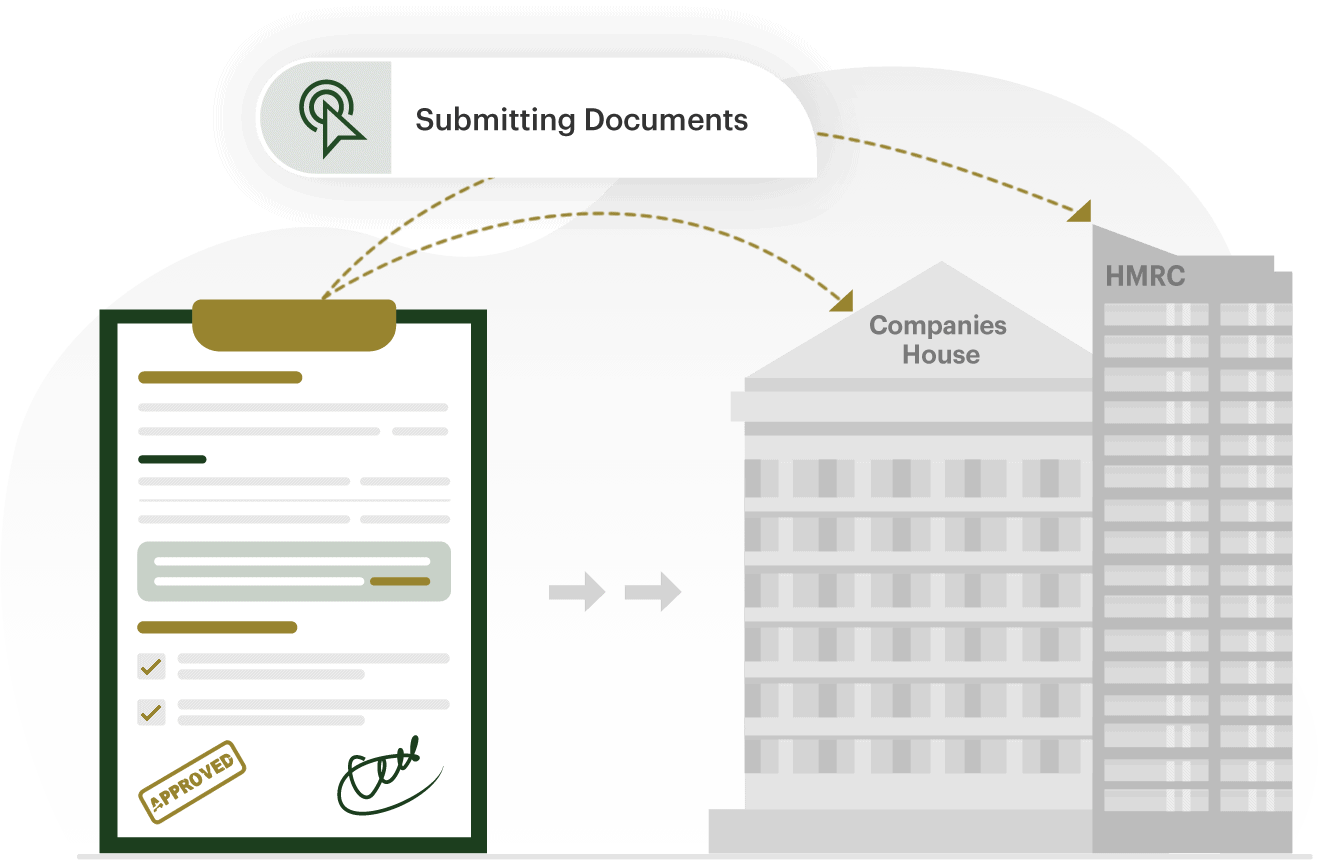

Do you have a limited company in the Uk? If so, you must file company accounts with Companies House. We can assist you whether this is your first filing or if it has been a while since your last filing.

Company Accounts are documents prepared at the end of a financial year which show how a company has performed over the accounting period.

Depending on the company’s size, specific rules and guidelines will be used while preparing company accounts.

Which financial records must be submitted? Accounts often include:

Your dedicated account manager will assess what you should include when you file company accounts. This is an excellent opportunity to get an up-to-date snapshot of your business and tackle any potential issues head-on.

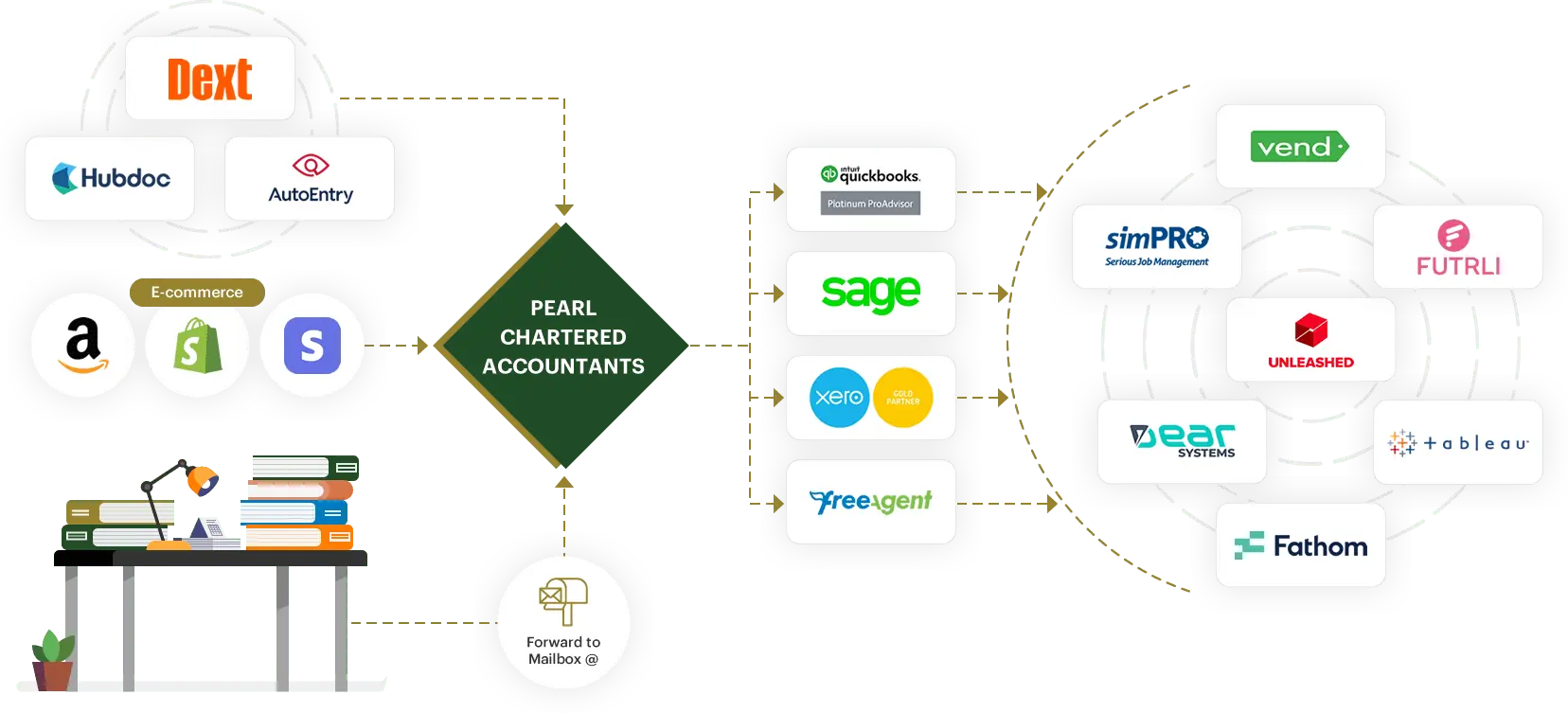

Our bookkeeping services give you peace of mind about your company’s financial standing. With four state-of-the-art accounting software at your disposal, our team of accountants will work with you to promote transparent communication and supervise finances from beginning to end.

A clear reflection of your company’s finances is our goal. We will conduct a thorough evaluation of your financials and recommend any adjustments that need to be made for your reports to be accurate.

We understand the importance of staying on top of your company accounts. At Pearl, we’re here to help you make sure that you meet HMRC deadlines and obligations, ensuring it is turned in in the correct format and meets all disclosure requirements so your company isn’t subject to penalties.

GROW YOUR BUSINESS

Our ICAEW-regulated chartered accountants help you from the outset. They understand your industry and accounting software preferences, from business structure to tax planning.

We're here to help. We recognise that every company, whether new or old, is unique. We build strategies that fit your requirements, objectives, and schedules whilst delivering objectivity and direction.

Pearl does the bookkeeping for all its clients. That's right: we take this problem off your hands. A hassle-free service means you don't have to worry about entering all your receipts and bills.

We pride ourselves on providing the best and most cutting-edge solutions for our client's business needs, with an array of software solutions from bookkeeping, productivity, and stock management.

As a one-stop shop for all your business needs, we provide a full range of services, from bookkeeping to legal counsel, to ensure your business's success and sustainability.

In our first meeting, we’ll go over the list of tax deductions with you and provide you with advice on how to maximise your return.

This depends on your accounting reference date. Usually, if your company’s year-end is December 31, your accounts are due 9 months after your year-end, and your corporation tax return is due 12 months after your year-end. Please note that these dates may be different in some circumstances, so please give us a call, and we can tell you more.

We’ll ensure your accounting software is updated throughout the year with the correct financial data. We will use this information to help us with your business’s end-of-year accounting and tax filing.