By Ashley Preen

April 20, 2021

After the decimation of the British economy as a result of neverending lockdowns, companies are looking for an urgent way to get themselves back in the game and come out of a slump that has seen record levels of shop closures.

The Chancellor recently announced a number of business incentives as part of Budget 2021, including the ability to claim back 130% of plant and machinery purchases.

Throughout the pandemic and the lockdowns, the Chancellor implemented several schemes to get business going again, including the Eat Out to Help Out discount which ran for only a month in August 2020 before restaurants were forcibly closed again.

But if there’s one thing that the year-long lockdowns and restrictions on businesses have taught entrepreneurs, it’s that you have to learn to go it alone and not rely on any government to “bail you out” when your business hits rocky waters.

So, here are some unconventional ways to add to your company growth strategy that might help you grow your business after the COVID-19 lockdowns.

People have been driven into unprecedented levels of fear as a result of a government-led campaign to elicit compliance to COVID-19 directives. Although almost 50 psychologists, including one former consultant to the NHS, have called this practice “morally questionable”, it doesn’t change the fact that it has happened.

People are afraid. And folks who are afraid of walking into stores will not buy anything in those stores.

To kickstart business in a post-COVID UK, you must make your business feel safe in the minds of anyone who visits your premises.

There are numerous ways to do this, and your imagination is your only limitation: Implement sanitisation stations, social distancing markers, posters of people cleaning your shop, etc.

Run a campaign to let people know that your place is safe to visit, and make it so.

If you’re truly bold, you could even offer free masks for anyone wanting to enter.

People will want to do more things alone now. This is driven partly by the fear mentioned above, as well as the fact that many have been forced to do things alone in their homes for nearly a year.

Leverage this new desire and create DIY-style products and services in your business, no matter what sector you are in.

Advertise these new services heavily and charge a premium fee for any additional work they might want done by a pro, i.e., you.

And then there are those who have just had enough of being locked up and would do anything for a good bash with friends, drinks, and a few ribs on the grill.

Now that the restrictions have been lifted, what better way to kickstart your business’s growth than by offering just that!

“Socially Distant and Safe Barbecues Every Day of the Week at 16:00”, or something like that. You could even make it a Bring Your Own.

Word will spread like crazy.

Then you can put up banners for your service or product while people socialise — you know, like humans are supposed to do.

Humans are social creatures. Leverage this now that the restrictions have been lifted.

Plenty of people have been let off and pockets are tight. Go wild on offering discounts that bring you even only a tiny margin in return.

Possibly people might need to sign up for a mailing list to get the discount. Whatever creative ideas you come up with, focus on driving in new business no matter what and getting over the initial inertia as people come out into the light of day again.

Remember that point about fear: Lots of people are going to be cautious in general, like prey watching out for predators. By offering deeply discounted services, you remove just one more barrier to them deciding to get back to life the way it supposed to be lived.

There’s been enough doom and gloom in the world. Offer solace, be friendly, let people know that you’re an okay bloke or lady. Make them feel comfortable at your business. If a client is upset, handle it smoothly.

As the UK comes out of its collective trauma, people will naturally gravitate to establishments that remove some of that threat from the world.

Did you also get the feeling that the mainstream media was frothing at the mouth for more bad news about the pandemic? Information overload, focusing on the numbers of deaths instead of the numbers of survivals.

Well, that might have been the point.

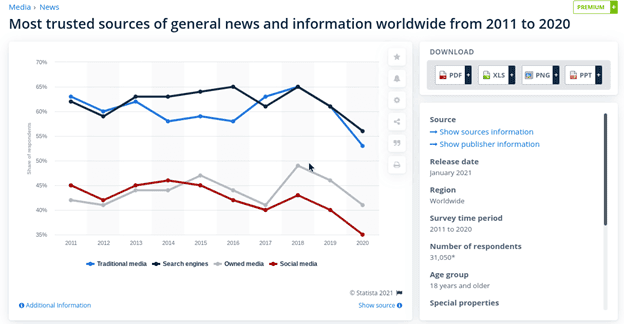

Trust in the mainstream media as a news source hit an all-time low in 2021. Why associate your business with that? Let people get their news at home.

By letting people know that you are a “NO BAD NEWS AND NO MAINSTREAM MEDIA” establishment, you will create a small island of calm where people will be willing to visit, just to get a break from it all.

We’ve had enough of the news. We just want to get back to normal. And doing business in a safe environment is normal — and fun.

Whatever unconventional method you use to boost business, be creative, and try bring back a touch of that joy and hope that we all took for granted a year ago. Happy people are the best clients. Try make them happy and watch how word of mouth brings you more business.