By Ashley Preen

July 11, 2019

Anyone can successfully go through the loan process without an accountant. But hiring an accountant increases the chances of getting the loan. Moreover, it can save a lot of time. Large businesses usually have accountants, so it is no big deal for them. It is small businesses that suffer the consequences.

In addition to successful loans, hiring an accountant can have other beneficial impacts. Funds are looked after properly. The time that is saved is valuable. The bits of advice of the accountant is far more professional than someone with little or no knowledge of accounts. Thus, hiring an accountant is a win-win situation as it is only going to benefit in the short and long run.

Getting a small business loan is one of the most significant challenges faced by owners. The most valuable thing to a small business owner is time. The owner cannot spend hours on loan application, doing things he is not familiar with. Moreover, banks require a strong business financial profile for a loan. They like to know if they’ll be getting back the money. Since it is quite common for banks to reject loans to small businesses due to weak financial profiles, having an account becomes necessary.

Other lenders also need a guarantee for the return of payment. They need to be convinced by a robust financial profile. Only an accountant can manage all your financial documents correctly. By doing what he does best, he can easily increase your chances of getting the loan.

Usually, small businesses find it hard to decide when to hire an accountant. Needing funds through loan could be the deciding stage. You just have to look for the right accountant.

Ask for the services they provide. Dig into the experience they have and in what industry. Decide everything beforehand and negotiate the fee. Once you have signed a contract, you have automatically increased your chances of getting a loan.

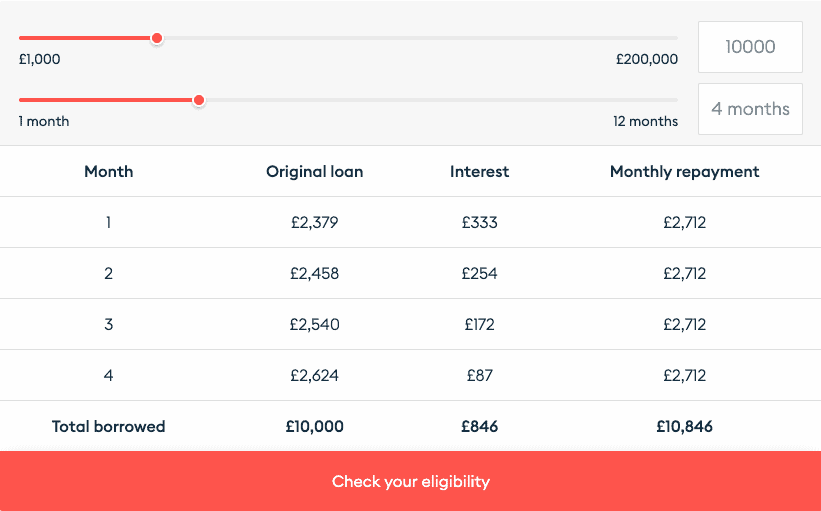

Another place you can look at for getting a loan or help is Iwoca Accountants.

The accountant is always up to date about your financial standings. He has all the balance sheets worked out and the financial documents ready. Given this, he can easily give professional advice about when to go for a loan. Moreover, he will know where to get the loan from.

An accountant will get you in contact with the right people. He can introduce to you all the loan options available, including the bank. He will know where to go if the bank has already rejected. Having worked in the field, he can best guide you about the better offers. Which offer has better rates and which lender has a better reputation. Your accountant can also tell whether the terms and conditions of the loan are favourable for you.

Pearl accountants are currently offering services to businesses. They can provide you with all the mentioned services in this article. Their services are available to people ranging from businessmen to contractors as well as start-up owners.

Many borrowers are unable to vocalize what they actually need. An accountant comes in handy here. Having a sense about the incoming and outgoing funds, he can tell whether getting a loan is necessary or feasible at the moment. If a loan is required, then he will know what range of amount is affordable for you. The future and current prospects of a business are well rooted in the mind of the accountant. He can organize a plan on how to return the loan with the interest while staying on the safe side.

This is another major factor that lenders look upon while deciding whether to give you the loan. A borrower who has no knowledge of accounts and finance cannot convincingly put out the purpose of the loan.

The accountant, however, can be a master at it. He can qualify the needs of the company and articulate the purpose of the loan. Using knowledge from different industries, he will know how to attract banks or lenders to provide the funds.

The accountant can portray the future prospects and growth of the business elegantly. The lenders are attracted if current profits are good and future profits are even better. This is where the accountant uses his skills and knowledge to convince them.

The accountant is easily the most familiar with the business’s finances. Having this knowledge at hand enables him to answer all the lender queries with perfection. He can talk about how serious you are about the loan and your financial capacity to return the loan with confidence.

The convincing powers of an accountant make him a better outlook for catering the lender’s queries and questions. He can help you stay on top of your business’s financials at all times.

Having an accountant makes the business look good. Usually, banks are impressed by the fact that an accountant is closely working with the firm. This gives the idea to the lender that you are serious about your business. Any lender would like to go through the financial documentation. If the documentation is in an organized manner and well presented, it will please the lender.

Many small businesses don’t hire an accountant to save up costs. Some even use software to manage their balance sheets and record of funds. However, having a professional work with you in person is quite different and has its advantages. Everything mentioned above is a testament to the fact that having an accountant can get you the loan. So, don’t wait for it and hire one!

Given all the difficulties withdrawn with the addition of an accountant, it can be easily said that hiring one can significantly increase the chances of a business getting a loan they need. Benefits such as saved time, perfected loan applications, advice about financial matters, advice about the growth of the company and future prospects are all in the package that an accountant comes with.