Pearl Accountants optimise your payroll experience to increase your focus on growing your business.

Managing payroll can be a major headache for any business. It’s not always simple to maintain an effective payroll system, whether you have one employee or 10,000.

Pearl Accountants is a leading payroll service provider in London and the UK. We are proud to offer a wide range of options for small and medium-sized businesses, including full and partial outsourced payroll services. With us, you can rest assured that your finances will be managed professionally and efficiently.

We created our payroll service to make running your company as easy and flexible as possible. Our expert team will work with you to set up a customised process that fits your needs and requirements, from tax filing to employee payslips.

Your payroll manager will provide 24/7 support, ensuring you stay compliant with UK regulations. With us, you can stop stressing about meeting deadlines.

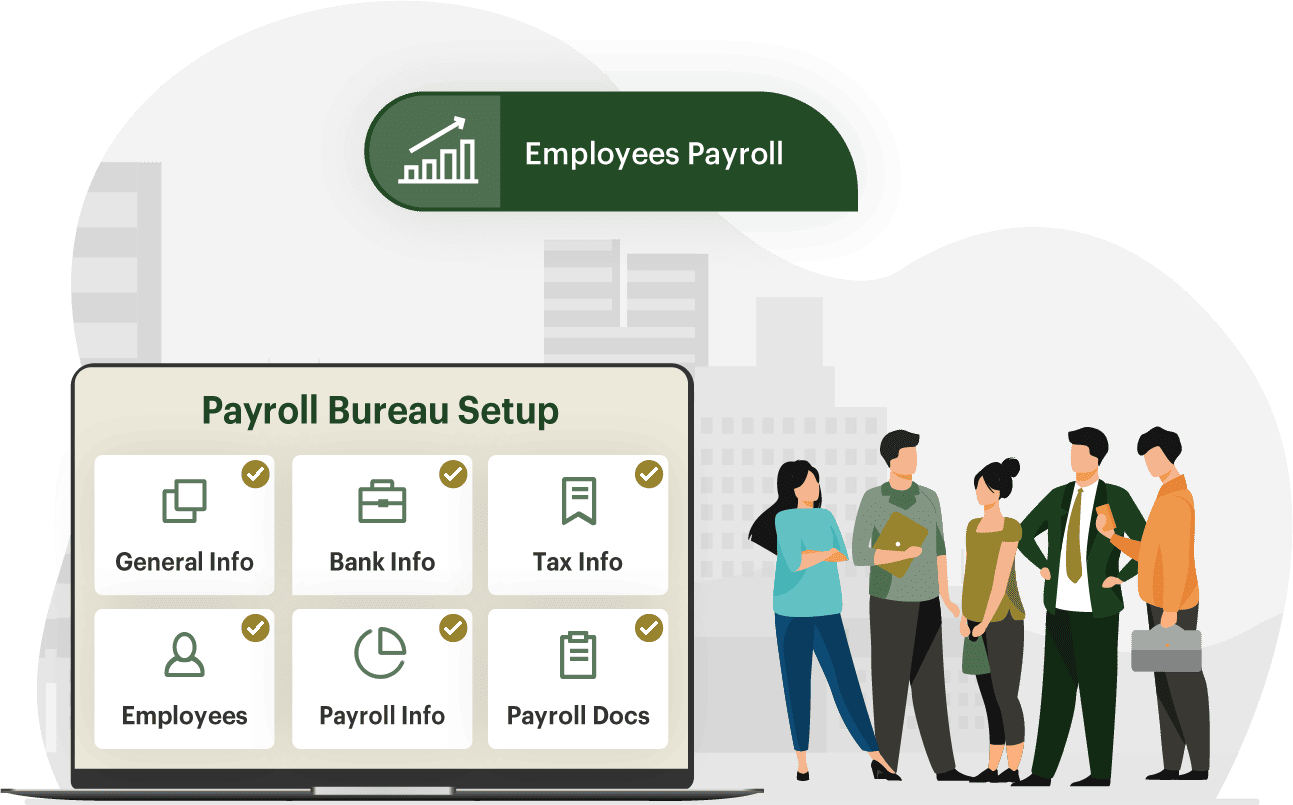

We have a standard process for setting up a payroll bureau for all your employees. This ensures that you have a payroll service provider who can deal with every aspect of payroll administration under one roof.

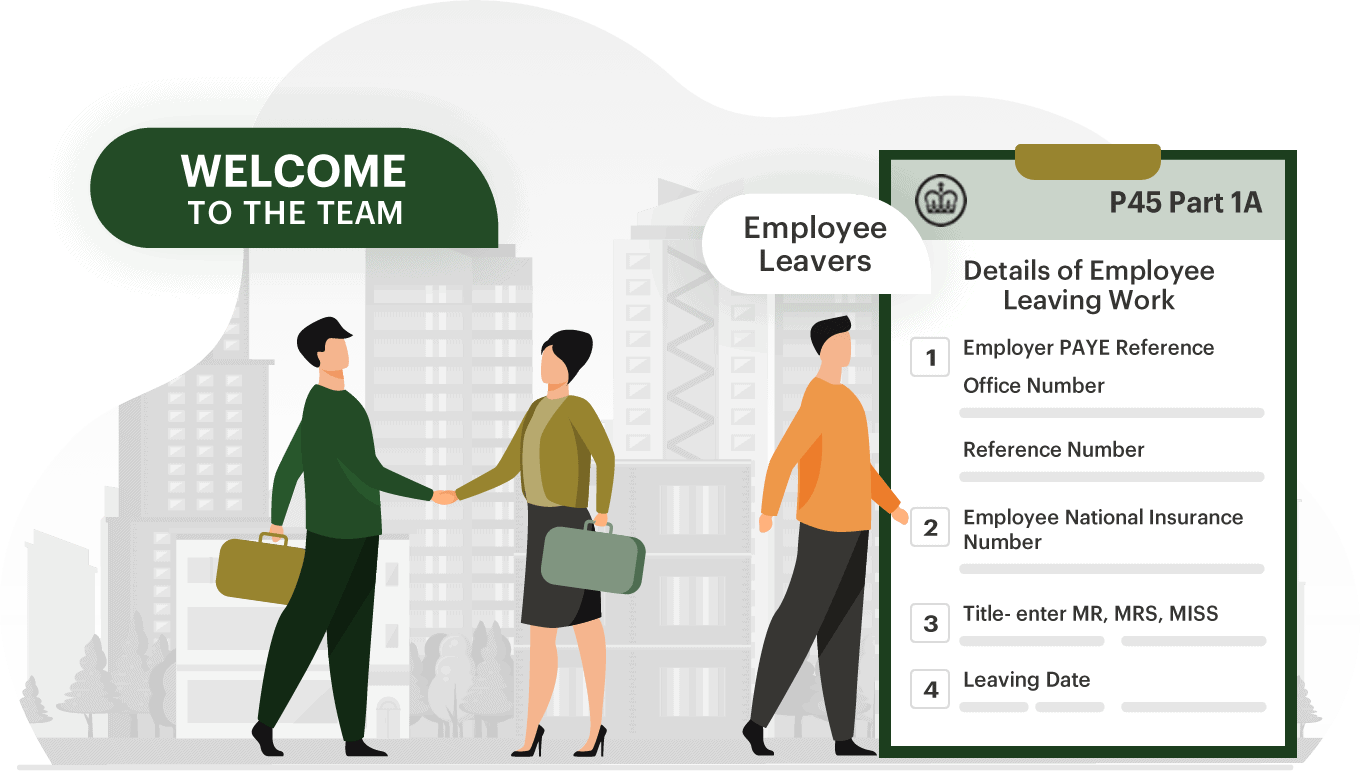

Our team of professionals is here to help you with payroll duties. With us, you can keep track of any new joiners or leavers (P45), maintain employee records and plan for tax payments. We also assist with pension contributions, expense claims management and statutory pay periods.

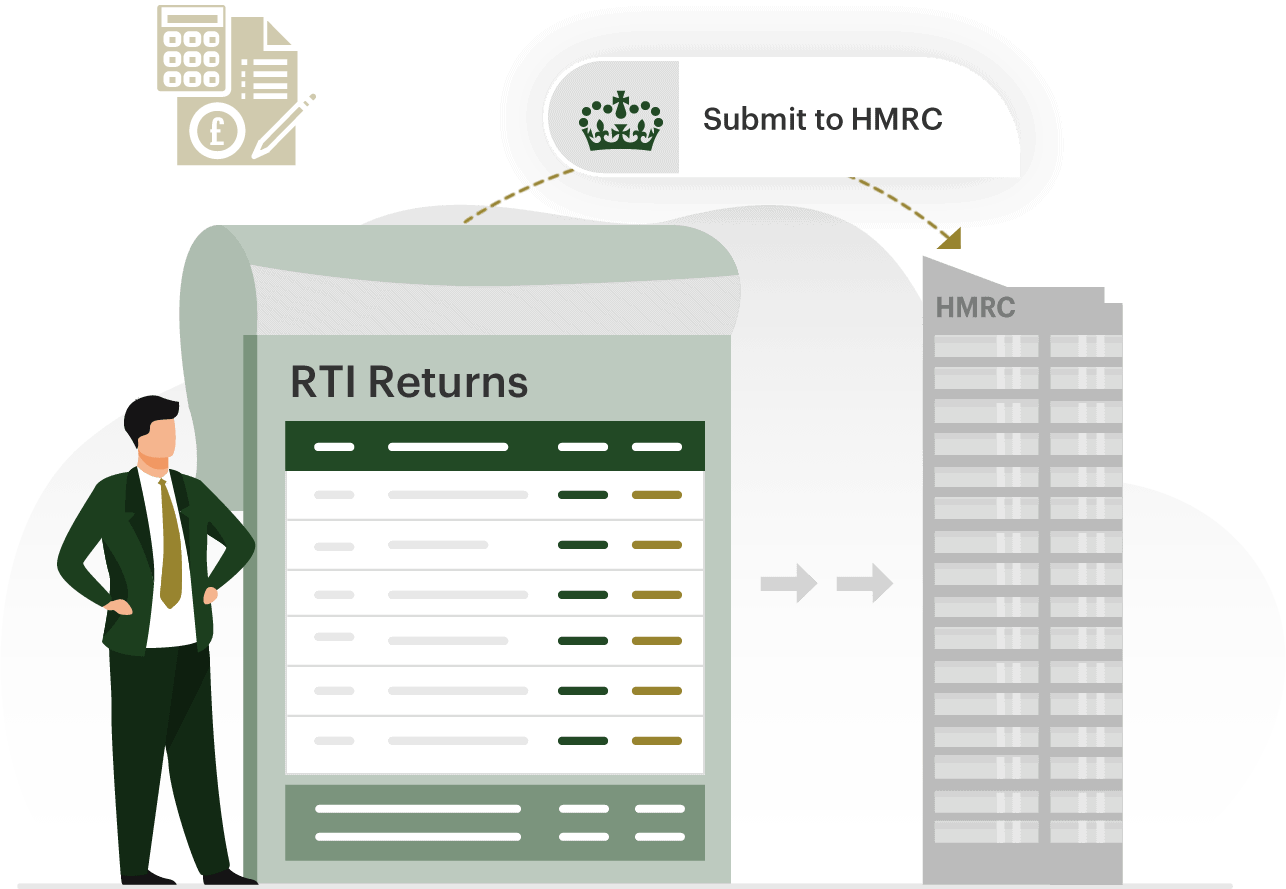

All UK companies with payroll must utilise Real Time Information, which Pearl Accountants specialises in. We’ll save you time and money with monthly or weekly payroll. We’ll set up and handle your payroll on schedule and email or mail payslips, deduct NI, PAYE, bonuses, pensions, etc., and guarantee accurate calculations.

The HMRC is always keeping us informed about the latest developments in tax legislation and changes to the PAYE system. We will notify you of the payment dates for your employees and payments to HMRC to ensure a seamless experience.

If you’re an employer, you need to make sure that your organisation is effectively meeting the requirements of Auto-Enrolment. We can advise if you need to register for Auto-Enrolment and help your business comply with these laws.

GROW YOUR BUSINESS

Our ICAEW-regulated chartered accountants help you from the outset. They understand your industry and accounting software preferences, from business structure to tax planning.

We're here to help. We recognise that every company, whether new or old, is unique. We build strategies that fit your requirements, objectives, and schedules whilst delivering objectivity and direction.

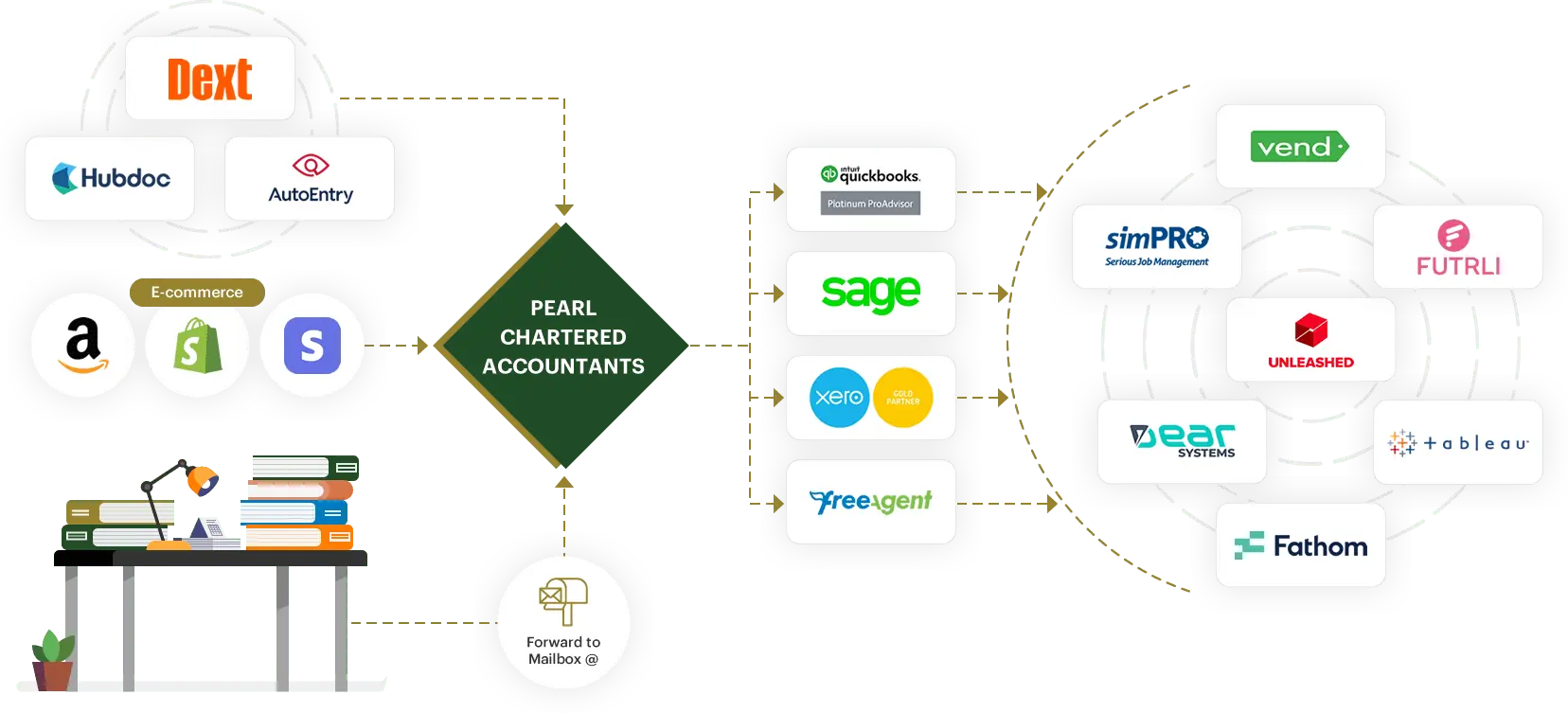

Pearl does the bookkeeping for all its clients. That's right: we take this problem off your hands. A hassle-free service means you don't have to worry about entering all your receipts and bills.

We pride ourselves on providing the best and most cutting-edge solutions for our client's business needs, with an array of software solutions from bookkeeping, productivity, and stock management.

As a one-stop shop for all your business needs, we provide a full range of services, from bookkeeping to legal counsel, to ensure your business's success and sustainability.

We will need to look at your income and tell you how to get the most money out of your salary while paying the least amount of tax.

Yes, we will need to evaluate the salary figures and depending on the outcome, we will let you know whether you need to register for PAYE with the HMRC.

This will need to be set up on your behalf, and we’ll need to send you payslips often while also informing HMRC of the PAYE employer’s taxes. Your accounting software may be configured to do this.