Need bookkeeping assistance? We offer an expert service for small, medium, and large businesses.

We’re dedicated to understanding everything there is to know about your business to provide you with the best service possible. From there, our team will allocate a client accountant with extensive experience in your industry and who is familiar with your preferred accounting software. We do all the work, tracking and monitoring your finances, so you always have complete visibility.

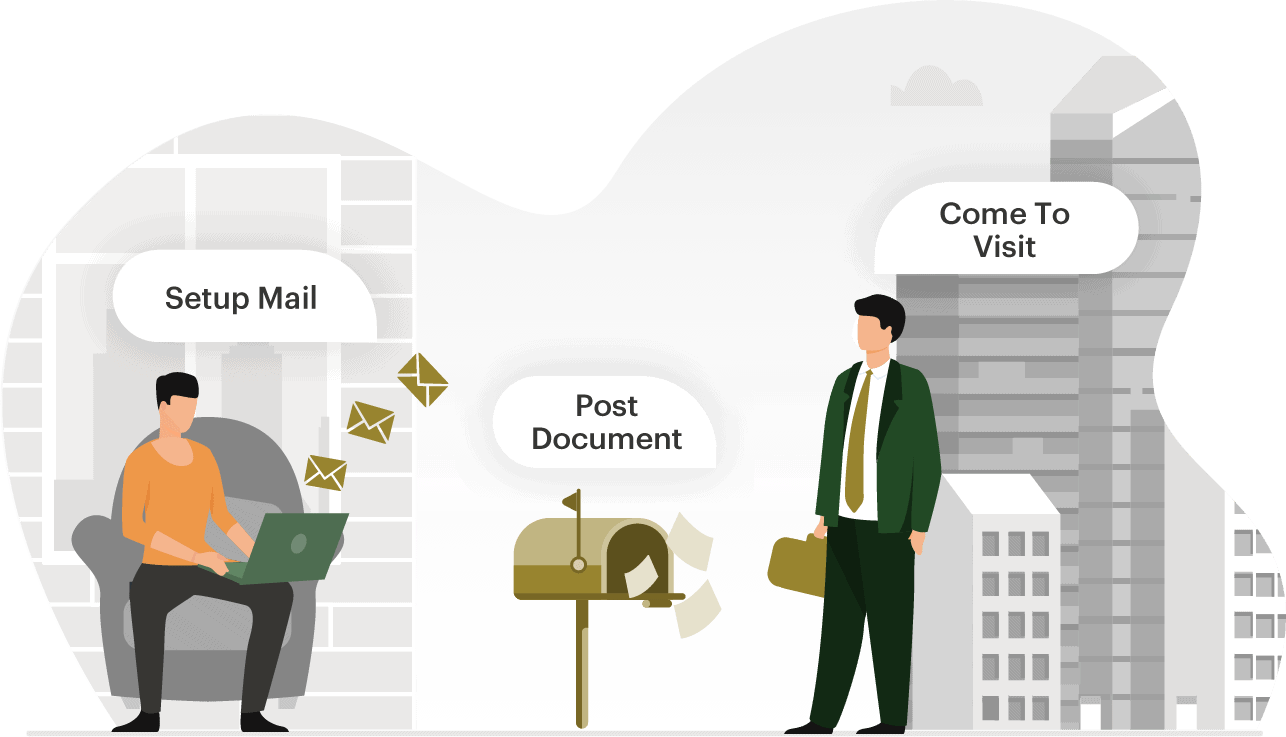

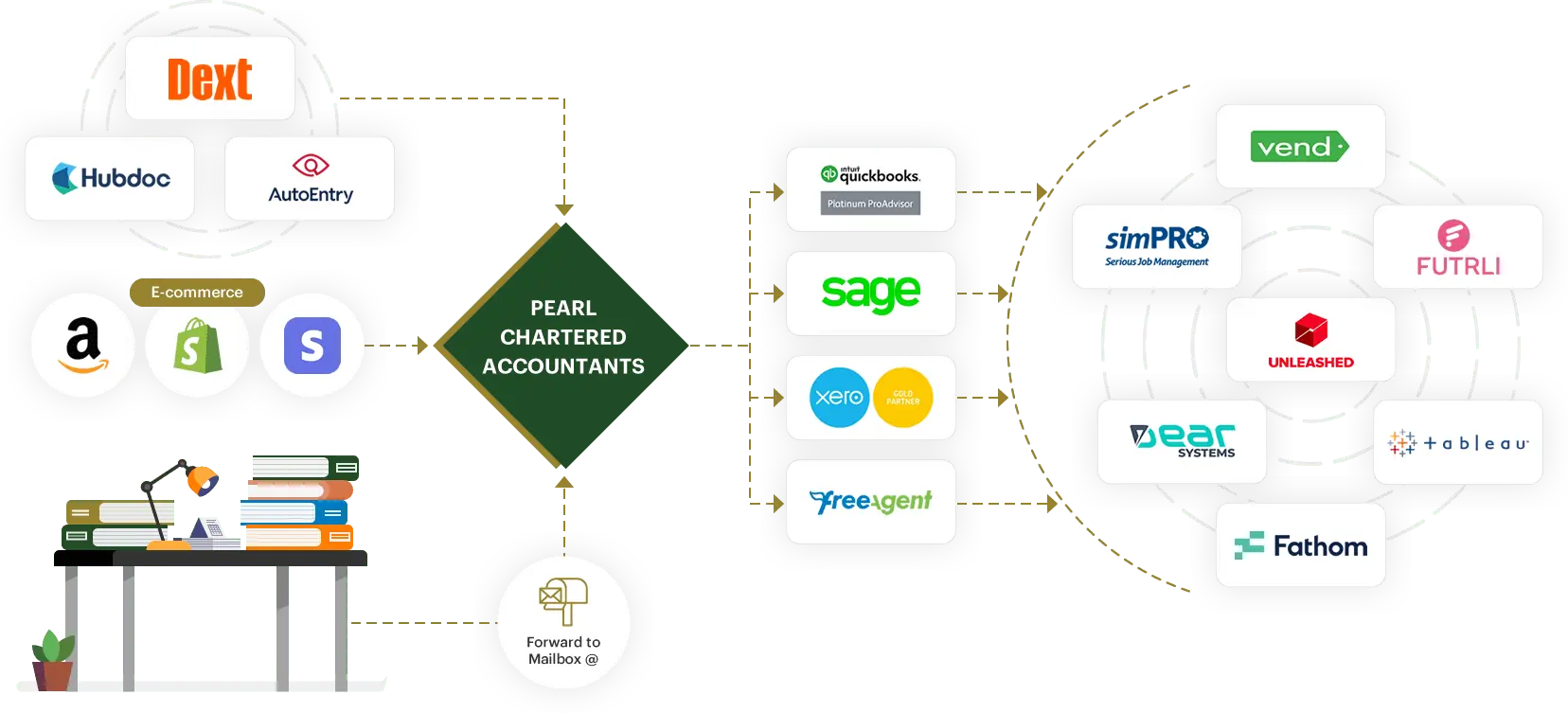

Sending us your records is easy; we will handle everything else from there on out.

We’ll set up a mailbox for you to send your receipts.

Post your records to our offices; we’ll handle the rest.

We come to you!

Our expert team of accountants will process the information in your selected accounting software and adjust it as needed to reflect your company’s success and profitability more accurately.

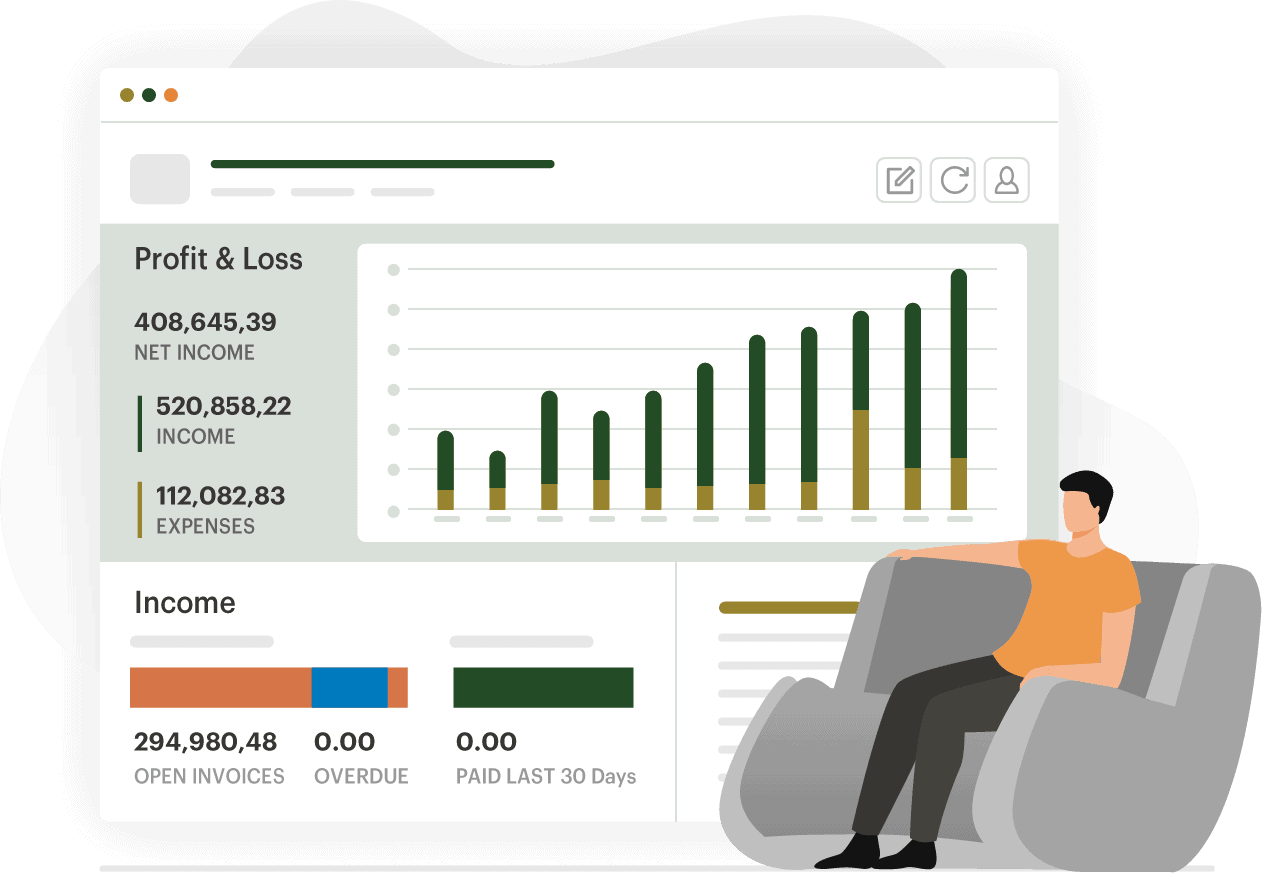

We ensure your online accounting software provides you with up-to-date information; with our help, you’ll have access to financial reports that show your company’s performance. Our team will provide you with an income statement, balance sheet, cash flow statement, and reports that provide industry-specific success metrics.

GROW YOUR BUSINESS

Our ICAEW-regulated chartered accountants help you from the outset. They understand your industry and accounting software preferences, from business structure to tax planning.

We're here to help. We recognise that every company, whether new or old, is unique. We build strategies that fit your requirements, objectives, and schedules whilst delivering objectivity and direction.

Pearl does the bookkeeping for all its clients. That's right: we take this problem off your hands. A hassle-free service means you don't have to worry about entering all your receipts and bills.

We pride ourselves on providing the best and most cutting-edge solutions for our client's business needs, with an array of software solutions from bookkeeping, productivity, and stock management.

As a one-stop shop for all your business needs, we provide a full range of services, from bookkeeping to legal counsel, to ensure your business's success and sustainability.

The decision is yours. Bookkeeping is a service we provide, but you’re welcome to use the accounting software we’ll give you.

This is dependent on how often you need bookkeeping. If your business is VAT-registered, we can handle your bookkeeping monthly or quarterly (although this can be performed more frequently too).

Yes, we can look at your processes to make sure as much of your bookkeeping as possible is automated, such as with bank feeds, invoice allocations, etc.