Pearl was runners-up for “Firm of the Future,” which means QuickBooks have recognised us.

We are QuickBooks ProAdvisors who know how to integrate software which helps us manage our client’s profit and loss reports and taxes when we work with freelancers, small business owners, and LLCs. Our software specialists can show you how to use QuickBooks for your business so that you can keep track of your money in real-time and make reports that are easy to understand.

Get the software you need to manage your business at a price that fits your budget. QuickBooks Online offers affordable monthly and annual plans, so you can start with the plan that works for you, whether you have one or many employees.

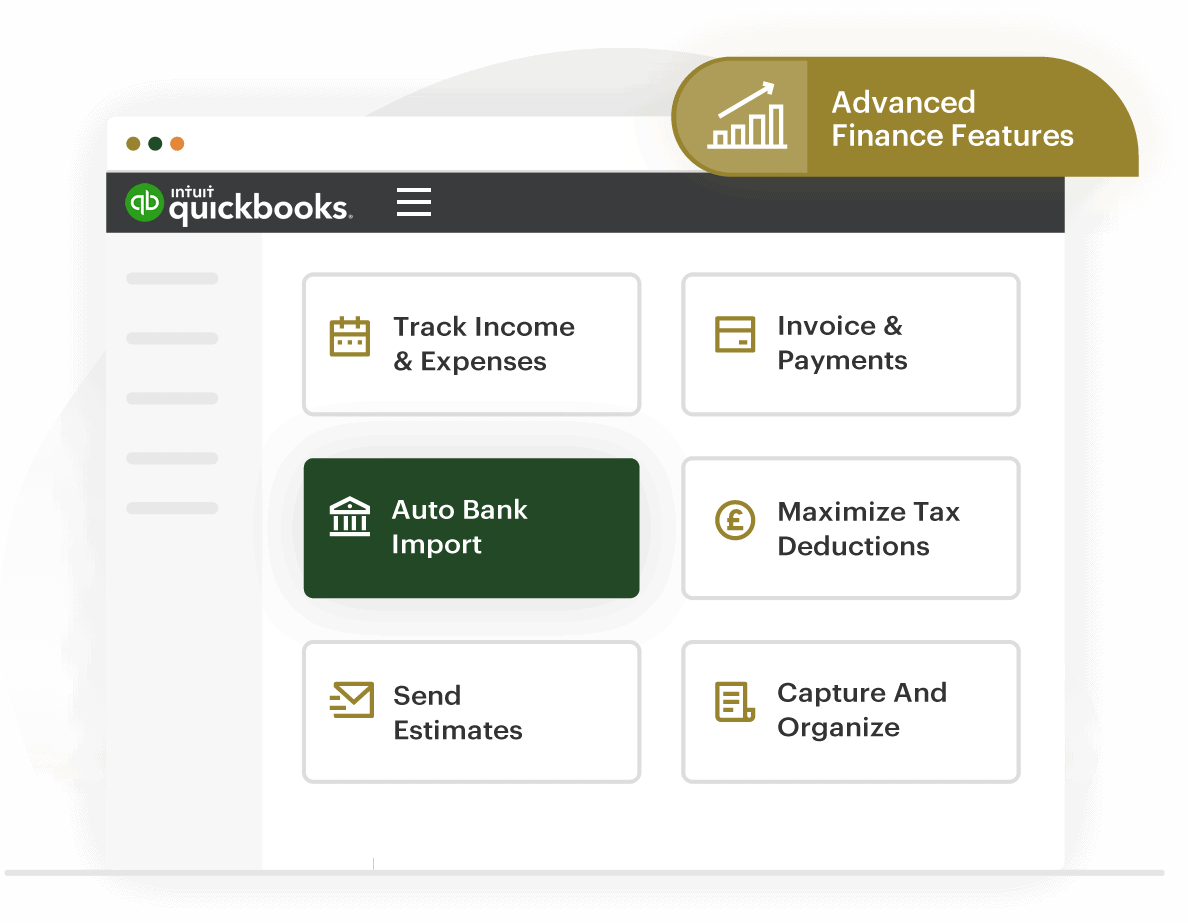

QuickBooks is a good choice for new businesses. Their accounting features cover all the basics that most new businesses need, such as keeping track of income and expenses and basic reporting. Your monthly financial statements are part of these reports, such as the balance sheet and cash flow statement.

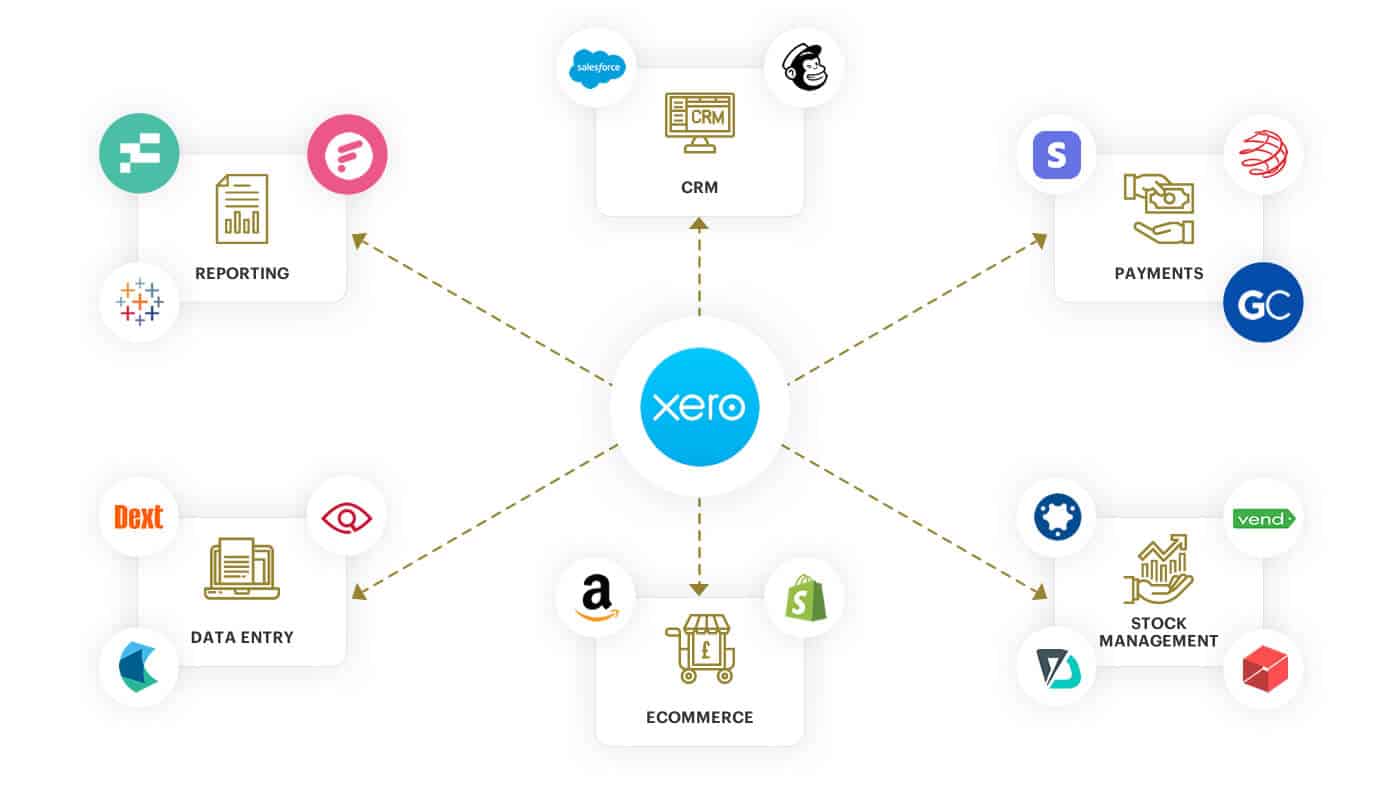

As your business grows, you may need specialised financial tools to handle the higher level of complexity in each function. Work with more than 650 different business tools, like PayPal, and automatically sync all your data so you can see the complete picture of your start-up’s financial health and speed up your month-end close process.

Using QuickBooks Online couldn’t be easier. It’s simple from the get-go. You can start using the software the same day; it only takes a few days to complete your data migration and set up the process. Once you set up, you can begin managing your accounting functions immediately – from one convenient place.

Accountants, bookkeepers, and financial experts often use accounting software to provide their services. If you choose an accountant unfamiliar with the software they will be using, they may make mistakes or miss chances to give you the best possible solution. QuickBooks is a well-known and popular choice. Hiring someone who already uses the same accounting software as your firm can easily avoid these problems.

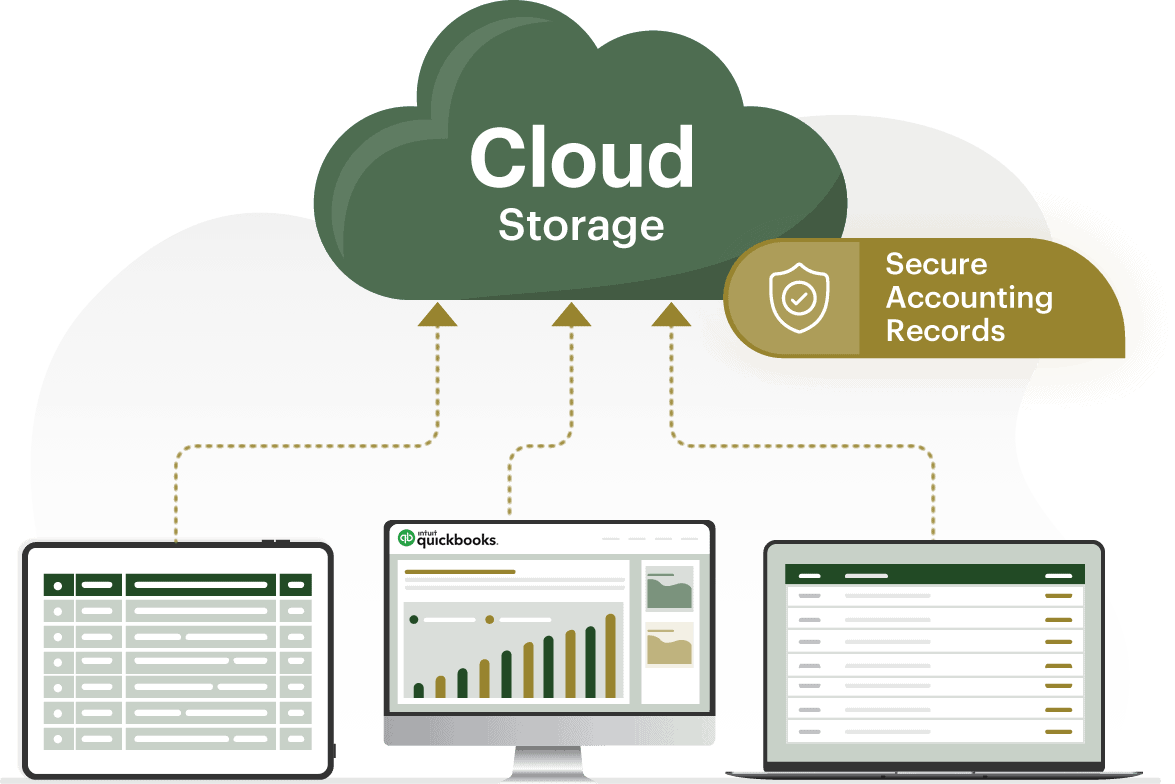

Access your financial records from anywhere in the world. This makes it a good choice for teams that work remotely or worldwide. Your accountant won’t need to come to your office; they’ll need a login and password to get to your company file, so filing your taxes doesn’t have to cause stress or headaches!

Invoice your customers in a few simple clicks and print completed invoices. QuickBooks will automatically record your income and track how much each customer owes you. By running an A/R ageing report, you can see how many invoices are still unpaid and how many days they’ve been past due.

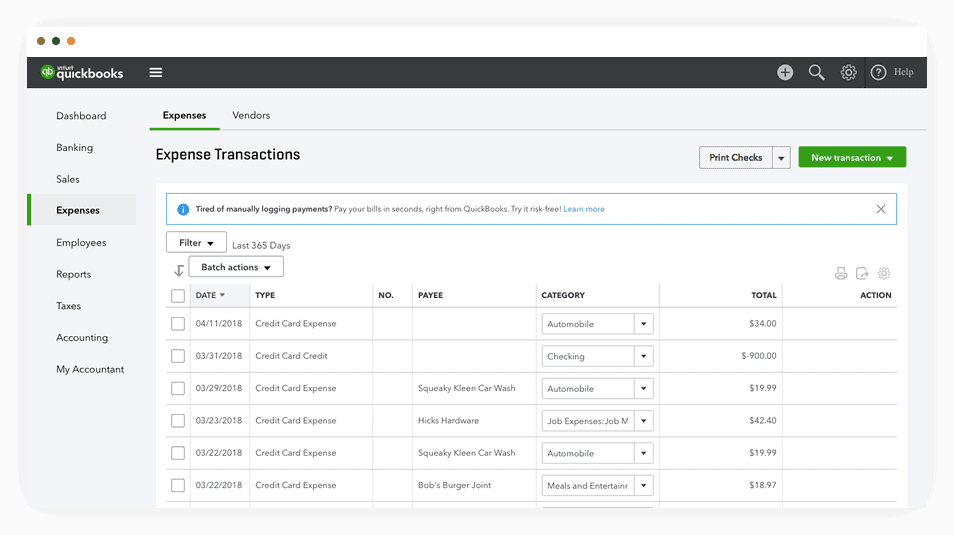

You have the option to add imported transactions manually,or QuickBooks will automatically import your bank and credit card transactions. You can add a check or cash transaction in a few minutes if you need to track it manually.

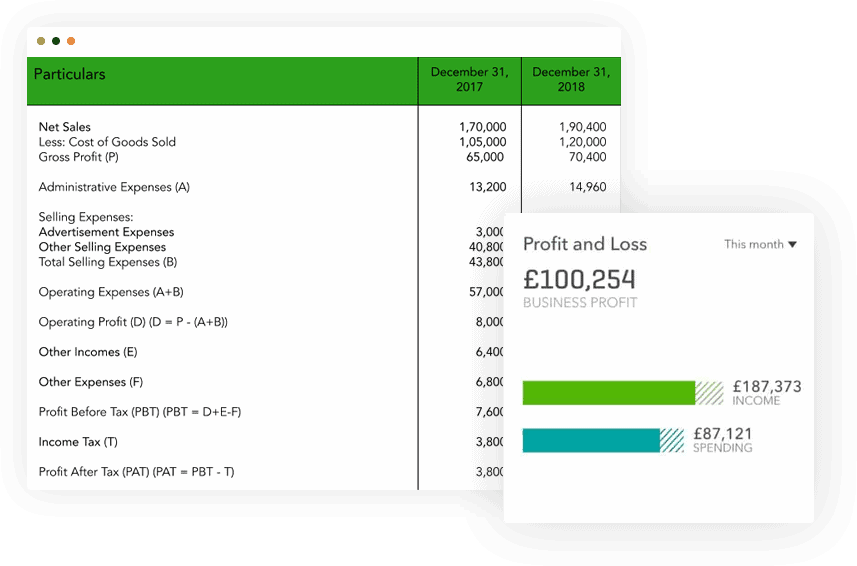

Printing financial statements is a handy tool for businesses that manage their cash inflows and outflows. Lenders generally require financial statements when you apply for a small company loan or line of credit. The ability to generate financial reports such as profit and loss statements, balance sheets and cash flow statements will help make the process easier.

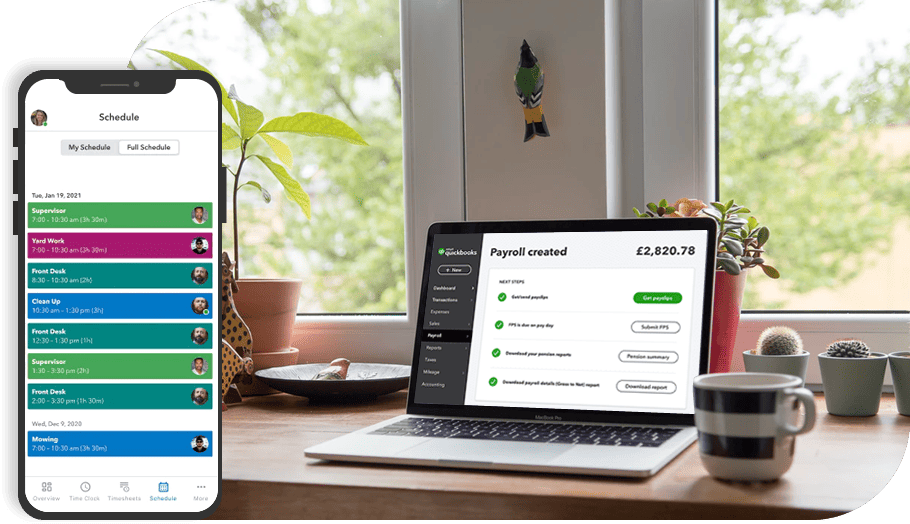

Doing payroll manually is a mistake that you don’t want to make. Payroll errors can lead to hefty fines and disgruntled staff, the built-in payroll feature in QuickBooks will automatically calculate and run payroll for you. Every time you enter hours for an employee, QuickBooks uses their information, including hours worked and job details, to generate accurate invoices for customers.

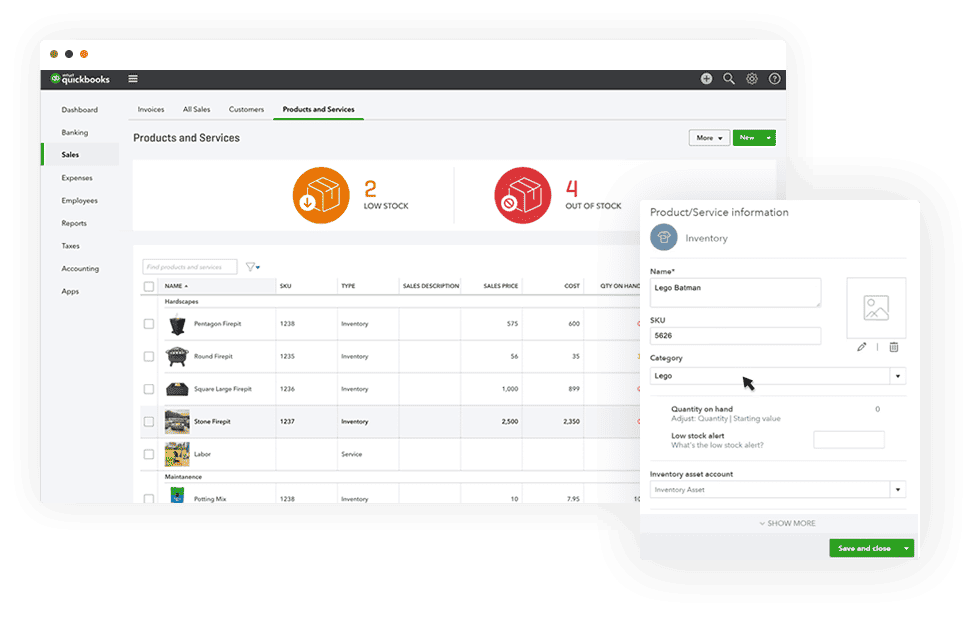

Track your inventory in QuickBooks, and let it do the work for you! This cutting-edge software solution calculates the cost of goods sold for you. This deduction from your income is automatically calculated as you sell inventory. For tax purposes, this allocation is necessary and time-consuming to perform manually. If you run low on inventory, QuickBooks will notify you that it’s time to reorder.

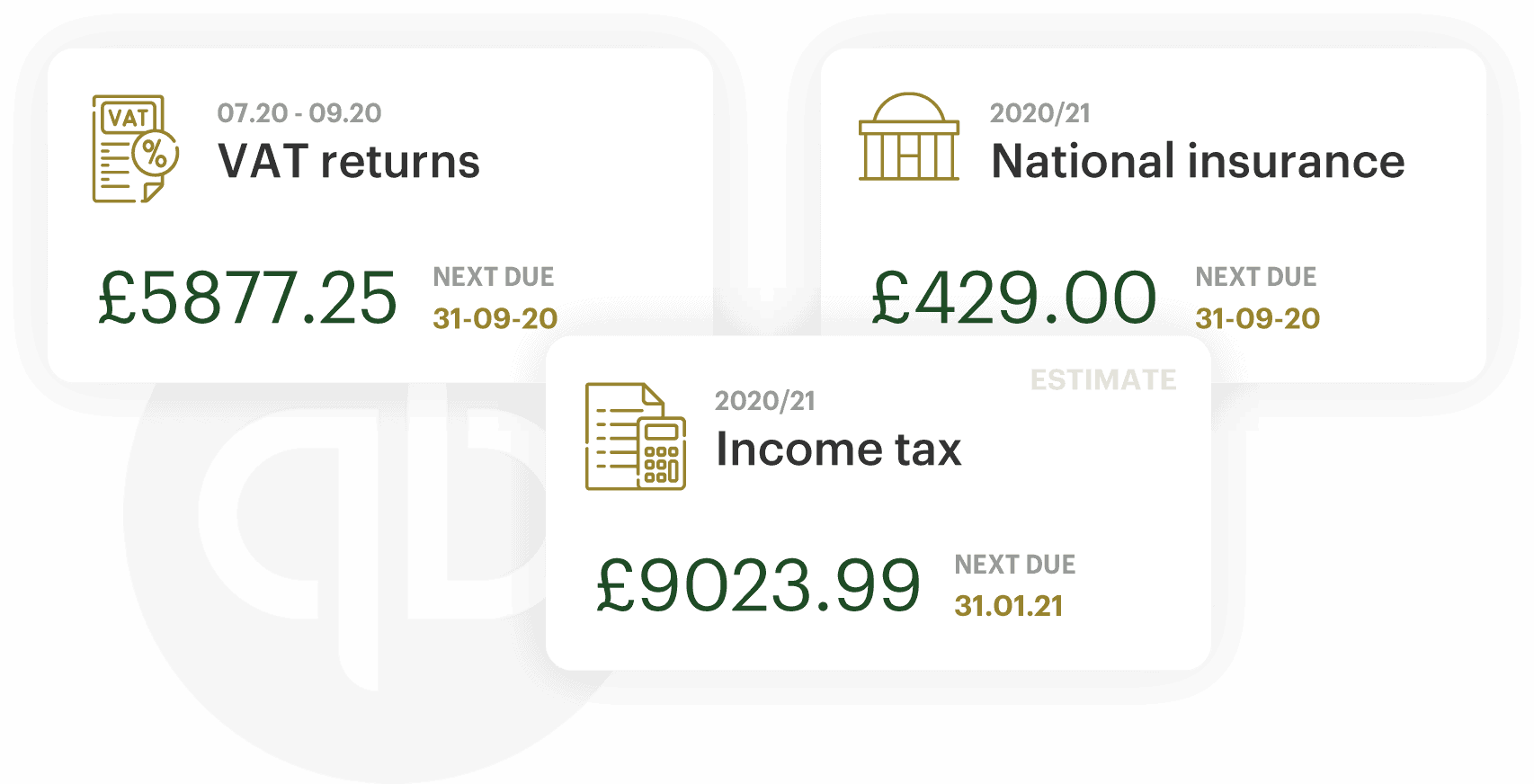

The easiest thing that QuickBooks can do for your small business is make tax time easier. Compiling your income and expenses is the most challenging part of filing your taxes. Now, you can give your accountant direct access to your account so they can look at your numbers and print out whatever they need to do your taxes.

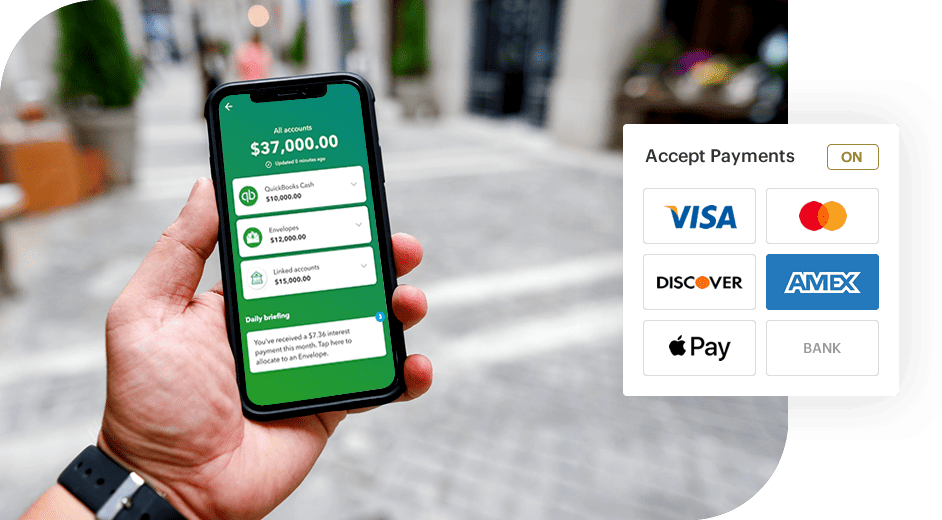

You can add QuickBooks Payments so customers can pay online from their emailed invoice. This is like other services for merchants, but because it’s fully integrated into the software, the sales, credit card fees, and cash deposits are all recorded automatically as they happen.

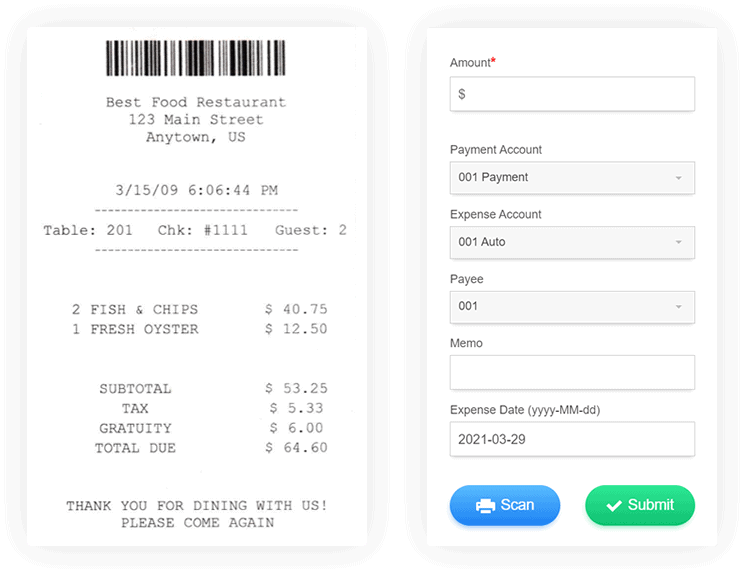

Organising your business receipts is the first step toward making tax time easier. QuickBooks Online subscribers can download our mobile app, take a picture of their receipt, and upload it in just minutes. All those purchases are automatically linked to your bank accounts, so you don’t have to worry about manual entry later.

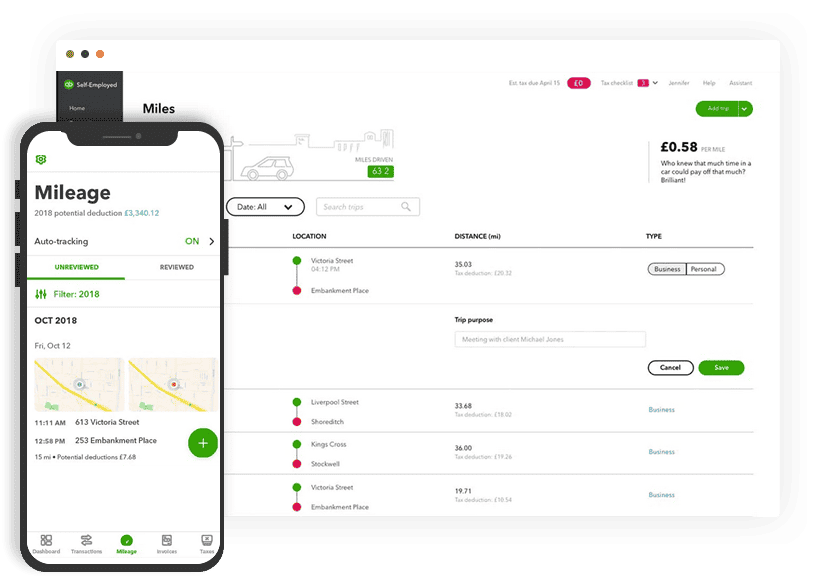

For self-employed people and employee/owners, using a personal car for business is a huge tax break. But to get the break, you must be able to track the details of each mileage trip. This all-in-one software solution makes this easy by automatically tracking your moving vehicle with GPS and then making it easy to add billable mileage costs to an invoice.

Want to know more about this all-in-one software solution? Our specialists are available to answer any of your questions and will set you up in no time.

QuickBooks integrates with over 750 apps that help your employees track time, generate sales leads, and communicate with customers.