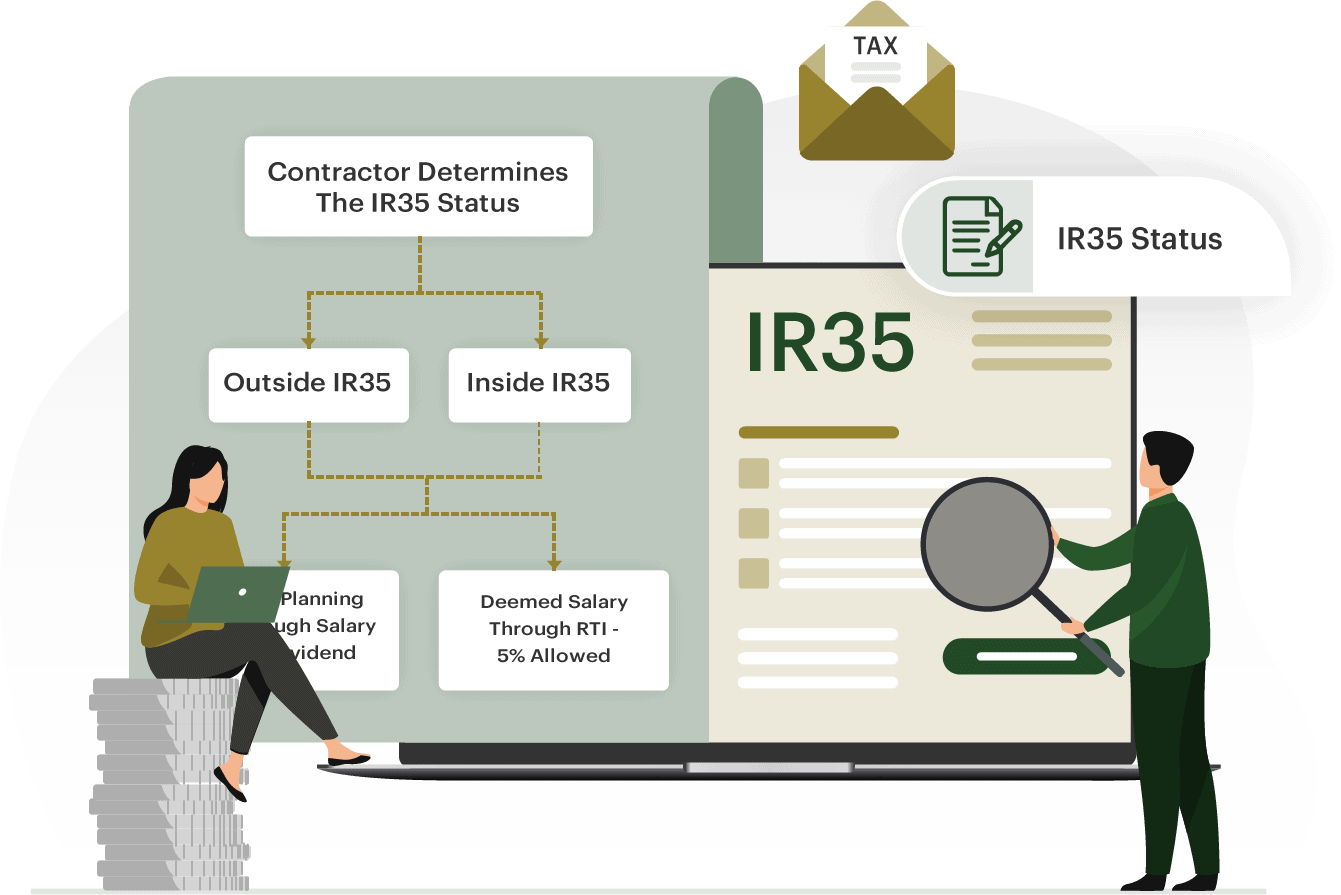

We are committed to helping our customers avoid IR35 problems. For those who want information and guidance, we provide specialist accounting for contractors that gives you up-to-date and accurate information and sound guidance. It is the best way to alleviate the stress associated with back taxes, fines, and penalties.

As a contractor, it’s your income, and you want to keep as much as possible. With the help of Pearl Accountants, this is possible! We will guide you on how to legally pay as little tax as possible to HMRC, which would mean keeping more of your own money. Our contractor accountants will ensure that you stay in line with the law and everything is being documented accurately to avoid any penalties or fines from HMRC.

An HMRC audit may be approaching. Protect yourself against a tax enquiry, including any court case.

View Details

Do you need a business address? Use our address registering service to get one quickly and simply.

View Details

We've partnered with Kingsbridge to ensure that all our contractors are adequately insured and protected.

View Details

We're here to help you with your finances so you can focus on being a contractor. Our expert contractor accountants ensure that you don't miss a deadline and are always on top of your accounts, so you're never worried about keeping track of revenue/expenses for your tax return.

View DetailsGROW YOUR BUSINESS

Our expert contractor accountants will need to determine your income and personal thresholds to recommend the best compensation and dividends.

This will depend on your income, industry and personal threshold levels, amongst other factors, we will discuss these with you in our initial consultation.

We will provide you with the appropriate filing dates based on whether you are a sole trader or a company.

If your business’s annual revenue is more than £85,000 (2022), you must register for VAT.