Our business and tax advisory service is aimed at start-ups and established businesses to expand their business interests.

As a start-up, your tax obligations are probably the furthest thing from your mind. But getting it wrong can mean penalties and interest later down the line.

We’ll walk you through all you need to know about business taxes, including how to register for VAT, what documents to keep, when the tax year starts and finishes, and what your tax obligations will be.

We do what we love, and we love doing taxes. We will handle your company’s tax returns and make sure they are submitted on time and accurately. Our team will advise you on which taxes are due, aiming to make your company as tax efficient as possible.

At the outset, having the proper structure in place is essential. Our experts will assist you in choosing the appropriate business structure and discuss the pros and cons of each option. We will also help you get money out of your business, set up a system that works for you and your company and figure out the most tax-efficient ways to buy, sell or restructure the business.

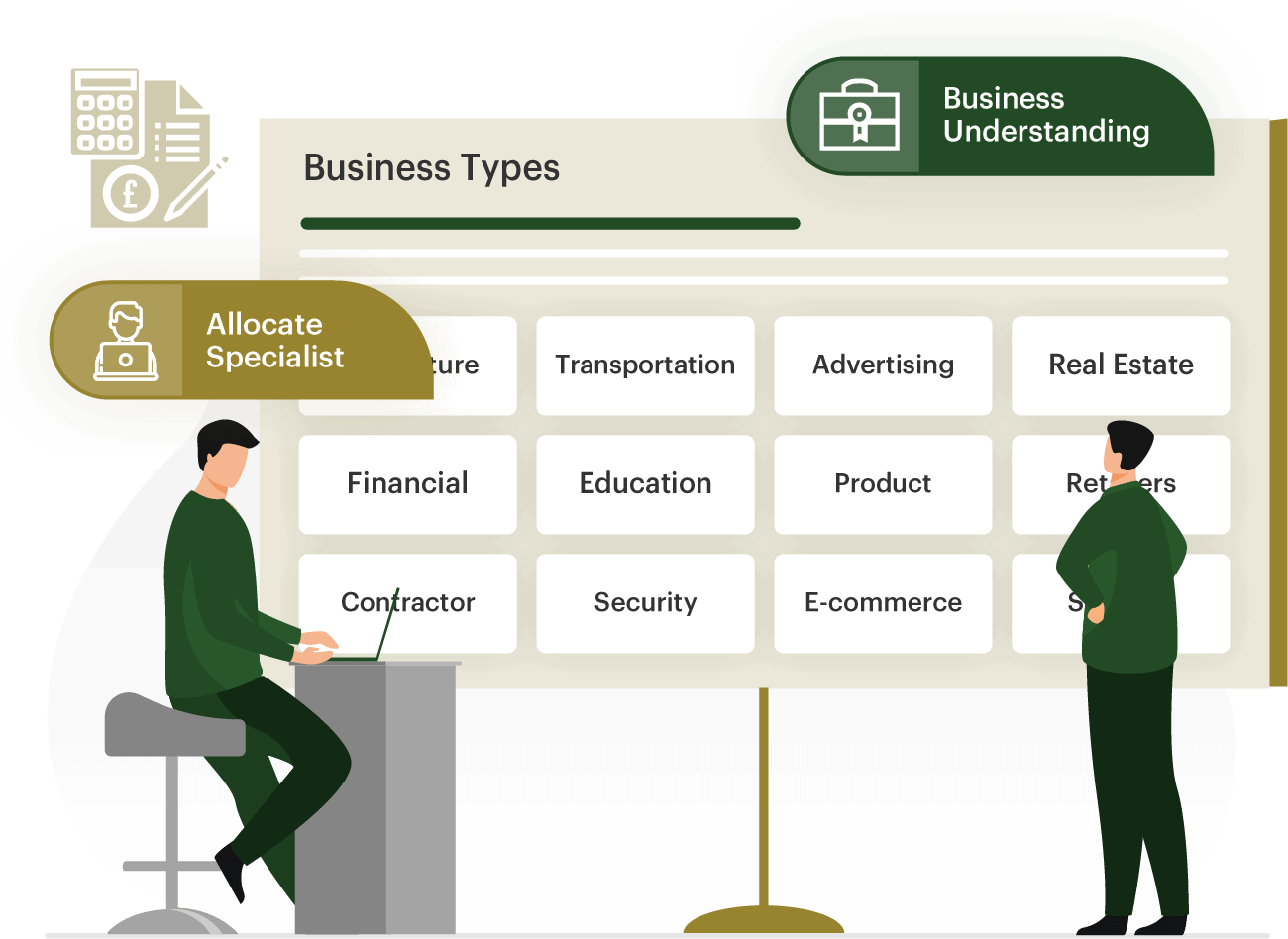

Your business is unique, and the more we learn, the better we can help. We’ll sit down with you and review your company to see where you are and your future projections. Then, we will help get your business in line with the current tax laws by minimizing your taxes while helping you uncover any potential sources of government relief.

Business owners can save a lot of money every year in taxes. Our team can look at several areas to reduce your tax burden and become more financially successful such as applying for an R&D tax credit to assist you in getting some money back from the government.

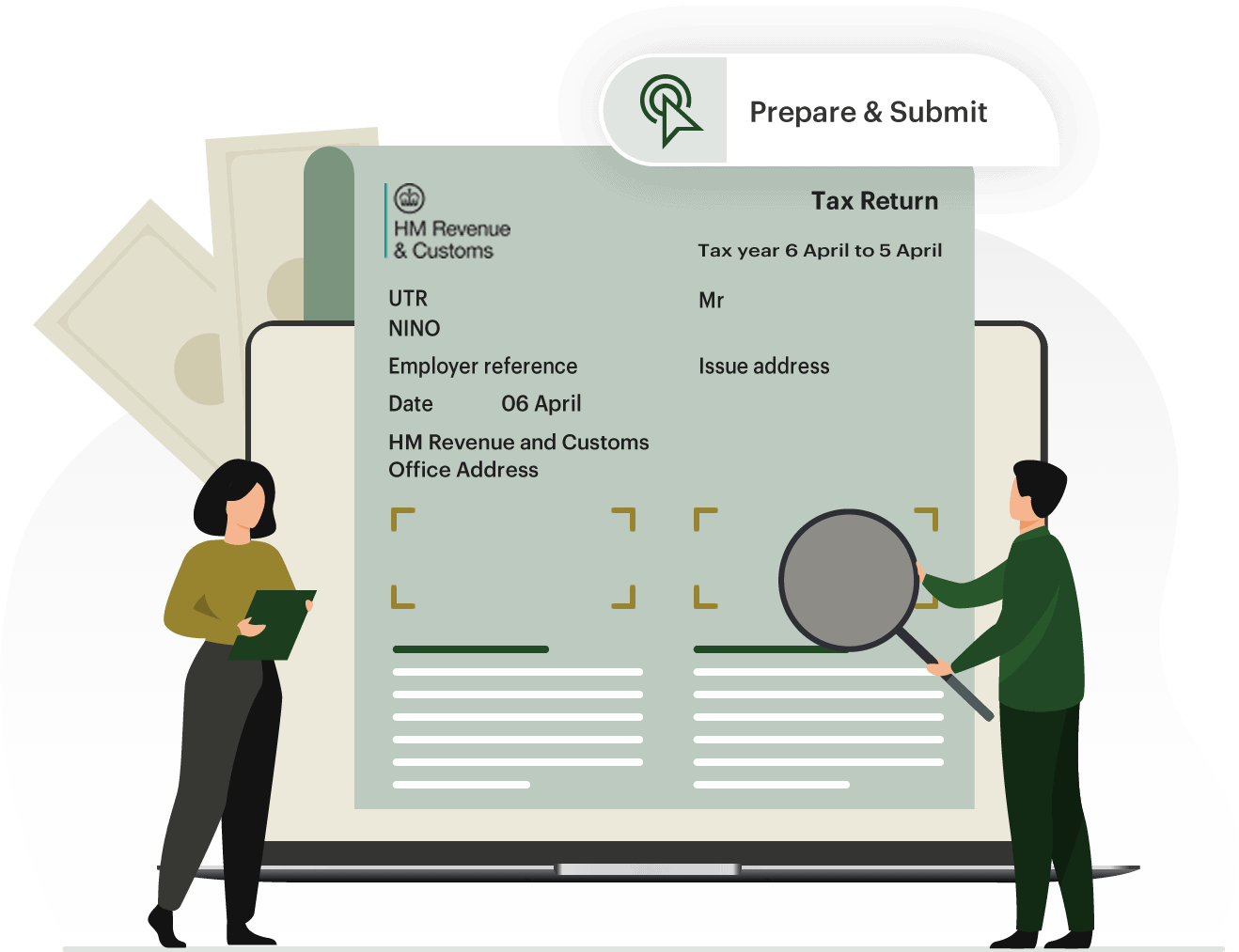

We are very skilled in preparing and filing your tax return for you. Our knowledgeable tax consultants will ensure everything is organised and handed in on the correct date, guiding you through any problems or queries that may arise along the way.

GROW YOUR BUSINESS

Our ICAEW-regulated chartered accountants help you from the outset. They understand your industry and accounting software preferences, from business structure to tax planning.

We're here to help. We recognise that every company, whether new or old, is unique. We build strategies that fit your requirements, objectives, and schedules whilst delivering objectivity and direction.

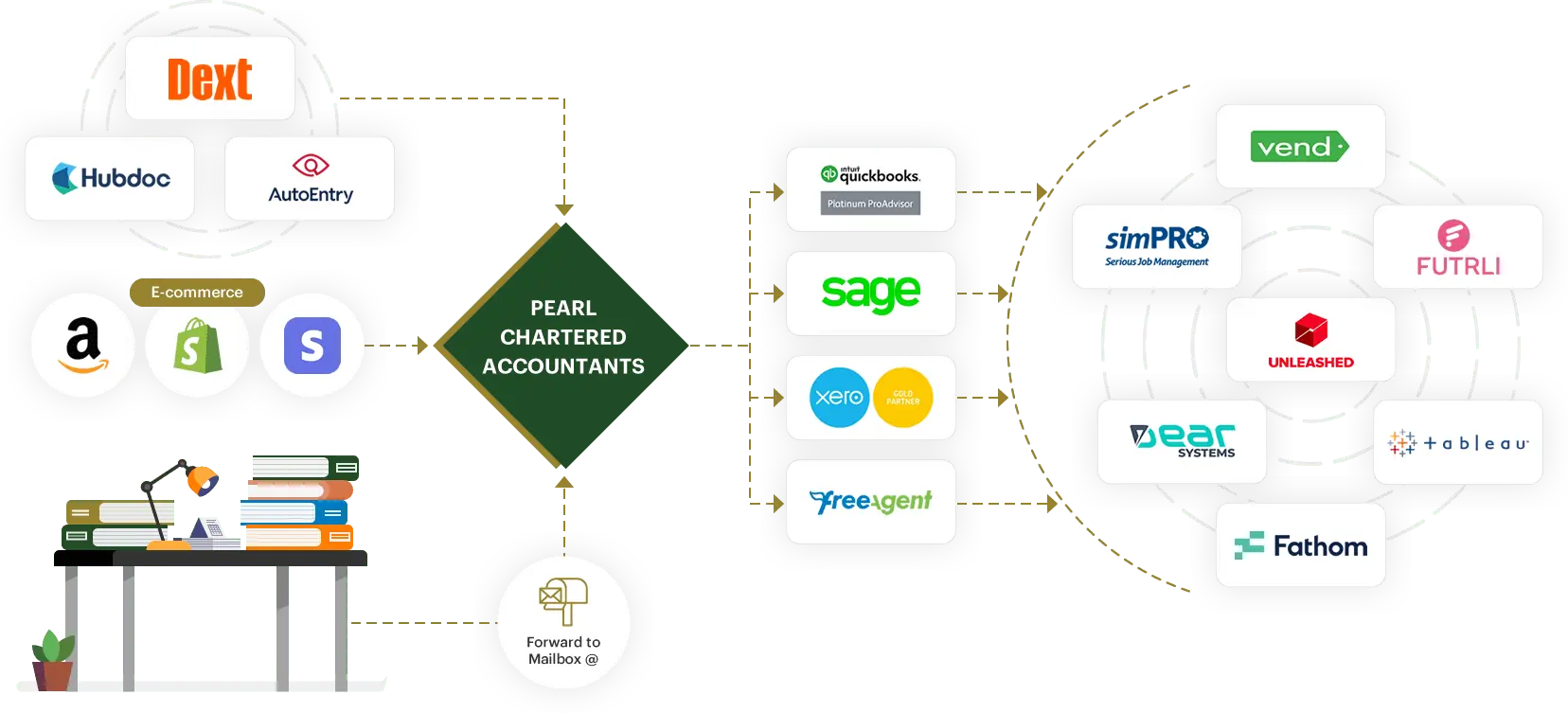

Pearl does the bookkeeping for all its clients. That's right: we take this problem off your hands. A hassle-free service means you don't have to worry about entering all your receipts and bills.

We pride ourselves on providing the best and most cutting-edge solutions for our client's business needs, with an array of software solutions from bookkeeping, productivity, and stock management.

As a one-stop shop for all your business needs, we provide a full range of services, from bookkeeping to legal counsel, to ensure your business's success and sustainability.

Our first meeting with you is free. Before we start, we’ll give you a quote if you want a comprehensive review of your tax planning and submission.

We can apply to HMRC for tax refunds or other tax initiatives in certain circumstances. We can discuss various possibilities based on your instructions during our initial review.

As a business, you may need to file different tax returns throughout the year, like monthly payroll and company tax returns CT600. Our team will remind you, so you don’t get penalised.

Yes, of course. We will look at the period and file these with Companies House and HMRC as our priority. If there was a good reason why these were filed late, we could also write a letter to the HMRC to stop any penalties from being added.

Yes, we have registered with the HMRC as an agent for over 10 years.