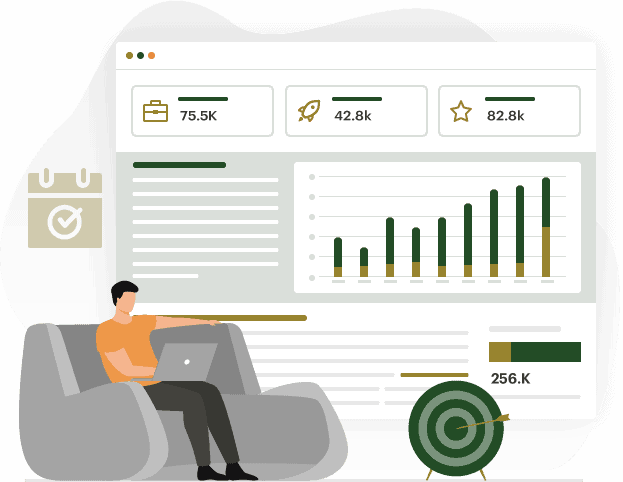

Pearl Accountants is passionate about helping entrepreneurs as you succeed in business. We enjoy hearing about your business idea, vision, and goals.

Of course, from a business plan and strategy to cash flow management, there is much to consider. We’ve helped hundreds of people start businesses and look forward to yours.

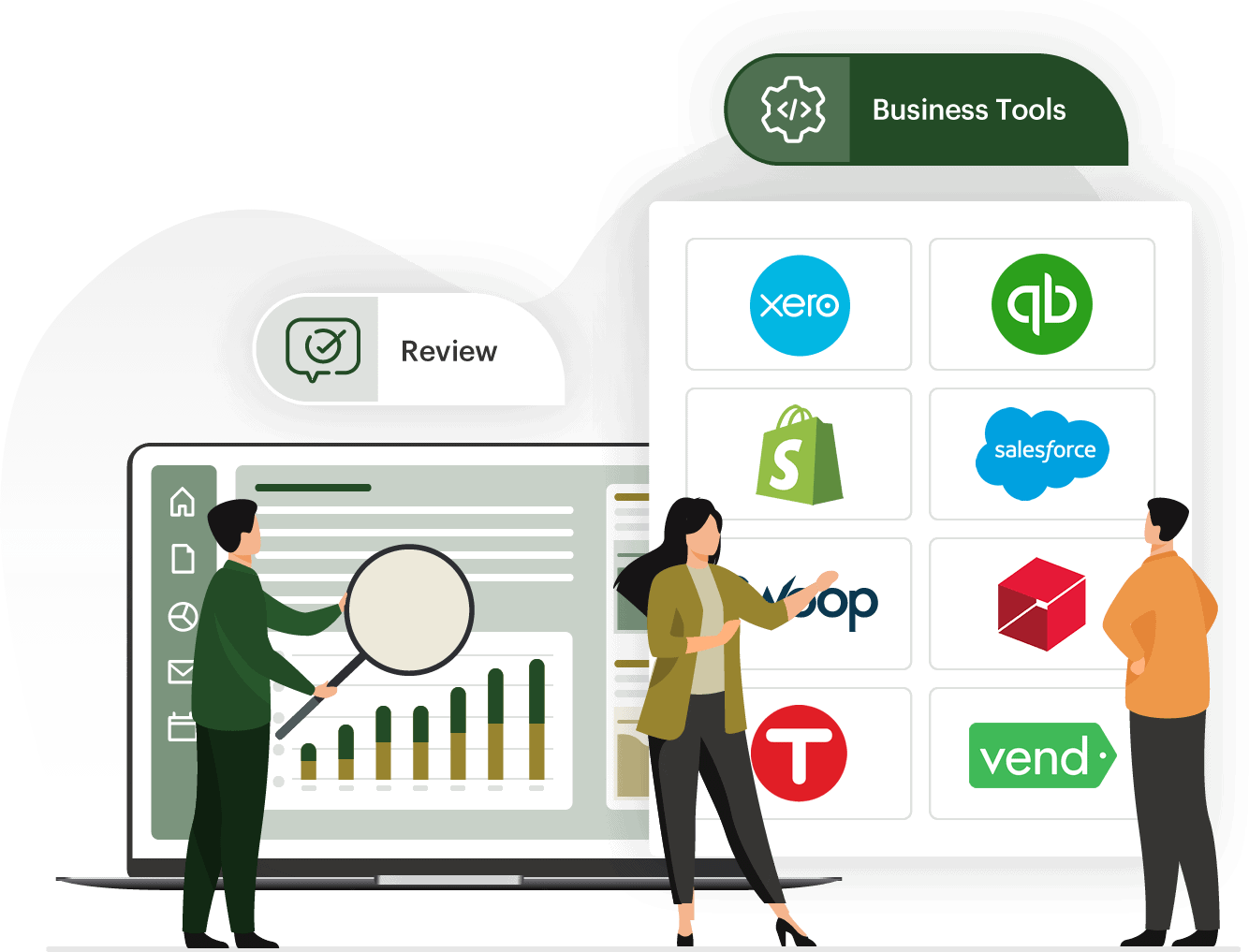

Small businesses are our speciality. We know the challenges you face, and we’re here to help you with proactive tax planning advice, streamlining procedures, and integrating with third-party technologies to automate operations, boost efficiency, save money and give you more time to generate additional revenue for your business.

At Pearl Accountants, we understand that running a limited company can be difficult in some ways. You could be working on your own or with a small team and probably doing everything from managing clients to marketing and keeping track of the money! A tax-efficient solution like setting up a limited company is very useful for many businesses, but it can be hard to choose the right accountant! We offer affordable and complete accounting solutions to help you manage your limited company accounting needs.

Running your own business is challenging. We know this, and we’re here to help. Pearl Accountants offer sole traders the right accounting to keep track of everything you need to file with HMRC. Whether your business sells goods or services, we’ll ensure you’re registered with HMRC and can send in all the necessary paperwork. We also have hundreds of self-employed clients, years of experience, and reliable software to help you grow your business.

If you’re a freelancer, you’ve probably felt like you’re a jack of all trades. And you are!

You’re a freelance designer, writer, or programmer, but the answer isn’t so simple when it comes to working the numbers. We know problems and have crafted our service to solve them.

When you join Pearl, we’ll look at your needs, help you set up the proper tax structure, and ensure you file taxes promptly. We will notify you of any changes to your taxes or business and how to invest your money to make it grow.

GROW YOUR BUSINESS

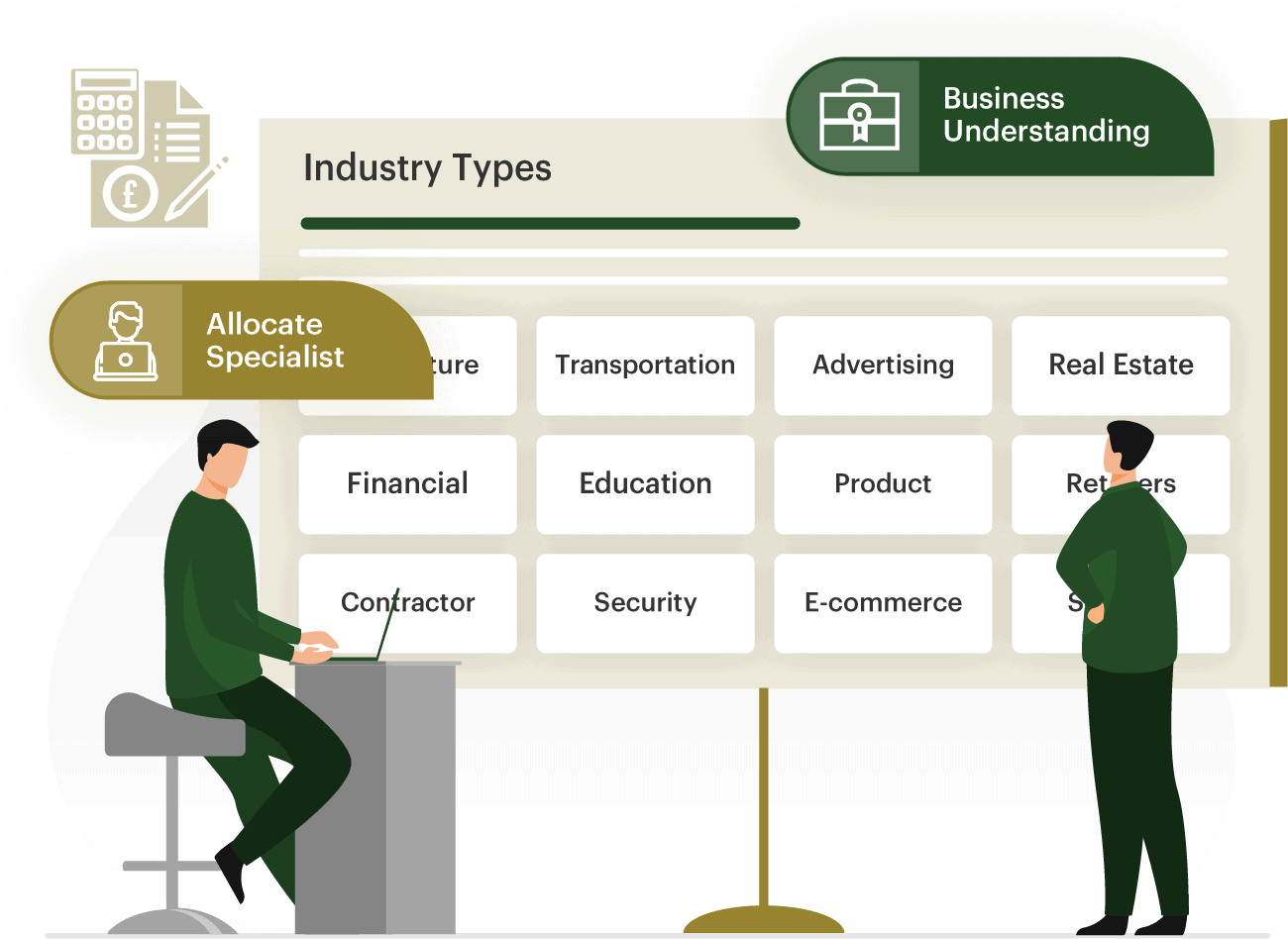

We are an accountancy firm that understands your industry. Pearl Accountants is a perfect choice if you are a start-up or business owner looking for new accounting solutions with a skilled professional. When you sign up with us, you will be allocated an account manager who will know your industry in and out. They will assist you in solving any problems or queries related to taxes, payrolls, VAT, or other financial matters.

Our business start-up services help you evaluate and ensure that your accounting systems meet your business’s needs. We will also recommend tools relevant to your industry, such as bookkeeping software, invoicing, and project tracking tools.

We’re a team of expert accountants and tax advisors, so you’ll never miss a deadline with us. We’re here to ensure that your business start-up doesn’t overwhelm you; that’s why we help you meet your deadlines, focus on what matters most, and give you time to grow your company

Whether you’re just starting a new business or need expert financial expertise to get your company back on track, we can help. Our Start-up service matches you with a part-time financial director who will work closely with you, providing guidance and support as your business grows.

Yes, we can analyse your needs and recommend whether a sole trader or limited company structure is best for you. (Startups)

We can assist you in getting started within one working day, depending on your structure. (Startups)

Yes, we will provide you with accounting software that will allow you to send invoices to customers while on the move. (Startups)

This will depend on how much money you make, your industry, and your thresholds (amongst other factors). Please call us, and we’ll look into this for you. (Small Business)

Our software integration team will look at your needs and suggest how integration could help your business become more efficient. (Small Business)

Along with accounting assistance, our business experts may provide you with strategic and business advice to help you launch and expand your company.

Your accounting reference date will determine this.

The corporate tax return is often due 12 months following the year end of your business, for example, if your company’s fiscal year ends on December 31.

However, keep in mind that these dates could change depending on particular circumstances. To learn more, give us a call. (Established Business)

This depends on whether you have salaried employees or if your business makes more than £85,000 (in 2022). Please call us, and we can explain more about this (Established Business)

We will need to register you as a sole trader with HMRC and get a UTR number. (Sole Trader)

During our initial meeting, we will tell you which solution is best for you based on your income, industry, and personal threshold levels, among other factors. (Sole Trader)

You must submit a personal tax return to HMRC by the 31st of January following the previous tax year, also known as self-assessment. (Sole Trader)

If you decide to hire people, you may need to sign up for PAYE (other factors are also involved here). If your business makes more than £85,000 (2022), you could also be required to sign up for VAT. (Sole Trader)

We will provide you access to accounting software so you can manage your bookkeeping and send clients invoices. (Sole Trader)

This depends on several things, including but not limited to the individual’s income, profession, and personal thresholds. During our first consultation, we can go through all your options. (Freelancers)

If you are a limited company, we will evaluate your overall income and thresholds and advise on the amount of salary and dividends you should withdraw. (Freelancers)

When you join us, we’ll provide you with excellent cloud accounting software that you can use to send your clients invoices. (Freelancers)