Like to keep things simple? Then our Personal Tax service is right for you. We will remove the jargon and confusion to help you confidently file your tax return.

If any of the following situations apply, you must submit a tax return:

The following sources of untaxed income may need tax filing:

You can fill out a tax return if you want to:

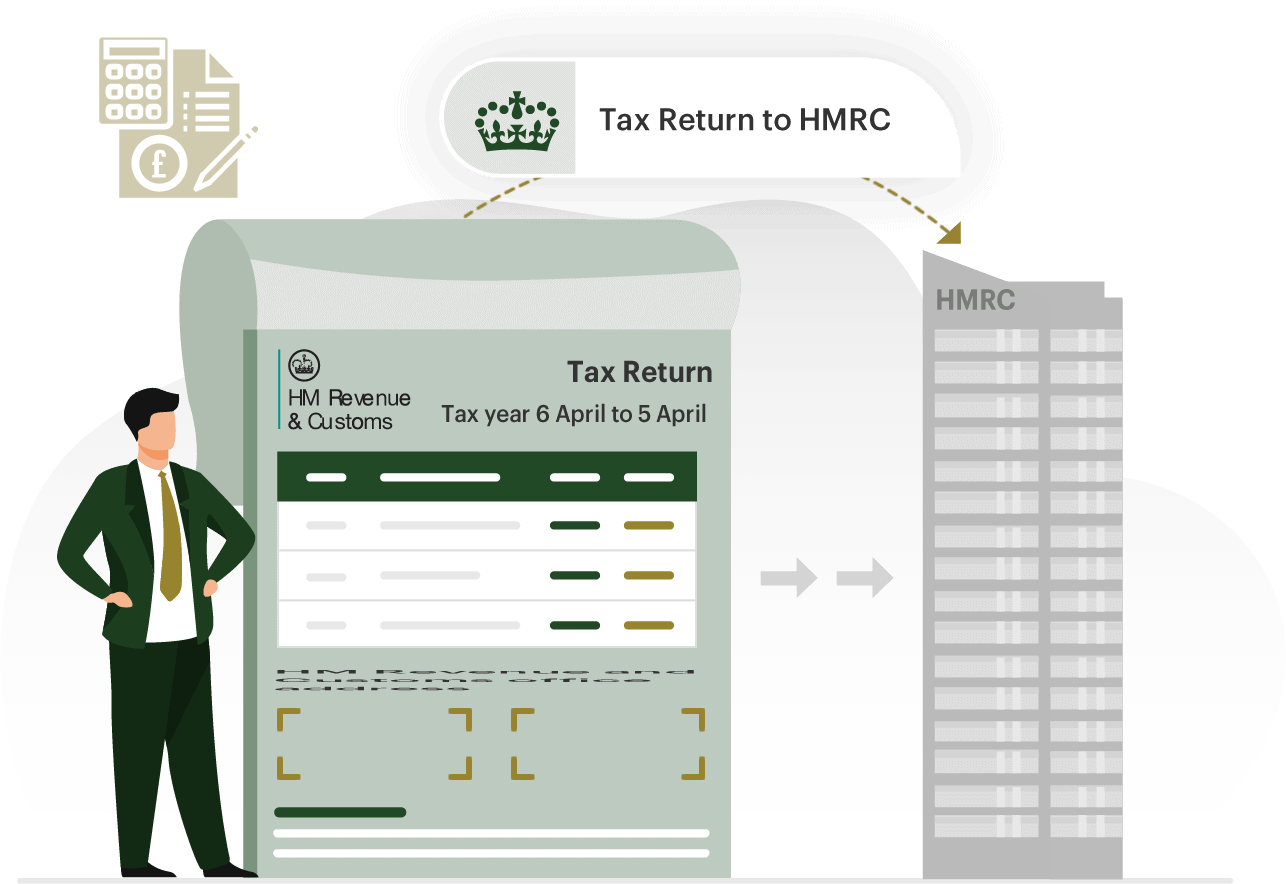

Your tax return may be submitted electronically or on paper, each with its deadline

You may be charged interest and penalties if you do not file your Self-Assessment tax return on time. The fine is £100 if you are up to three months late with your return; if you are more than three months late, the amount you owe grows.

TYPICAL SCENARIOS

The director of a limited business must submit a yearly self-assessment to HMRC that includes employment, dividends, rentals, and sole trader income. Allowances include personal pension contributions.

Tax-free rental income of up to £1,000 is allowed. You must report if it’s more than £10,000 before allowable expenses or between £2,500 to £9,999 after allowable expenses.

You can pass on your wealth to loved ones without the taxman taking a big bite out of the inheritance. The standard Inheritance Tax rate is 40%, and it’s only charged on the part of your estate above the tax-free threshold, which is currently £325,000.

Any profits that fall within the limits of the Capital Gains Tax allowance are exempt from taxation. Those who file their taxes using the self-assessment option and sell assets for more than four times the allowance amount are required to record their profits.

As of 5 April, the tax season is over, and we want to make sure you prepare for the year ahead. To ensure you get the most out of your experience with us, our specialists in personal tax will sit down with you to discuss your current financial situation so we can set up an action plan that works best for you.

Taxes are a big deal, so we work with you to help you make the most out of yours by offering advice, suggestions, and updates on dealing with your tax issues. Our consultants include accountants and tax advisors who are experts in their fields and have the knowledge and expertise to guide you through all aspects of your taxes.

Our team of UK tax accountants will ensure that you don’t have to worry about submitting a self-assessment to the HMRC. We take care of all the necessary paperwork, file it on your behalf and respond to any queries.

GROW YOUR BUSINESS

Our ICAEW-regulated chartered accountants help you from the outset. They understand your industry and accounting software preferences, from business structure to tax planning.

We're here to help. We recognise that every company, whether new or old, is unique. We build strategies that fit your requirements, objectives, and schedules whilst delivering objectivity and direction.

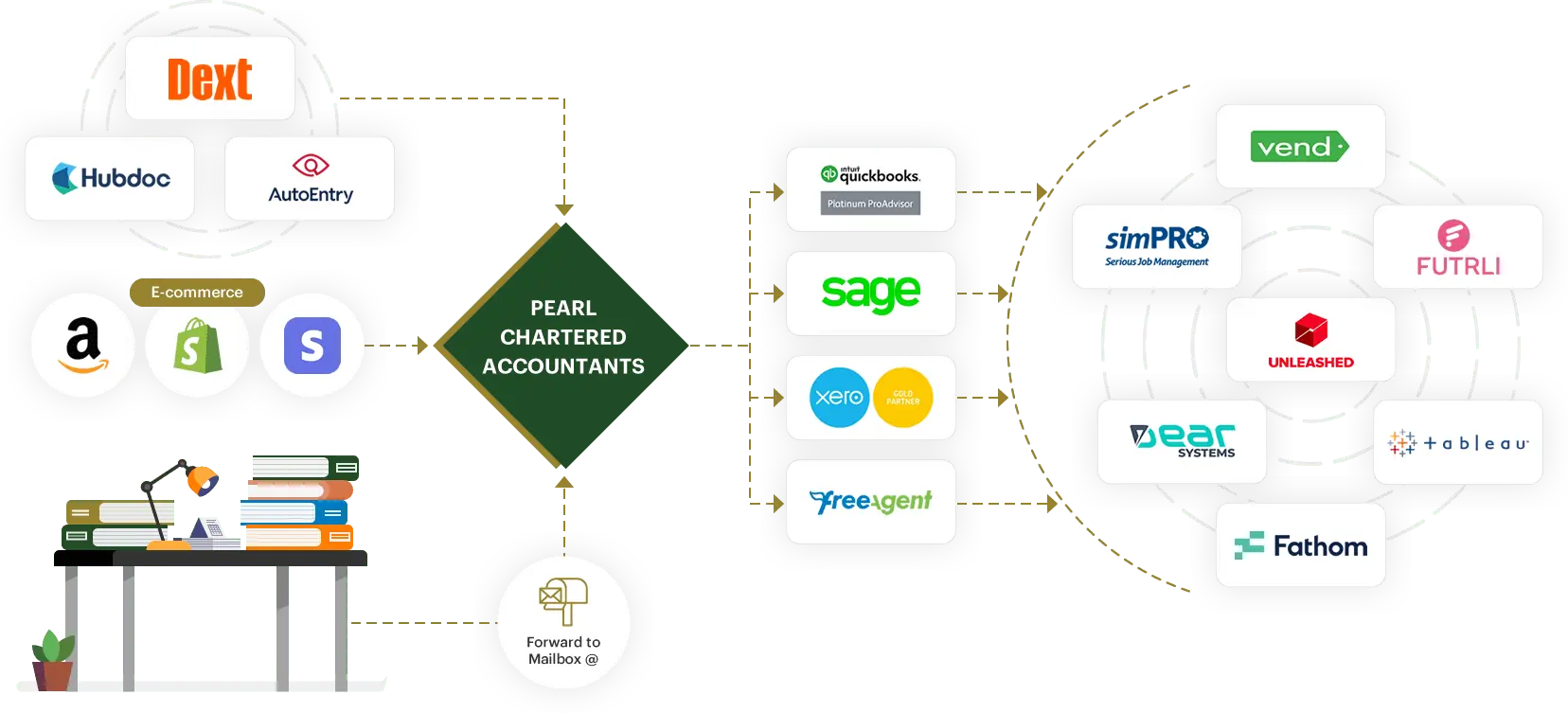

Pearl does the bookkeeping for all its clients. That's right: we take this problem off your hands. A hassle-free service means you don't have to worry about entering all your receipts and bills.

We pride ourselves on providing the best and most cutting-edge solutions for our client's business needs, with an array of software solutions from bookkeeping, productivity, and stock management.

As a one-stop shop for all your business needs, we provide a full range of services, from bookkeeping to legal counsel, to ensure your business's success and sustainability.

If you aren’t sure whether you need to submit a personal tax return, please review the information above. If you’re still hesitant, contact us, and we’ll give you our professional advice at no cost.

This will depend on your needs and the work’s complexity. For instance, you may have two rental properties with dividend income from a limited business; therefore, we’ll need to determine the expenses accordingly.

This is feasible in certain circumstances; therefore, we advise you to provide us with all the information we need to analyse and determine the necessary tax refund from HMRC.

Every year, you must submit a personal tax return. Don’t worry; our experts will let you know when it’s due.