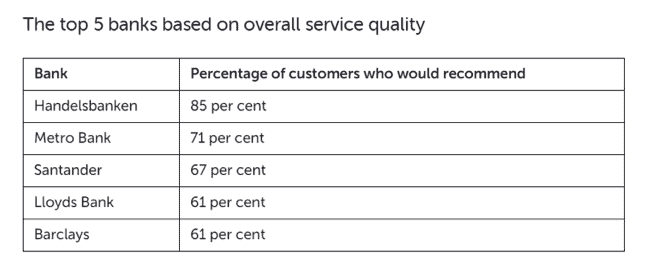

We have listed the best-rated business banks, as of December 2018. The list below is to only provide you with options for you to make your own informed decision. Moreover, this list was ranked by your fellow small business owners.

So, please view this as a guide, rather than “you must join this bank.” As we have said, you need to find a bank that’s right for you and your business needs.

As you begin analysing your business needs and comparing the bank market, you will see there are tons of options. However, the answer to What is the best business account for a small business?

Is simply, what is right for you and your business. Nearly all of the high street and online business banking options provide new customers with appealing deals. Also, each has its own respective features and benefits, as well as cons. Our key advice is that you shouldn’t rush into what may seem like an amazing deal, without reading the full terms.

Perhaps you’re still thinking; I don’t know how to find the best business account for me! Don’t worry; this is where is Pearl Accountants can help! We are dedicated to helping our fellow entrepreneur grow and succeed, in the somewhat uncertain market. If you’re not one for paperwork, or you don’t know how to register your startup, then we can take care of it all!

Well, you’ll obviously have to provide us with some information to help us get started! Alternatively, if you just need help setting up your account, then that’s an option too! We have two options that you might find helpful.

Option One: Form a UK company with Pearl

If you decide to form a UK company with Pearl accountants, we can then help you set up a bank account. Currently, we have two schemes, with Barclays and Lloyds.

Barclays – You will receive 12 months free business banking – and we’ll help you decipher the small print.

Lloyds – You will receive 18 months free business banking – again, we’ll guide you through any hidden features.

Option Two: Established Businesses

If you are an established small business that already has a business account. We will assess if your current bank is right for you. Our team will look at your banking habits, and help you switch to a better account that’s best for your business. You could even be entitled to free banking for a year if you switch to a better account.

Bonus: If you use Pearl accountant to help you find the best business account for your small business. We will help you set your bank account up to your software for free, so it will help you manage and maintain your finances to help your business grow.