By Ashley Preen

March 26, 2019

Until cloud technology exploded onto the scene, there was little development in accounting and financial technology. However, now with cloud-enabled systems like Xero accounting software being available on the market, small businesses have more flexibility and stability than ever before.

Xero’s cloud enablement means that you can use Xero online on a variety of mobile devices, including your smartphone, laptop, tablet, or PC. This essentially means that business owners can have access to their financials anywhere, which can really help them out if they’re travelling for work and suddenly find themselves needing some important financial data which they don’t have to hand.

For instance, what if a small business owner was on their way to meet a small business accountant when suddenly they realize that they don’t have the appropriate documents with them? Fret not – with Xero accounting software, they could simply pull the information upon their smartphone while they continue commuting to the accountants.

As you can see, this technology makes it easier and more convenient than ever before for small businesses to track and update their accounts in real time. This is why Pearl Accountants offers a Xero accounting software service where we help you to set up and manage Xero online, providing your Pearl Accountants lawyer and yourself with all the financial data they need at a glance.

The developers of this software designed Xero for small businesses. Alas, this software was not designed with accountants in mind – it was designed with the end-user (i.e. small business owner) in mind. This means that it is laid out in a simple and easy-to-understand manner, making it easy for small business owners (who are not well-versed infancy accounting terminology) to use it. Of course, accountants, such as our small business accountants, are also able to use Xero comprehensively.

So, why should you consider switching to Xero accounting software? If you’re a small business owner who is thinking about making the switch to Xero but you’re not quite sure yet, read on to find a list of compelling reasons why our tax and business consultants think it would be wise for you to make the switch and simplify your accounting processes today.

The #1 reason to choose Xero online, of course, has to be its mobility. If you need to do some tax paperwork but you’re sick of being stuck inside your tiny office, Xero online means that you’re able to take your laptop/tablet and mosey on down to the local library, coffee shop, or coworking space, allowing you to do your accounting work without needing to stay in one place. Of course, you’ll need a secure Wi-Fi connection, but unless you live in the middle of an abyss, it’s pretty easy to find a decent Wi-Fi connection is most cities these days.

Working away from your usual haunt has also been shown to boost productivity, as the lack of familiar distractions means that you more effectively force yourself to work harder. In fact, around 67% of managers note that their employees are more productive when they work remotely away from the office. The lack of office gossiping, watercooler conversations, and “bunking off” means that remote employees are more effective with their time.

If you use Xero online, you are able to take advantage of this productivity and freedom, giving your brain a different environment to soak up from your usual office. Changing the scenery around you helps to stimulate your brain and make it more creative in coming up with ideas and solutions, so why not try hitting the road when you use Xero accounting software to do some financial work?

If you’re doing your accounting offline, you risk all sorts of accidents and disasters which can leave you in a tough spot. For example, if all of your accounts information is stored locally on a laptop, what happens when that laptop gets stolen or it breaks beyond repair? A single stray gamma ray can cause your hard drive to fail and for you to lose all your work, meaning that you’re left in a very tricky financial situation.

Even if you have your accounting data stored on several different servers/computers in your office, what happens when your office burns down or there is a flood? Putting all your eggs in one basket is very risky, and you don’t want to risk your financials getting into the wrong hands or becoming lost entirely, leaving you in a bit of a pickle.

Although online backup can help to alleviate these problems, there are still questions about the security of online backup, with 2014’s well-publicized celebrity iCloud hacking incidents calling the reliability of online backup systems into question, especially for businesses which deal with large sums of money on a regular basis, or businesses which may be easier to hack and steal from.

However, with Xero online, you are able to safely and securely store your data online, and the information is accessible from anywhere that you need it to be accessible from! Whether you’re in your office, a Starbucks, or the queue at your local corner shop, you have access to all the information that you need in a safe and secure manner.

When you’re working with dedicated advisors, such as the accountants for small businesses that Pearl can provide, collaborations (whether remote or in-person) are made a lot easier with software such as Xero. For example, if you call up one of our accountants with a query about your tax bill, the accountant is able to access your data immediately, helping to tackle your problem. In the past, you would have needed to find the appropriate paperwork and take it to the accountant’s office, which could add many hours, if not days, onto the length of this process.

As a result, this helps accountants such as Pearl Accountants to keep our costs down due to the reduced time required to solve your problems and alleviate your concerns. This is one of the many reasons why we recommend our Xero online integration service – we can solve your problems quickly and easily in a fraction of the time that it would take us otherwise.

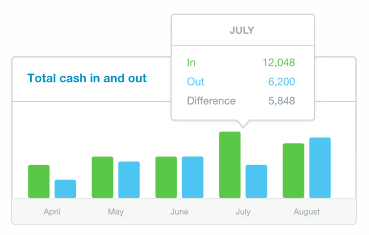

You might think that Xero is just a bridge between your small business and your accountants, but Xero is so much more than that. One of the biggest benefits to Xero accounting software is its massive boost to your productivity as a business. In fact, Xero was named as one of the 5 techs wins that SMEs can use to boost their productivity and is consistently hailed as one of the best pieces of software within its category.

For instance, there are a bunch of everyday accounting tasks which can be automated, saving you time and labour hours throughout the week. This includes automated banking feeds, online invoicing, online payment methods, and much more. Whether it’s automating tasks or reducing the time that it takes you to perform routine tasks, Xero is a productivity haven.

The more time that you save on everyday accounting thanks to a system like Xero, the more time that you have available for performing value-added tasks which aim to grow and/or sustain your business overall. Dedicated businesspeople should want to strive for as much free time as possible, as this allows them to brainstorm and try out their next best idea for the business.

Alas, a small business which is led by someone tied down with “busywork” is never going to flourish quickly. Pearl Accountants’ Xero accounting software integration service is one of the best ways that you can carve time out of your schedule without worrying about the impact that it will have on your small business’s growth in the long term.

If there’s one thing that any small business owner loves, it’s financial stability. Business can have its ups and downs, as I’m sure you’re aware, and entrepreneurs ideally want to avoid any unexpected bills coming out when they may be going through a slower time in their performance. If there’s any way of reducing the chances of surprise bills, small businesses would be wise to take it.

Luckily, Xero is a “pay as you go” monthly subscription service, and there are no setup costs, hidden fees, or one-off payments that burn a hole in your pocket. This is ideal if you’re trying to keep track of your financials and you don’t want too much volatility in your expenses and overheads for your business. It also helps with your cash flow, which can be difficult to manage in a small business.

If you work with Pearl Accountants for your Xero online accounting, then the price of working with us already covers the necessary Xero accounting software fees. So if you work with us, you’re getting the same “pay as you go” monthly stability, in addition to the knowledge, experience, and expertise of business consultants and accountants who know how to do your taxes and grow your company sustainably.

With IT consultant jobs starting at around £20,000 and going up with experience, it can be very costly to hire technical people and IT staff to help with the running of your business. If you can avoid this expense, it’s probably your best bet. Luckily, with Xero accounting software, you don’t need to hire any technical people for system-wide updates and whatnot.

No, Xero’s technical team will do all of its own updates – you probably won’t even notice that anything has changed. If you need to update your version of the software, you may be prompted to do so in the same way that you would update your phone software every now and then. To make a long story short, you don’t need to be Bill Gates in order to run Xero at your organisation.

A lot of small businesses run their office work on PCs and laptops which are a little outdated and past their prime. If you’re trying to save money on expenses, then it makes sense to use basic machines which do what you need them to. However, if you’re looking to install fancy accounting software which needs a lot of processing power to run the numbers, you’re quickly going to run into problems with old computers being too slow and laggy.

However, because you can access Xero online and it is not natively installed on your machine, these problems are not an issue! The only thing which can really slow Xero down is the speed of your browser and your Wi-Fi connection’s strength. Other than that, you can use it on low-level laptops and PCs without experiencing any major issues.

This is a lifesaver if you want to modernize your accounting system to save time but you don’t fancy making a very capital-intensive hardware investment which could ruin your cash flow and ultimately not affect your business that much in the long run. This is especially true if you’re not a business which is technically inclined or which does a lot of work on computers.

Why should your tiny café have to fork out for an iMac just to punch in a few numbers? Don’t bother! UK small businesses spend an average of 19% of their business expenses on IT, but Xero accounting software helps you to greatly reduce this amount, especially when you don’t need all of that expensive processing power in the first place.

It’s rare that customers of Xero will ever need to contact their support team, as Xero for small businesses is designed to be as easy and intuitive to use as possible. Nonetheless, if problems do arise, their Xero Cental support centre is standing by to answer your queries and FAQs. Most people who use Xero, at least in our experience, have never had to get in touch with them, but it’s handy to know that they’re there.

No one wants to waste time on a slow and drawn-out phone call to a lackluster technical support team, and we all know how infuriating and stressful that can be at the best of times. Luckily, Xero has a brilliant system in place for training and technical support, including the brilliant Xero Learning and Xero TV which are filled with useful information.

Nevertheless, if you’re using Pearl Accountants’ Xero integration service, we are able to handle many of these issues for you, making it easier for you to get the help and support that you need without having to lift a finger. You see, our accountants have been using Xero and similar accounting software for many years now, so they can often troubleshoot issues due to their own personal experience anyway.

Sick of triple posting and double handing? With Xero accounting software, you are able to harness the power of many business add-ons which make the everyday running of your business smoother and more seamless. Xero is able to be integrated with over 700 apps and add-ons which are designed to save you time and money. These Xero-friendly apps include PayPal, Stripe, Expensify, and much more.

For example, by tracking your business expenses with Expensify while you’re out and about, you can easily enter them into your accounts and keep track of your business expenses without any gaps. Similarly, if you often use PayPal to make or receive payments from clients, Xero online allows you to enter this data into the right accounts system seamlessly in real time.

In case you’ve been living under a rock for the past tax year, the UK is soon to be introducing Making Tax Digital (MTD) for businesses in the UK which exceed the VAT threshold. Part of the rules of MTD state that you need to use accounting software which is compliant with their strict security guidelines for digital tax processing. In other words, a sloppy Excel spreadsheet isn’t going to cut it anymore.

Luckily, Xero is completely compliant with the guidelines set in place by HMRC, meaning that once the rules take effect in 2019, you will be 100% compliant from the get-go. This is also a testament to the safety, security, and convenience of Xero accounting software – the UK government has it on their recommended list of software for digital bookkeeping.

As you can see, there are many things that you can do with Xero accounting software, making it easier than ever to streamline your small business and take it to the next level. Xero accounting software makes it easy and convenient for your business to manage its books and accounts from anywhere, helping to reduce downtime and the possibility of human error.

Here at Pearl Accountants, we offer a Xero integration service, meaning that our small business accountants set your company up on the Xero system and make it accessible for both you and themselves. This way, you not only have the help of a world-class accounting system like Xero, but you have the support of a professional UK chartered accountant as well!