By Jahan Aslam

February 16, 2024

When a company offers a loan to its employees, it’s important to understand the tax implications that come with it. These loans can range from getting paid early to helping to buy necessary items like train tickets for commuting. With the help of Pearl Accountants, one of the top accountants in London, we’ll go through the rules and give you practical advice.

Whether you’re an employer who gives loans to your staff or an employee who gets these benefits, this guide will give you the information and strategies you need to manage your finances well.

Employee loans involve a company providing a loan to an employee or director for personal use. These loans come in various forms:

The types of loans can vary widely and may include:

For Employees:

For Employers:

There will be tax savings for both the employee and the employer if done with due diligence.

For Employees:

For Employers:

Creating clear agreements for employee loans is vital to avoid misunderstandings and ensure legal compliance. Key elements should include:

Proper documentation helps both parties understand their obligations and assists in maintaining accurate records for tax purposes. It also serves as evidence in case of disputes.

As we delve into the intricacies of taxation on these loans, it’s essential to grasp that while they offer mutual benefits, careful consideration of tax implications and adherence to regulations are necessary to prevent any unintended financial consequences.

In terms of taxation, when an employee’s relative obtains a beneficial loan, such as an interest-free loan or a loan with an interest rate below the official rate, it will lead to a tax obligation. A relative will include a spouse, parents, brothers, sisters etc.

Employee loans are subject to taxation by the Her Majesty’s Revenue and Customs (HMRC). Within this framework, the employer plays a significant role, being responsible for reporting and paying tax on these loans.

The HMRC oversees the taxation of employee loans. Its primary focus is on loans that exceed £10,000 within a tax year. These are considered ‘benefits in kind’, meaning they are benefits employees receive from their employment but are not included in their salary.

To calculate the taxable benefits, employers must take into account the ‘official rate‘ of interest published by HMRC. If an employee loan exceeds £10,000 at any point in the tax year and the interest paid by the employee is less than the official rate, the difference is reported as a taxable benefit.

For instance, if an employer lends an employee £15,000 with an interest rate of 2%, but the official rate is 2.5%, the difference (0.5%) will be considered as a taxable benefit.

Employers must report these benefits to HMRC through a P11D form at the end of each tax year. Additionally, they are required to pay Class 1A National Insurance on the total value of all taxable benefits.

As we delve deeper into employee loan taxation, it becomes evident that understanding specific rules relating to employment-related loans is imperative.

As long as the loan is interest-free or interest is charged below the official interest rate, the loan will be treated as a taxable benefit.

When employees receive loans from their employers at a below-market rate, often referred to as a cheap loan, there are specific tax implications that need to be considered.

Loans sourced from third parties like employee benefit trust (EBT) but facilitated by an employer also have tax consequences. The origin of the loan matters. If the employer has arranged for a third party to provide a loan at preferential rates, it can still result in a taxable benefit.

Facilitation will be regarded as advancing the loan similar to guaranteeing a loan on behalf of the employee.

A director’s loan account (DLA) is essentially a record of all transactions between a company and its directors that are not salary, dividend, or expense repayments. Directors may borrow money from the company, which creates a loan account.

The main purposes of a director’s loan account are:

When a director borrows from their company, it can trigger tax consequences:

These considerations necessitate meticulous record-keeping and reporting to ensure compliance with HMRC regulations. It’s crucial to differentiate between these loans and regular employee loans, as they pertain specifically to directors who have a vested interest in the company. This distinction impacts how these loans are recorded, reported, and taxed. The intertwining of personal and company finances through DLAs requires careful navigation to avoid costly penalties.

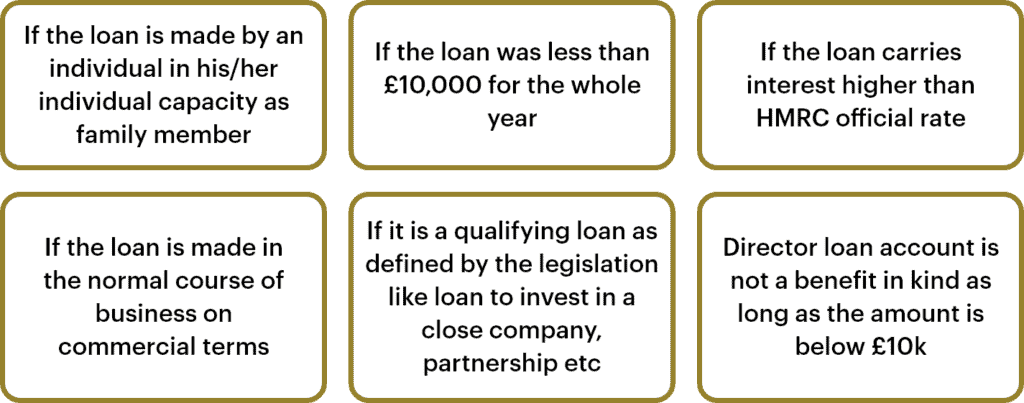

Following is the brief detail of non-taxable benefit in kind loans to employees;

Ali, a taxpayer in the 40% bracket, intends to renew her travel season ticket let’s say for £46 to keep the example simple in March 2023. See below the impact of taxes on the employee and the employer if the ticket is financed via an increase in salary or advance of employee loan.

| Scenario | Salary Calculation | Loan Calculation |

|---|---|---|

| Using Salary | Gross Pay: £80 | – Salary: £80 |

| Tax (40%): £32 | ||

| Class 1 NICs (2%): £1.60 | ||

| Net Pay after Tax and NICs: £46.40 | ||

| Using Interest-Free Loan | Gross Pay: N/A | – Loan Amount: £46 |

| Tax (40%): N/A | ||

| Class 1 NICs (2%): N/A | ||

| Net Pay after Loan Repayment: £46 | ||

| Taxable Benefit (if applicable) | N/A | – Total Beneficial Loans: £46 (below £10,000 limit) |

| – No taxable benefit | ||

| – No additional tax liability | ||

| – No secondary Class 1 NICs for the employer |

There is a tax savings in terms of PAYE and NI for both the employer and the employee if the ticket is financed by a loan to the employee assuming the total loans to the employee remained

Navigating the complexities of employee loan taxation requires a firm grasp of the UK’s tax laws. Expert guidance is not just beneficial; it’s often essential to ensure that both individuals and businesses remain compliant while optimizing their tax positions.

Pearl Accountants, a team of seasoned accountants in London, specializes in addressing the intricate aspects of employee loan taxation. They offer tailored advice and support to:

For those seeking assistance with managing employee loan taxes, Pearl Accountants in London stands ready to provide comprehensive support. Their approach focuses on clear communication, meticulous planning, and strategic execution.

Businesses and individuals looking to navigate these waters are encouraged to seek out the expertise of Pearl Accountants. With their specialized knowledge, you can approach employee loan taxation with confidence and precision.

Navigating the intricate tax landscape of employee loans presents its own unique set of challenges. An in-depth understanding and proactive management of these tax implications prove crucial.

Here are some key takeaways to keep in mind when dealing with employee loans and their tax implications:

You can download our newsletter packed with free valuable information by following the link Pearl chartered accountants ebook.

Remember, expert advice is just a call away. Contact us today.