By Jahan Aslam

January 16, 2024

As per HMRC “A dividend is a payment a company can make to shareholders if it has made a profit”.

Dividend is not a business cost and therefore not allowable as a deduction against company’s taxable profits.

The directors are appointed by the shareholders to manage the affairs of the company. The directors are responsible for compliance with company law and other applicable laws. When a dividend is paid to the shareholders, it leaves fewer assets in the company to meet its liabilities to its creditors. Therefore, to safeguard the interests of the creditors, payment of dividends has been controlled by different laws. Directors will need to refer to the following laws while paying dividends.

| Applicable laws | Comments |

|---|---|

| Capital maintenance law (CML) | Though dividend legislation has superseded most of the CML, however, one aspect is still relevant for the directors i.e. to assess if, at the time of paying a dividend, losses have depleted the reserves to warrant payment of dividends approved a few months back. It is a dynamic approach. Dividend legislation on the other hand stipulates to assessment of the relevant accounts at the yearend for the sufficiency of realised profits for paying dividends. It is a static view as opposed to a dynamic view required under CML. |

| Law on Directors’ Duties | This law requires directors to assess the impact of paying dividends on the solvency of the company before paying dividends. It is the responsibility of the directors to make decisions in the best interest of the company. |

| Insolvency Law | This law safeguards the interests of the creditors. So, if the directors are aware that paying dividends will jeopardize the interests of the creditors, they may be personally held liable for wrongful trading. |

| Sector Regulation | In some sectors like banks and insurance, the law requires the companies to have assets in excess of their liabilities. |

| Contract Law and Similar | Some company contracts may impose restrictions to pay dividends, e.g. borrowing contracts with banks. |

| Dividend Legislation | The dividend law is contained in Part 23 of CA2006. Any dividend paid in breach of its stipulations will be held unlawful. |

If you want more details, please visit ICEAW’s article on dividends.

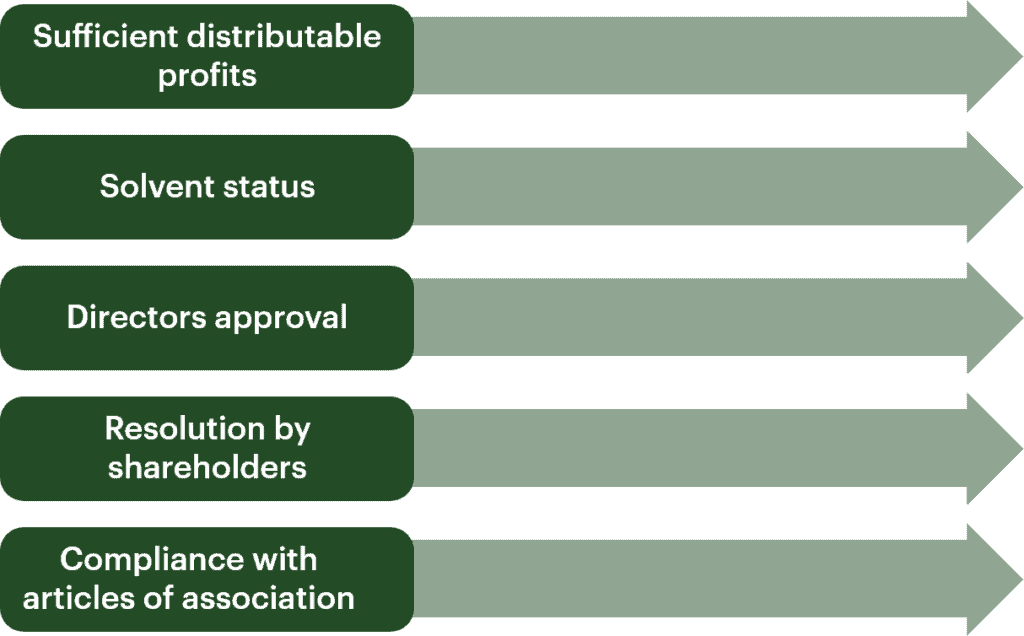

To pay dividends legally, companies must adhere to the following conditions:

Dividends can only be paid out of the company’s profits. Before declaring a dividend, it’s crucial to ensure that the company has sufficient distributable profits.

It is very important to remember that not all profits are available for distribution i.e., paying as dividends. Only distributable profits as defined on the page below can be used to pay dividends.

“Distributable profits” refer to the amount of a company’s earnings that is available for paying dividends to its shareholders. It represents the profits remaining after accounting for various expenses, taxes, and any accumulated realised losses. An example is given below;

| Profit and loss account | Amount (£) |

|---|---|

| Total Earnings | £100,000 |

| Taxes | -£20,000 |

| Accumulated Losses (Realised) | -£10,000 |

| Distributable Profits | £70,000 |

The concepts of realised and unrealised profits/losses are relevant to the calculation of distributable profits, particularly in determining the amount of earnings available for dividend distribution.

The terms, “realised profits” refer to earnings that have been confirmed and are ready to be used. Usually, money made from regular business activities falls into this category.

When looking at financial statements, it might not be clear which profits are confirmed and which ones are still potential. For instance, some company activities create entries in the books that are not yet confirmed, like property value changes or certain internal transactions. It’s important to be careful and only pay out dividends from profits that are certain and confirmed.

Realised profits contribute directly to distributable profits. When a company completes a transaction, earns revenue, and receives payment, the resulting profit becomes part of its realised profits. For example, if a company sells goods, receives payment, and makes a profit from the sale, that realised profit can contribute to the distributable profits available for dividends.

Unrealised profits, being paper gains that haven’t been converted into cash, generally do not contribute to distributable profits. These profits are contingent on the future sale or conversion of an asset. Until that happens, they are not considered available for immediate distribution as dividends. For instance, if a company holds investments with unrealised gains, those gains might not factor into distributable profits until the investments are sold.

Realised loss refers to a loss that has occurred, e.g. if operating expenses exceed the turnover of a company or if an asset is sold below the carrying value in the Balance Sheet.

An unrealised loss is a loss in asset market value that has not been captured through disposal. It is only when the asset is sold, the loss will become realised. Similarly, impairment of an asset is also unrealised loss.

Profit is only realised if it is in cash or readily convertible into cash.

A company must be solvent when declaring dividends. Insolvency can lead to legal repercussions for directors, making it imperative to assess the company’s financial health.

The decision to pay dividends rests with the board of directors. Directors must exercise due diligence, considering the company’s financial statements and future obligations.

Shareholders may need to pass a resolution approving the payment of dividends. This often occurs at annual general meetings (AGMs) or through written resolutions.

Accurate and up-to-date financial records must be maintained. This includes keeping track of profits, losses, and any resolutions or decisions related to dividends.

The company’s articles of association may include specific provisions regarding the payment of dividends. Compliance with these provisions is crucial for legal dividend distributions.

Following is a checklist for paying dividends.

Payment of dividends on preference shares is governed by the same law as payment of dividends on ordinary shares which means a company needs to have enough distributable profits to pay preference dividends.

Understanding what constitutes an unlawful dividend is crucial for avoiding legal pitfalls.

Unlawful dividends under UK company law refer to dividend payments made by a company to its shareholders that are not in accordance with legal requirements. Some key points about unlawful dividends include:

If you have a question or need help regarding dividends, contact Pearl Accountants in confidence.

Contrary to common belief, companies can indeed pay dividends even if they’ve experienced financial losses. However, such decisions must be made cautiously, considering the company’s overall financial health and future prospects.

This will be the case only if the company has enough distributable profits that have accumulated over time. So, if a company makes a loss in one year, it may still be able to pay dividends from profits brought forward from previous years. If the loss has eroded any accumulated distributable profits such that reserves are negative, the company cannot then pay dividends. It must build up distributable profits again before any lawful dividend payments.

Following is an example where a company may be able to pay dividends despite having losses in the current year.

| Financial Details | Amount (£) |

|---|---|

| Profits from Previous Years | 500,000 |

| Current Year Losses | (200,000) |

| Reserves and Retained Earnings | 300,000 |

| Liquidity and Solvency | Passes tests |

Accumulated earnings from the beginning of a company’s existence are known as retained earnings. If a company’s losses and dividends are more than its total earnings, it ends up with negative retained earnings. This could mean the company is not making enough profit or is giving out more money than it’s making, possibly indicating financial trouble.

In a specific scenario, a company can distribute dividends despite having negative retained earnings: when it’s concluding its operations, it can provide dissolution or liquidation dividends to shareholders, irrespective of its balance sheet status.

While it might seem counterintuitive, UK law doesn’t explicitly prohibit a company from paying more dividends than its recorded profits for a financial year. In the following example, a company pays dividends of £150,000, exceeding the current year’s recognized profits of £100,000. However, it can still do so because it has accumulated profits from previous years and maintains sufficient reserves and retained earnings. This situation allows the company to distribute dividends that surpass the profits recognized in the current year.

| Financial Details | Amount (£) |

|---|---|

| Profits from Previous Years | 400,000 |

| Current Year Profits (Recognized) | 100,000 |

| Dividends Paid | 150,000 |

| Reserves and Retained Earnings | 350,000 |

Dividend waivers offer a solution to the rigid structure of fixed-rate dividend payments, allowing flexibility for tax-efficient profit distribution among shareholders. This flexibility is crucial, especially when shareholders face varying tax brackets or potential tax implications, such as the higher income charge on Child Benefit.

In a dividend waiver, a shareholder voluntarily relinquishes their dividend entitlement, enabling remaining shareholders to receive profits based on their ownership stakes. The shareholder waiving the dividend receives nothing, leaving their share of the profits in the company’s account.

To prevent challenges from tax authorities, particularly HMRC, proper documentation through a formal deed is essential. HMRC scrutiny may arise if waivers result in increased dividends for family members or connected entities. It’s advised to state in the deed that the waiver aims to retain funds for a specific commercial purpose.

Consider using Alphabet shares as a beneficial alternative for businesses with frequent waiver needs. It’s important to be aware of the law of settlement, especially when waivers lead to higher dividends for family members or connected entities.

Monthly dividend payments can be attractive for business owners, but their feasibility and legality require careful consideration. Updated monthly management accounts will be required to be made each time the interim dividend is paid to make sure the company has enough realised profits and cash available to meet its financial commitments.

Directors must exercise their fiduciary duties responsibly and make decisions that align with the best interests of the company and its shareholders. It’s essential to consider both short-term financial needs and long-term strategic objectives when determining whether to pay dividends.

There is no legal compulsion on the directors of a company to pay dividends to the shareholders.

Surprisingly, not all successful companies choose to pay dividends. There may be various reasons behind this decision, including strategic reinvestment, debt reduction, and other financial priorities that may take precedence over dividend distribution.

Paying illegal dividends can result in severe consequences, including legal penalties such as fines and director disqualification. Shareholders may be required to repay unlawfully received dividends, and the company’s reputation may suffer, affecting its financial standing and business relationships. To avoid these repercussions, businesses must adhere to legal guidelines and maintain transparent financial practices.

Before distributing dividends, companies must conduct a thorough assessment. By using the checklist provided above, companies can avoid paying illegal dividends.

In conclusion, paying dividends is a multifaceted process that requires a keen understanding of legal obligations and financial considerations. By addressing common questions surrounding dividends in the UK, this guide aims to guide business owners and stakeholders with the knowledge needed to navigate dividend decisions responsibly and legally. Remember, seeking professional advice is always a prudent step to ensure compliance with the ever-evolving legal landscape.

If you need any help with dividends, contact Pearl Accountants who will ensure your company complies with applicable laws while optimising your own personal tax position.