By Jahan Aslam

November 24, 2023

Value Added Tax (VAT) is the tax that we pay on the purchase of goods or services. It is applied at each stage of a supply chain. The standard rate of VAT in the UK is 20%. There are different VAT rates in each EU member state.

VAT refunds are claimed by filing VAT returns to the tax authorities of a country. Businesses registered for VAT in the UK are required to file their VAT return to HMRC normally on a quarterly basis. It is the process through which businesses can recover the VAT they have paid on business-related expenses. Businesses charge Output VAT on the services or products they provide and can reclaim the Input VAT, i,e, VAT they have paid on their purchases.

If you need help in securing a VAT refund for your business, contact Pearl Accountants who have helped countless satisfied clients with their VAT returns.

It is possible to claim refunds on the goods or services you bought in an EU country if your business is registered in the UK or in The Isle of Man.

A certificate of status confirms that a business is trading in the UK. This certificate is provided by the HMRC. To get a refund of the VAT you paid in other EU countries on the purchase of goods or services, you will have to show a certificate of status.

You can request a certificate of status through email to:vat66@hmrc.gov.uk. Please refer to HMRC guidance for more details on how to get confirmation from HMRC that you are trading in the UK.

The new certificate of status of a taxable person is called VAT 66. It contains a link that can take you directly to the UK VAT registration checker. This way the information provided on the certificate can be verified by the refunding authority.

From January 2021, following the UK’s exit from the EU, changes were made in business trade with the EU countries. UK businesses lost access to the EU electronic portal from 1st April 2021.

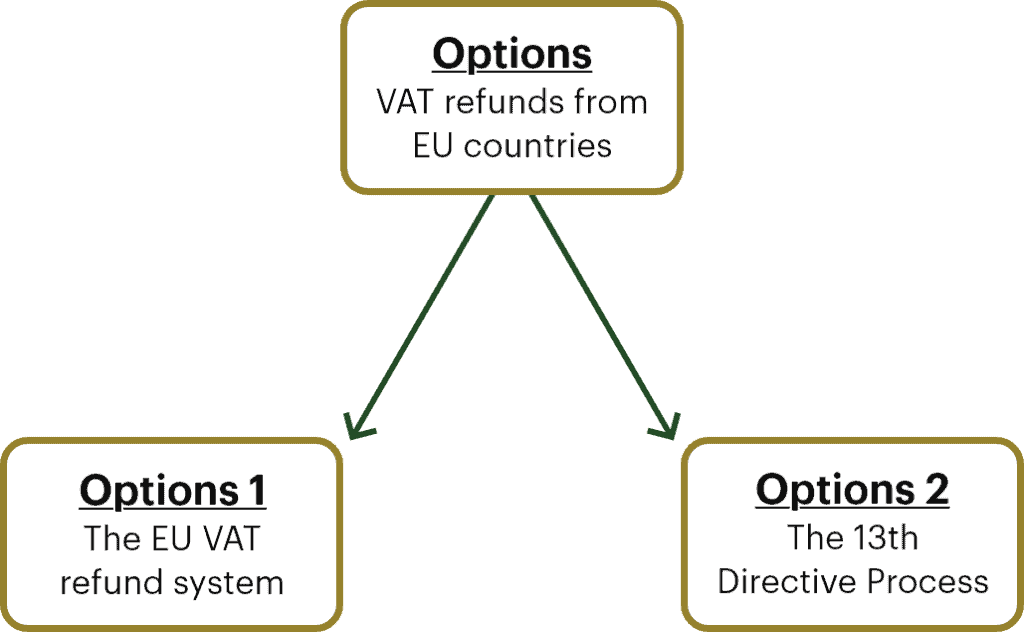

There are two options to claim a refund from EU member countries.

If you are a business established in Northern Ireland (NI) and making supplies of goods and services from NI and buying goods from EU member countries, you will need to apply for a refund for VAT incurred in EU countries using the EU VAT refund system.

Under the EU VAT refund system, you can only claim VAT on invoices for goods and not on the purchases of services or both.

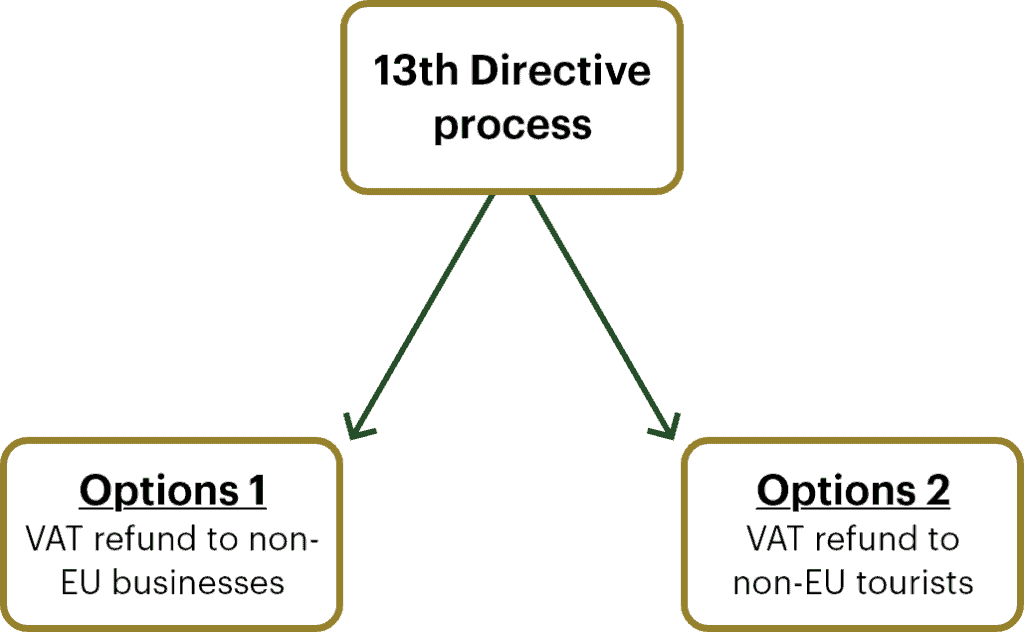

You can claim a VAT refund from other EU countries through the 13th Directive Process if you do not meet the conditions of using the EU VAT refund scheme i.e. your business is not established in NI. There are two categories in this process:

Businesses in the UK that have paid VAT on the services or goods they purchased in an EU country can get a refund from that country. To claim a VAT refund, the businesses need to send an application to that country’s national tax authorities.

The following conditions must be met to qualify for a VAT refund.

Tourists can get a VAT refund if they can prove that their permanent residence is not in the EU. The following conditions must be met for a VAT refund in this case.

For full guidelines on how to use the 13th directive to get a VAT refund, please visit the European Commission website.

Please note that each EU member state may have specific VAT rules which may make the claim inadmissible e.g., restriction on the type of expenditure eligible for refunds.

It is possible to get a refund of the VAT you paid in other EU countries on the purchase of goods or services subject to the fulfillment of certain conditions. A VAT refund application is made to the relevant tax authority of the relevant EU member state. There are two ways to apply for a VAT refund.

A skilled, experienced, and qualified accountant can be of immeasurable value to you while dealing with VAT refunds from other EU countries.