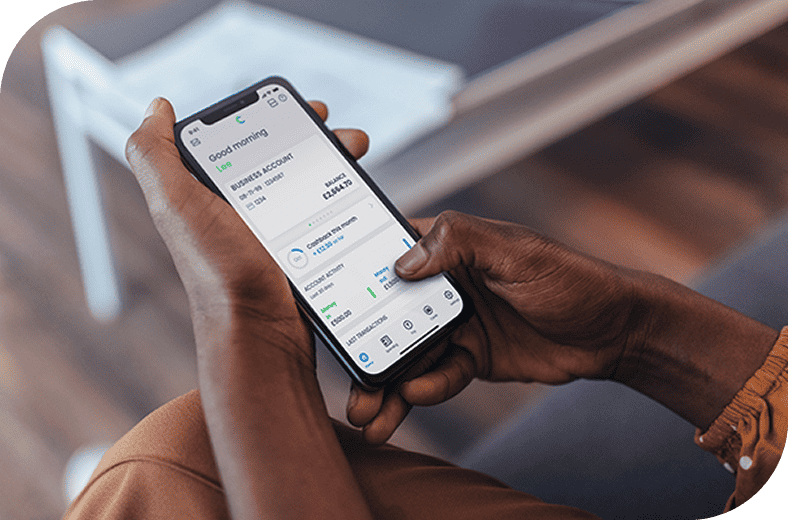

Pearl Accountants believe in offering our clients the best solutions; we have partnered with Cashplus to provide the best low-cost alternative to high street banking.

Cashplus offers business bank accounts designed around small business needs. They understand your finances’ importance, which is why their services are tailored to help you get the most out of your accounts.

If you would like to open a business bank account with Cashplus, you must meet the following criteria :

If the information you submit can be validated, you will be issued a bank account

Cashplus offers a wide variety of features to ensure an exceptional experience.

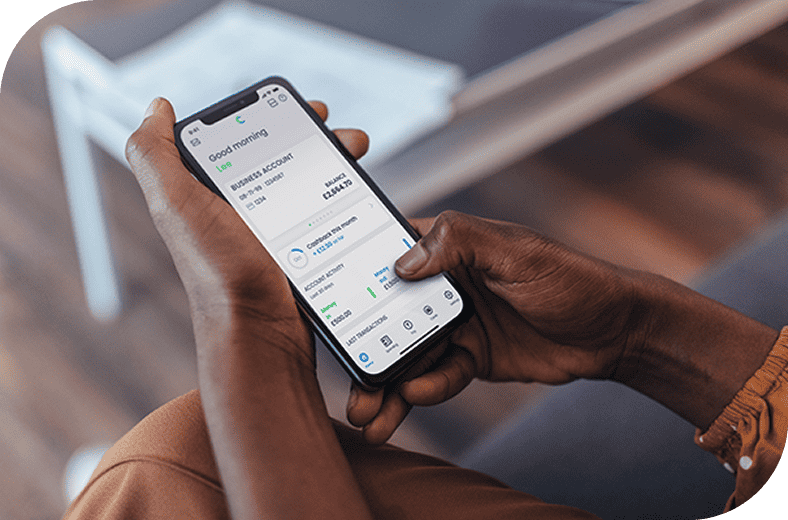

Google Maps helps you track and categorise payments. You may categorise transactions, assign them to projects, and attach receipts and comments.

Google Maps helps you track and categorise payments. You may categorise transactions, assign them to projects, and attach receipts and comments.

Google Maps helps you track and categorise payments. You may categorise transactions, assign them to projects, and attach receipts and comments.

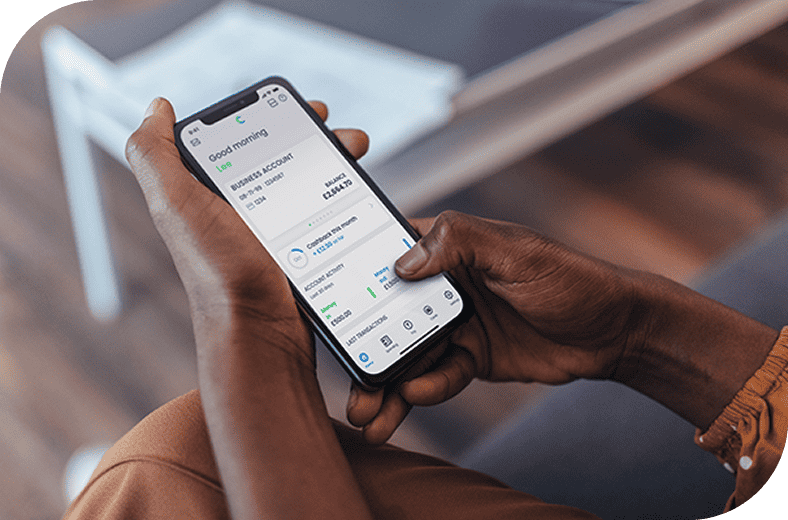

You can make an application online; it only takes 4 minutes! We highly recommend you use the button below when making your application.

If you apply through us, we’ll be able to keep track of you as one of our clients, which will streamline the application process and the following accounting data integration. When filling out an application, please make sure that:

You can call Cashplus to purchase a Code Key for £8.00. This will give you a one-time verification code that you can use to log in to Online Banking.

A Code Key is a physical security token that creates a verification code to make sure it’s you and not someone else.

Businesses may accept overseas payments; contact one of our Cashplus representatives for further information.

Your Cashplus Bank Account is FSCS protected, so your money is secure. Learn more here FSCS information page