Let our specialist team of accountants take the hassle out of your VAT affairs so you can get back to business.

VAT is compulsory if:

Regardless of your VAT taxable turnover, you must register if all of these apply:

Voluntary registration:

You may also choose to register if your annual sales are less than £85,000 or if you are just starting a business and expect to make several VAT-inclusive purchases that you can reclaim from the taxman. This will put you in a repayable situation with the HMRC, which will help your company’s cash flow.

Your business might be small, and getting VAT registered can seem daunting. But all will be taken care of by your dedicated vat specialist, who will inform you about new laws and rules. They will also sign you up for a suitable VAT scheme, handle the process of signing up, and look at how tax-efficient your business is. If your income is less than £85,000, you don’t have to register immediately, but it’s still good to prepare for the future.

If you are looking to save, it is always recommended to analyse and consider your VAT scheme. Our VAT experts and tax advisors will analyse your industry and consider your circumstances, such as conducting business internationally; based on this, we will provide advice regarding the most suitable VAT scheme.

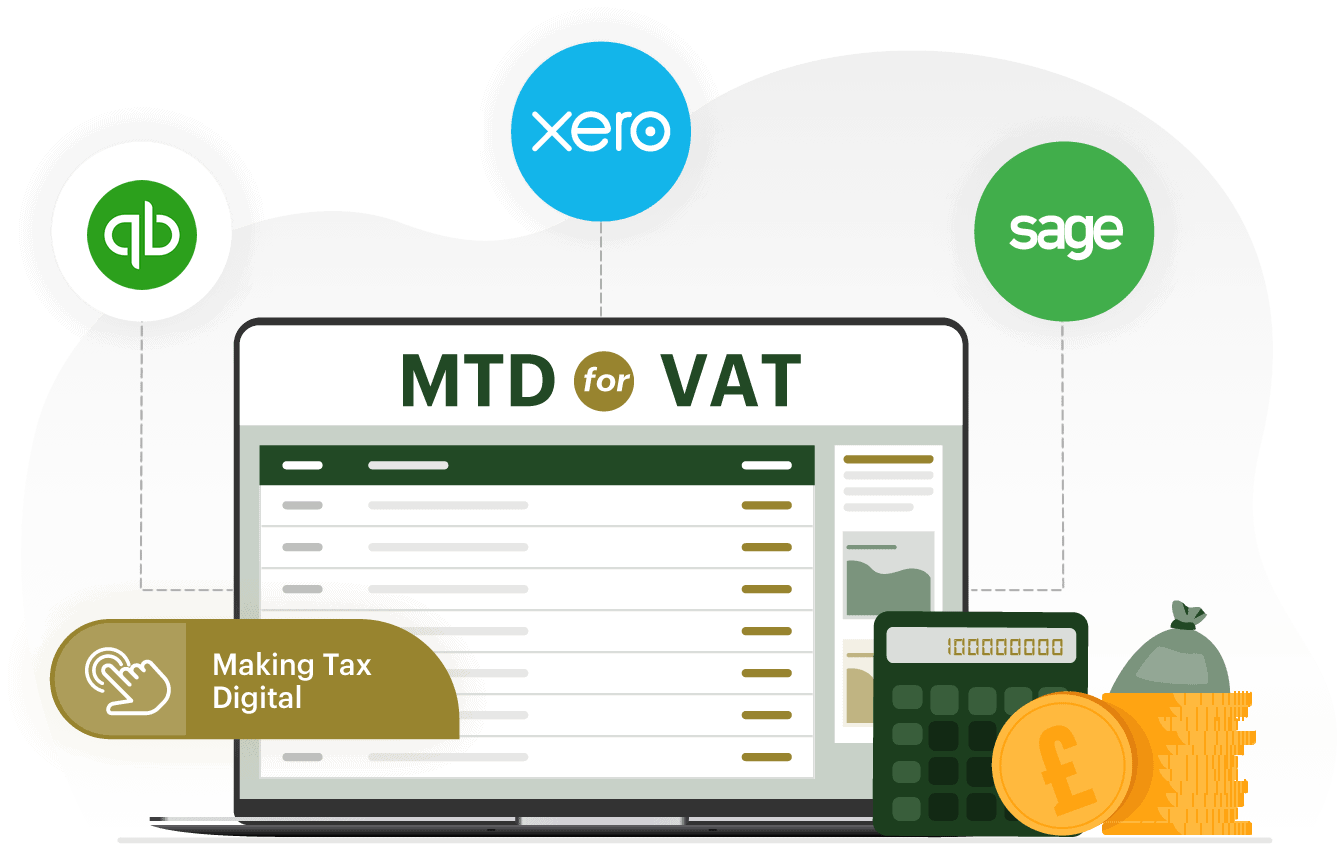

We will ensure that your VAT returns are submitted and filed as quickly as possible. We are MTD compliant and will file your vat returns using our online accounting software solutions (when you join us, you will be provided with either Xero, QuickBooks, or FreeAgent depending on your requirements).

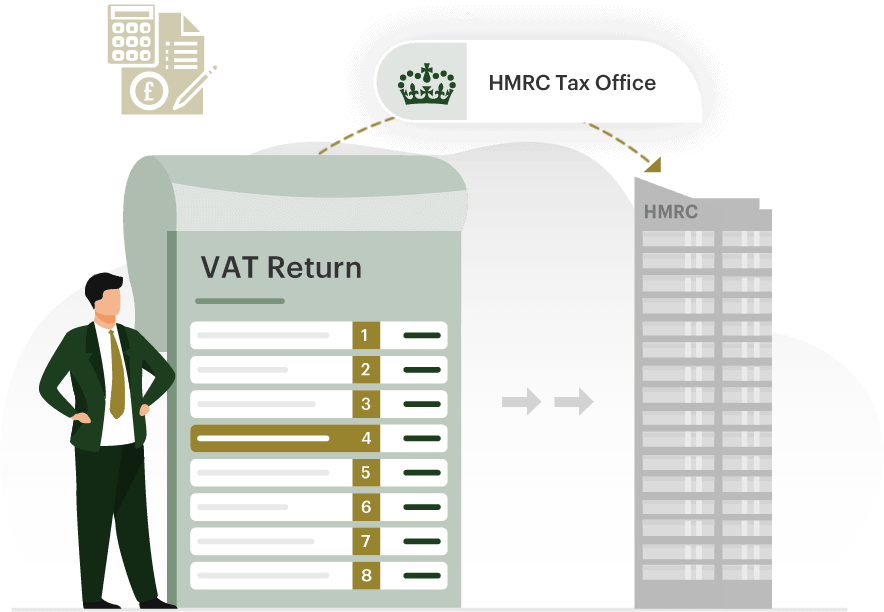

Our VAT services will help you complete your return quickly and easily. You can rely on our expertise to manage your submission to HMRC regularly, taking the hassle out of submitting your returns.

We will promptly remind you when your VAT returns are due and ensure these are prepared and filed to the HMRC on time; we will advise you if the business is in a payable or repayable situation. We will examine your expenditure and identify what is claimable from the HMRC on your return.

VAT SCHEMES

The VAT Flat Rate Scheme ensures companies pay the same amount of VAT with less paperwork. The amount paid to HMRC depends on business type and customer fees. You keep the difference between what you charge and what you pay HMRC, and you cannot get the VAT back on purchases, excluding capital assets above £2,000.

Customers who pay promptly but purchase on credit may prefer a cash basis since VAT is recouped sooner. You may choose an invoice-based payment system if your customers wait longer to settle their accounts, but you pay your suppliers immediately.

Standard VAT accounting implies reporting financial activities as they happen, regardless of payment date. This might damage your cash flow since you must pay HMRC VAT on services or items supplied but not yet compensated. You may claim VAT on the invoice if you haven't paid for products, improving your cash flow.

GROW YOUR BUSINESS

Our ICAEW-regulated chartered accountants help you from the outset. They understand your industry and accounting software preferences, from business structure to tax planning.

We're here to help. We recognise that every company, whether new or old, is unique. We build strategies that fit your requirements, objectives, and schedules whilst delivering objectivity and direction.

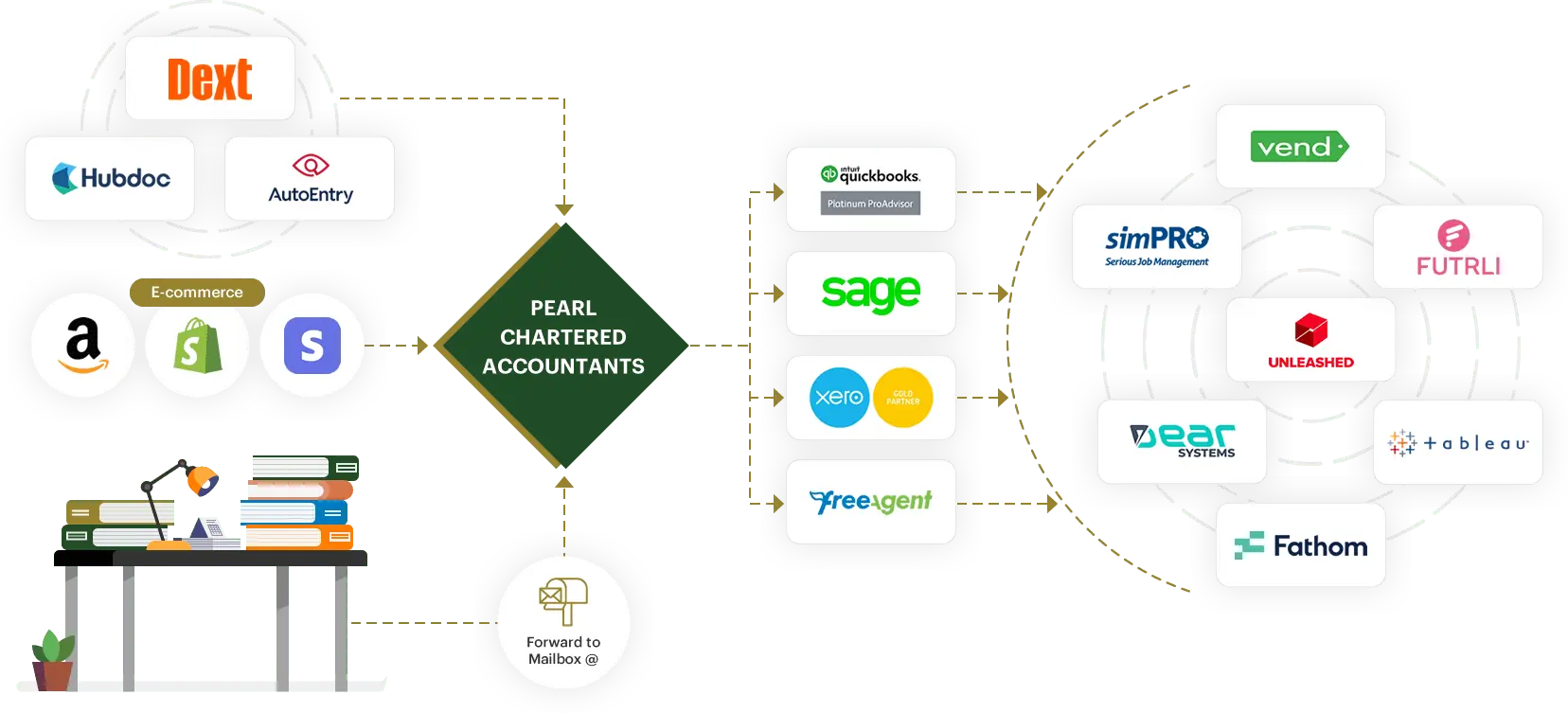

Pearl does the bookkeeping for all its clients. That's right: we take this problem off your hands. A hassle-free service means you don't have to worry about entering all your receipts and bills.

We pride ourselves on providing the best and most cutting-edge solutions for our client's business needs, with an array of software solutions from bookkeeping, productivity, and stock management.

As a one-stop shop for all your business needs, we provide a full range of services, from bookkeeping to legal counsel, to ensure your business's success and sustainability.

Although we have provided some fundamental information above, you can still get in touch with us, and we will determine if you need to register for VAT. Don’t forget that not registering for VAT might result in hefty fines and fees.

We know this service is associated with filing your company’s year-end financial statements and tax returns. This is why we will offer you a set monthly fee to cover the cost of preparing and filing your VAT returns.

We will review all the business-related expenses you can claim during onboarding.

Your company’s VAT registration could be filed monthly, quarterly, or even yearly. Most of the time, you will file quarterly.