By Jahan Aslam

November 17, 2023

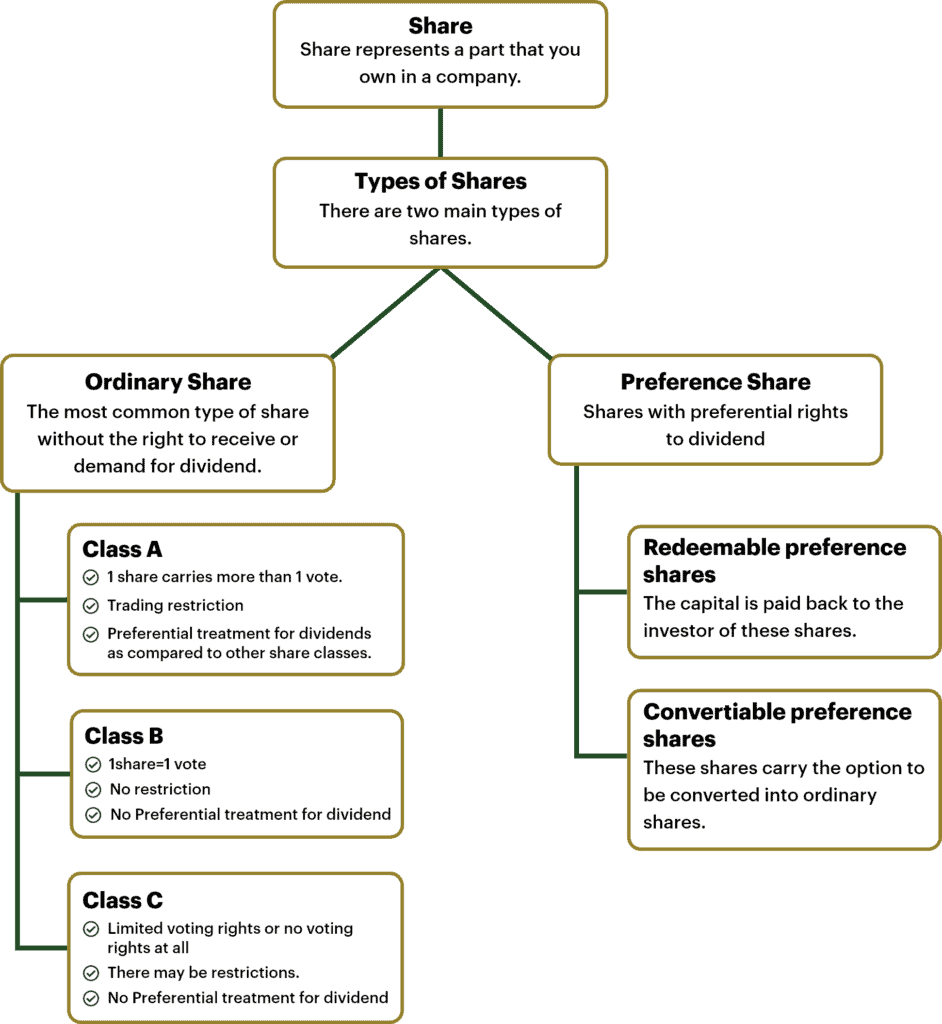

In financial terms a share represents a part or portion that you own in a company. In order to become a shareholder, capital is exchanged by the investors in return for ownership/share in the company. The number of shares you hold directly affects the percentage of ownership you have in the company.

The nominal or par value of a share is the amount assigned to each share when the company is incorporated. This amount is stipulated in the memorandum of association of the company.

If you are a busy entrepreneur with no time to spend on accounting and doing complex tax calculations for your business, leave this to Fusion Accountants who are experts in self assessment.

As per Companies House UK, a company limited by shares must have at least one shareholder. This means that there is a minimum requirement to issue at least one share. A company may issue any number of shares it deems appropriate, there is no maximum limit.

As per the Companies Act 2006, a limited company having a share capital must have a fixed nominal value, e.g., 1p, £1, $1 or 1 euro or even £0.0001.

A company cannot issue share with no nominal value. An allotment of a share that does not have a fixed nominal value is illegal.

There are two primary types of shares:

The main features of equity shares are as follows:

Equity shares offer an opportunity for long-term financing and investment. They do not have a maturity date and provide the opportunity for the shareholders to benefit from the company’s progress on a long-term basis.

Equity shares give voting rights to the shareholder. It allows the shareholders to participate in the decision-making process and attend the company meetings.

Equity shares carry both risks and rewards for the shareholders. Meaning where the shareholders can benefit from the success of the company, they can also face the risk of loss if the business is not going well, and the share prices are decreasing.

The equity shareholders may receive dividends but not if the company reinvests its earnings to grow the business. The amount of dividends is not fixed and depends on the board of directors’ decision and on the profit margin of the company.

In cases where a company goes bankrupt, equity shareholders can have a claim on the assets that remain after all the debts and other obligations have been paid off. It is a fact though that in asset distribution, ordinary shareholders are at the bottom of the line.

Unlike equity shares, preferred shares offer a fixed dividend rate. Also preferred shareholders receive their dividends before the common shareholders.

Most of the time, preferred shares do not give voting rights to the shareholders. In cases where voting rights are offered, they are limited depending on specific circumstances.

Preferred shareholders have a higher claim to the company assets than the equity shareholders. This means that if a company liquefies or declares bankruptcy, preferred shareholders can possibly get their investment back.

Preferred shares can be cumulative which means that if the dividends are unpaid over a certain period, then the dividend amounts accumulate. This accumulated amount must be paid to the preferred shareholders before the common shareholders. It must be noted that preferred shares can also be non-cumulative, which means that if a company skips paying the dividends, they do not accumulate.

Preferred shares are perpetual or in other words redeemable. It means that these shares can be bought back by the company at a price that was predetermined. Also, the company can redeem the preferred share on certain specified dates.

Shares are divided into two main types discussed above i.e., common or ordinary shares and preferred shares. The two broad types of shares are further divided into sub-types or categories, and these are called classes of shares.

Class A, Class B, and Class C shares are different classes of share within a company, each with its own set of rights and privileges. These are also called alphabet shares.

These are a subcategory of common shares. Class A shares typically have more voting rights per share compared to other classes. These shares are often held by company founders or early investors to maintain control over the company. These shares often receive a higher dividend rate.

Google parent company, Alphabet Inc, has class A shares (GOOGL) with voting rights, allowing co-founders Larry page and Sergey brin to retain significant control.

Also, a category of common shares, Class B shares may have the same economic rights (dividend) as class A shares but less influence on corporate decisions.

Berkshire Hathaway has class B shares (BRK.B) that trade at a lower price than class A shares have significantly fewer voting rights.

These are used for specific purposes like using it for ESOP i.e., employees’ stock option plan. Class C shares are typically nonvoting or have minimal voting rights.

Facebook (Meta)issued class C shares (FB) during its IPO, which have no voting rights while class A shares (FB) have one vote per share and class B shares (not traded) have 10 votes per shares giving Mark Zuckerberg control over the company.

The main idea behind these different classes of shares is to tailor ownership and control structure to meet the specific needs and objectives of the company’s founders, early investors, and management while raising capital from public markets.

Yes. Preferred shares are further divided into different series like Series A shares. These shares have distinct characteristics like fixed dividends and higher claims on assets on liquefaction.

H2: What are Convertible preferred shares?

These shares offer the possibility of converting preferred shares into ordinary shares.

Voting shares allows the voting rights to the shareholders while non-voting share does not.

Restricted shares present certain restrictions on the sale or transfer of shares.

As the name suggests, these are the shares offered to a company’s founder. Such shares allow specific rights like appointing the board of directors.H:2 Why might shareholders need different classes of shares?

A company’s founder wants to maintain control and holds Class A shares with 10 votes per share while issuing Class B shares with only 1 vote per share to raise capital.

Some investors prefer regular income, so they own Class C shares with a fixed dividend, while others seek growth and hold Class D shares without dividends.

A tech startup grants employees Class E shares with stock options, encouraging them to contribute to the company’s growth and success.

A company offers Class X shares with extra benefits to institutional investors who require stability while selling Class Y shares to the public.

An insurance company must issue Class Z shares to policyholders and Class W shares to external investors to comply with regulatory obligations.

Through mergers and acquisitions, a conglomerate ends up with multiple share classes representing different companies’ legacies.

A company creates Class M shares with unique voting rights to facilitate a potential merger or joint venture in the future.

Share classes can be used for tax planning purposes to optimize the tax treatment of various shareholders. In a family-owned company, class B shares with no voting rights but dividend preferring shares may be issued to family members with low income to avail personal allowance.

These examples illustrate how different share classes serve specific purposes and stakeholders within a company.

The topic of shares may appear complex for inspiring entrepreneurs. Deciding the type or class of share may seem confusing. It is important to make an informed decision. That is why it is best to seek professional help and guidance. Hiring an accountant is highly advisable when you are dealing with shares whether as a company or as an individual.

Pearl Accountants are experienced in company formations. If you need professional help to incorporate your company, you are at the right place. Contact Pearl Accountants for free consultation to find how they can help.