AutoEntry is one of our favourite software partners because it uses optical identification technology to precisely extract all the critical information from your receipts and invoices.

When you keep your data in the cloud, you have access to it from any computer connected to the internet. You no longer must move around with paper copies of documents and folders or worry that you’ll lose something important.

Pearl Accountants understands that data entry is complicated. We love AutoEntry because it lets us automate the process of data entry and get your information faster and more accurately. This information can be used to provide financial forecasting and opportunities so that you can focus on running your business.

Instead of stuffing your pockets with receipts and bills, you could take pictures of them and store them digitally. They are less likely to be lost and reduce the amount of clutter. Once everything is automated, you will have a visual overview of expenses.

It’s important to keep track of your cash flow and automating your business might help you figure out where the money goes. With all your data in one place, you can see trends and make the necessary changes to secure your company’s success.

Automation is the future of business. If you’re a small business owner, Software Automation can help you make your business more successful. By getting rid of mistakes made by people, you can save money that would have been used to fix them.

Take a picture, scan, or upload a copy of your invoice, receipt, or bank statement. When it comes to analysing and taking out information in your documents, AutoEntry is incredibly precise. Line-item capture performance is unmatched by any competitor software.

The next step is to categorise the document. This will make it easier to find what you are looking for in the future. AutoEntry includes plenty of helpful features for organising your papers and grouping them automatically.

Publish refers to transferring your data onto your accounting software It’s as simple as clicking the “publish” button after your documents have been uploaded and organised. Now that the first steps have been completed, processing starts.

Pearl Chartered Accountants knows that accounting and Bookkeeping determine the performance of your business. We offer AutoEntry to automate your bookkeeping process, enabling you to stay ahead in every way possible.

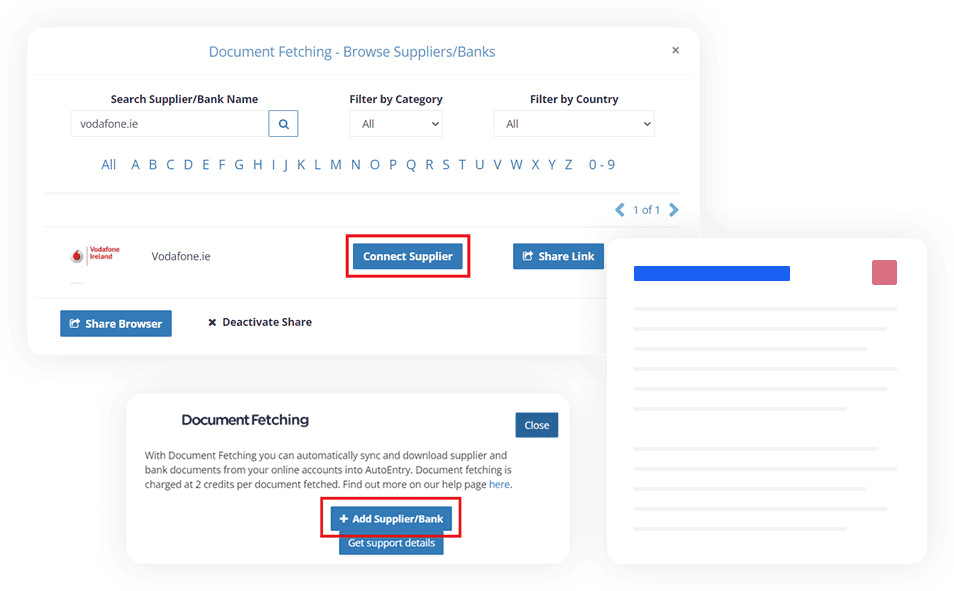

To take out data from your document, you can use the platform in several different ways. Visitors may submit data for removal through the website, via uploading a document or using an individual email address. You may also utilise the fetching module if you wish to extract data from multiple locations, at once.

This feature lets you have your bank and supplier paperwork automatically linked to your account. This is a great way to avoid entering data by hand and make sure your accounts are correct because you can get the data right away.

AutoEntry protects data by using the l technologies like End-to-End Code across the entire platform. Systems are made to protect data, which is a very important goal. Whether you share your information with customers or business partners, a lot of work goes into making sure it is safe.

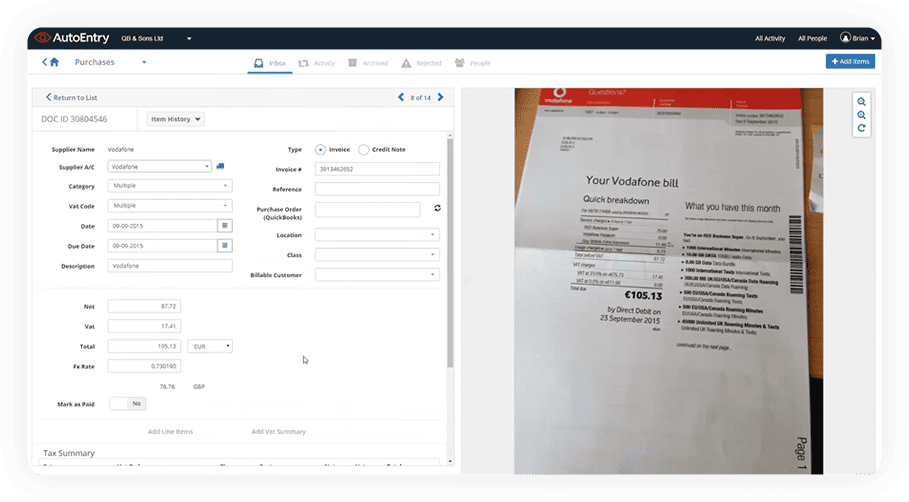

When tracking inventory or sales, pricing, and taxes, it can be easy to miss an item. Make a list of all the line items with their list price, quantity, cost per unit, and total cost. This extra layer of confirmation enhances the accuracy of data.

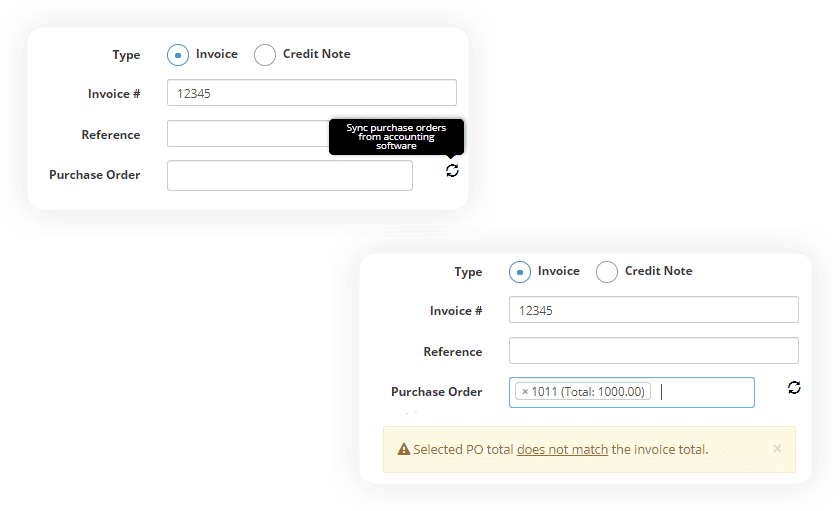

Save time and money by automatically syncing the data extracted from captured invoices with the correct open purchase orders. The software removes the need for manual entry and provides accurate records in a seamless process.

Many of the main accounting software companies allow AutoEntry as a data input method for their products. Let's explore three of the most popular accounting software and see how easily they may be integrated.

As soon as you connect AutoEntry to QuickBooks, it automatically pulls the necessary data and adds it to your QuickBooks account.

Scan, email, or take a picture of the document you want to save, and the software on your phone or computer will do the rest. Accounting software like AutoEntry can keep track of tax summaries and full line-item information, such as description, price per unit, and information about purchase orders.

Accounting and bookkeeping actions as well as businesses of all sizes are Sage’s primary focus. Not only will automation make data entering less difficult, but it will also expedite the whole data collection process.

When you’re done collecting data, you’ll have access to better data in real-time, which will give you more time to work on more important tasks.

AutoEntry provides live chat help and is also accessible via phone and email at support@autoentry.com.

AutoEntry has packages to satisfy everyone’s demands. To learn more, contact one of our specialists.

AutoEntry is compatible with all the most popular accounting software solutions, for a complete list, visit Autoentry Website