By Ashley Preen

June 8, 2020

The Self-Employment Income Support Scheme(SEISS) was officially opened for applications at 8 am on 13 May 2020.

The scheme is yet another in a series of schemes released by Chancellor of the Exchequer Rishi Sunak in the last few months to assist businesses and individuals adversely affected by the COVID-19 pandemic and the subsequent UK lockdown.

The SEISS is explicitly aimed at self-employed individuals and offers up to 80% of your average monthly trading profits. The payout is capped at £7,500 and is supposed to be made no more than six working days after the claim.

The scheme will initially be available for three months.

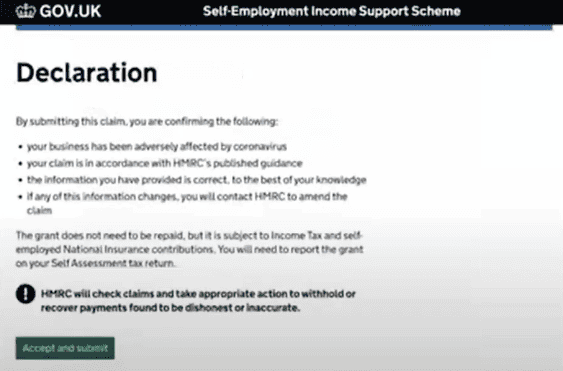

The grant is taxable and will be subject to income tax and self-employed National Insurance. You will need to note it as income in your 2021 tax return.

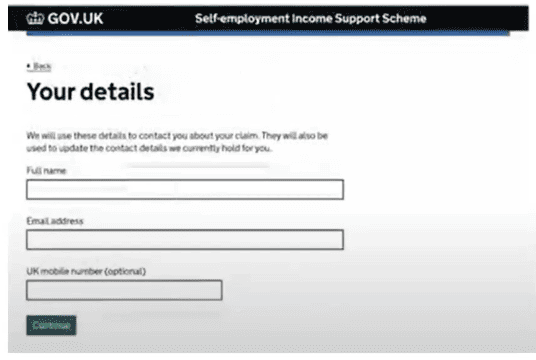

In this post, we’re going to show you precisely how to apply for this grant. (Some of the screen-captures below are provided courtesy of QuickBooks’ webinar on this subject.)

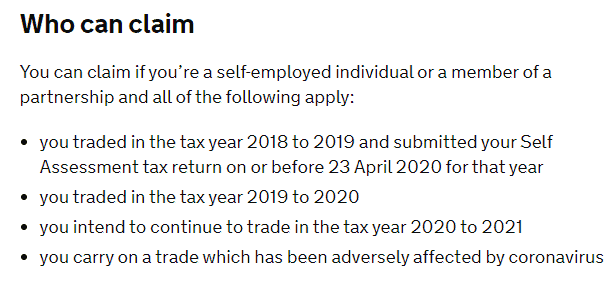

If you are self-employed or in a partnership and have lost profits as a result of COVID-19, you may be able to claim for the grant.

Check out the government’s Eligibility Checker to find out if you are eligible to claim for the SEISS.

If you are eligible, you will have received an invitation to claim.

If you did not receive this invitation, you may still visit the eligibility checker and enter your details to check if you are eligible.

Important: If you are eligible, you will be given a specific claim window. You will not be able to place your claim on a date before this window begins.

Important: A key factor to be eligible for this claim is that your business was indeed adversely affected by the coronavirus. You must have and keep accurate records regarding this fact should this point require proving at some later stage.

You will need:

You have to make a claim yourself. A representative (such as an accountant) may not apply for you.

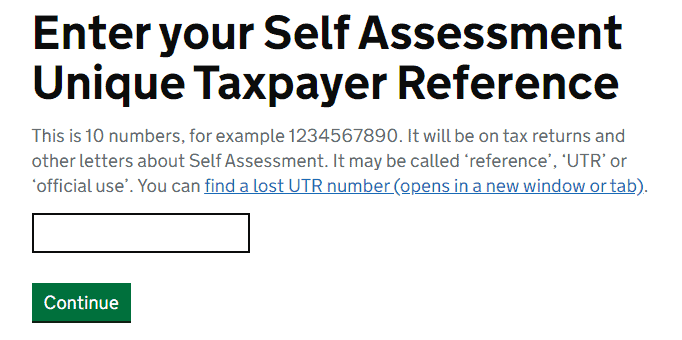

To start the application, visit this link:self employment support

Type in your UTR and click “Continue”.

You will then be shown a screen with prepopulated figures for what you have been approved for.

These figures are based off your earlier tax returns, as the amount you qualify for will be dependent on what you have earned in the last three fiscal years.

There will be an explanation on the page describing how the figure was arrived at.

The page is downloadable if you wish to review it personally or send it to your accountant/tax adviser to revise it for you.

If you believe the amount is incorrect, HMRC recommends continuing regardless and then contacting them at a later stage to have the amount reviewed.

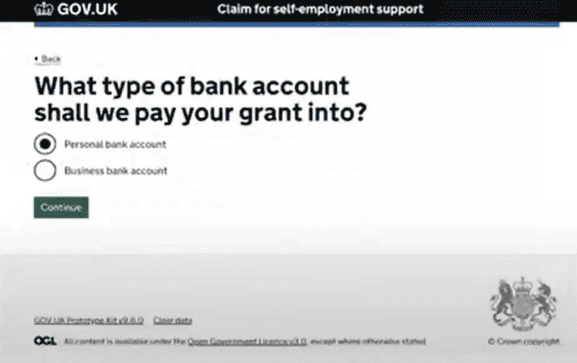

You will then be prompted to choose either a personal or business bank account for the payment.

The bank account must be UK-based and must be able to accept BACS transfers.

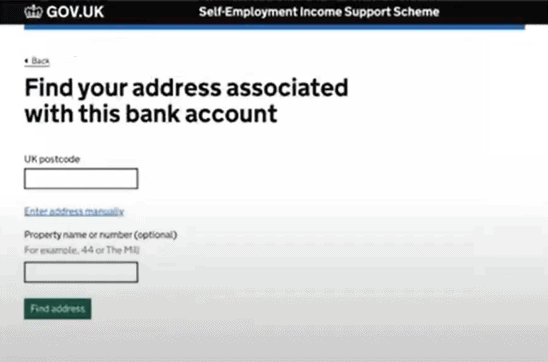

After filling in the banking details you will be asked to confirm the bank’s address. If you type in the postal code of the bank, there is an address finder which will assist you in finding the bank’s address.

You will be asked to confirm all the details before submitting.

And, finally, you must accept the declaration at the end which affirms that your business has been adversely affected by the coronavirus, your submission is in line with HMRC guidelines, and other points as delineated in the screenshot below.

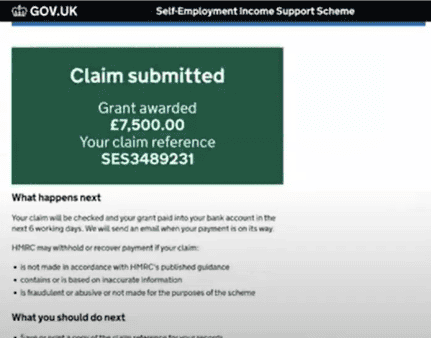

If all is in order, you should receive the confirmation screen showing how much was awarded, and giving you a reference number.

Be sure to print this screen, or take a screenshot and save it, for your records.

The amount will be paid within six working days of submitting the claim.

If you have not received the payment after six working days, and it is after 25 May 2020, give HMRC a call to query. Be sure to have your reference number handy when doing so.